busy airport

There are signs that the US air revenge travel surge has peaked. For example, this piece from the New York Times a month ago. Is there data to suggest this is happening? Delta’s Ed Bastain was caught by surprise at the surge’s momentum.

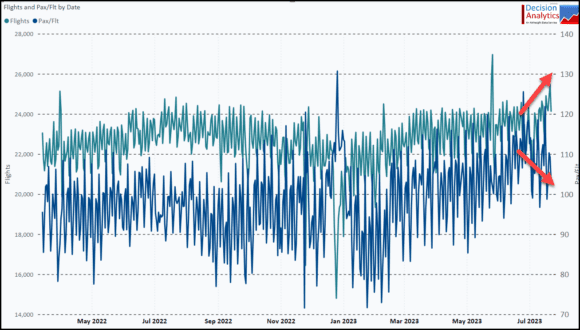

The data suggests that the surge may have peaked in the US domestic market. The following chart is our first exhibit. While it is challenging to “call it” so soon, US airlines have kept adding flights during July, while the average number of passengers/flight has started to soften.

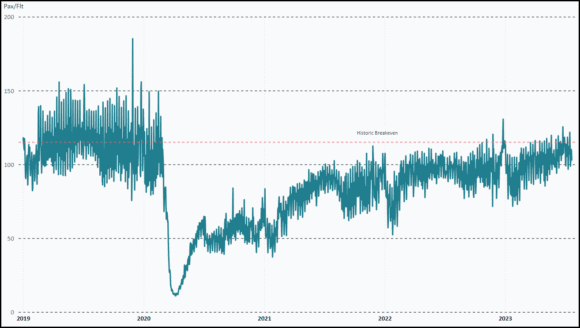

Take a look at another exhibit. Back in the good old days of 2019, flights were fuller. There has been a long clawback as traffic grew. There are spurts and slumps. Summer 2023 saw bigger loads than 2022.

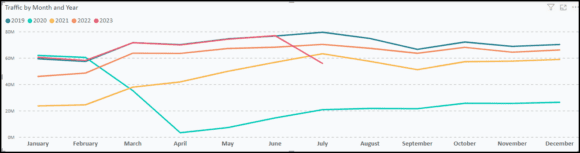

Here’s exhibit three. Notice that 2023 was tracking 2019 in a near-mirror fashion until July. Now the data for July 2023 is only through the 25th, with several days to go. July 2019 saw 79.5m people go through TSA. Through the 25th, we have 63.6m – we need an average of 2.7m people per day to reach the 2019 July number. The daily average over the past seven days is 2.6m – so it could be close.

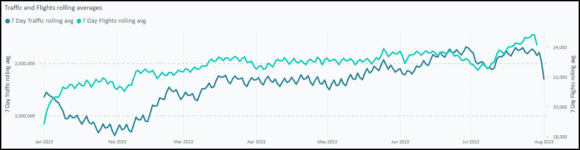

Here’s exhibit four with seven-day rolling averages for 2023. The traffic drop-off is quite obvious.

In summary, if the trends we see continue, and it is a big if, US airlines may run into headwinds later this fall and winter. During the pandemic, we saw traffic falling faster than airlines could reschedule their networks. Then we saw how long airlines took to bring back their networks to meet the travel surge.

Airlines can “see” future bookings. Back in April, Travel Weekly noted bookings were softening. A week ago, Southwest started its fall sales campaign. A month ago, Frontier started its fare sales. Watch for more industry signals to confirm the market has gone ex-growth.

Views: 0