K66558 scaled

Unless Omicron plays havoc in Asia and delays the reopening of air travel in Asia and the Pacific, Malaysia Airlines (MAS) is on track to leave its troubled years behind. The airline produced its first cash positive month in October and repeated this in November. Malaysia Airlines optimistic about getting break-even in 2023.

Malaysia Aviation Group CEO and MAS managing director and CEO, Izham Ismail, shared his optimism in an interview on the Asian website The Edge Markets on December 28. The carrier, which has seen very difficult years since 2014 when flight MH370 was lost without a trace and MH17 was downed over Ukraine by what the prosecutors say was a Russian BUK rocket, has worked hard to restore its balance sheet. Ismail describes the balance sheet now as “lean and agile.” It still has RM 2.3 billion available from the RM 3.6 billion in capital funding that the airline received from its shareholder, Khazana Nasional. MAS expects to end 2021 with a net loss after tax of RM 1.6 billion compared to RM -4.0 billion in 2020.

Malaysia “is not yet out of the woods”

The Covid crisis has delayed any chance of a quick recovery, but Ismail says in the interview that even at operating at just 25 percent op 2019 capacity, the daily cash flow was positive from October. MAS saw a significant pent-up in bookings but this was before the Omicron mutation was discovered, which has dimmed the prospects for a sustained recovery. Ismail confirms that Malaysia Airlines “is not yet out of the woods” and Omicron could require the airline to revise its plans for 2022. These include recapturing market share and positioning itself as a premium airline to high-value destinations in Europe, Australia, and Asia. Its regional subsidiary Firefly wants to expand its activities from turboprop operations to jets again with Boeing 737-800s, having suspended jet operations when the region was hit by the Delta variant. MAS also wants to grow its partnerships. In 2019, it announced a business arrangement with Singapore Airlines.

Since the tragic events in 2014 and in subsequent years, MAS has been reviewing its fleet policy. Out went the fifteen remaining Boeing 777s. The fleet now includes 83 aircraft, but that number comprises sixteen aircraft that have been parked. The most prominent are the six Airbus A380s which MAS used to operate in London, Paris, Frankfurt as well as Tokyo, Melbourne, and Australia. They were grounded at the start of the pandemic and were offered for sale. Izham Ismail says in the interview with The Edge Market that he expects to complete the sale in Q1 2022 after shortlisting potential buyers. All six A380s have done very short flights since the end of October, likely to check their systems.

MAS wants to start replacing its A330s in 2023

While the A380s are now on average 9.7 years old, its nine A330-200s are 12.8 years, and its fifteen -300s on average 9.6 years old. Ismail says the MAS will issue a request for proposal in Q1 with lessors to replace the partly leased and partly owned A330s, which he would like to replace as early as the second half of 2023. MAS wide-body fleet also consists of six leased A350-900s, which most likely will stay. Ismail adds that he prefers to lease to prevent repeating the mistake of over-spending on buy aircraft at the start of this century.

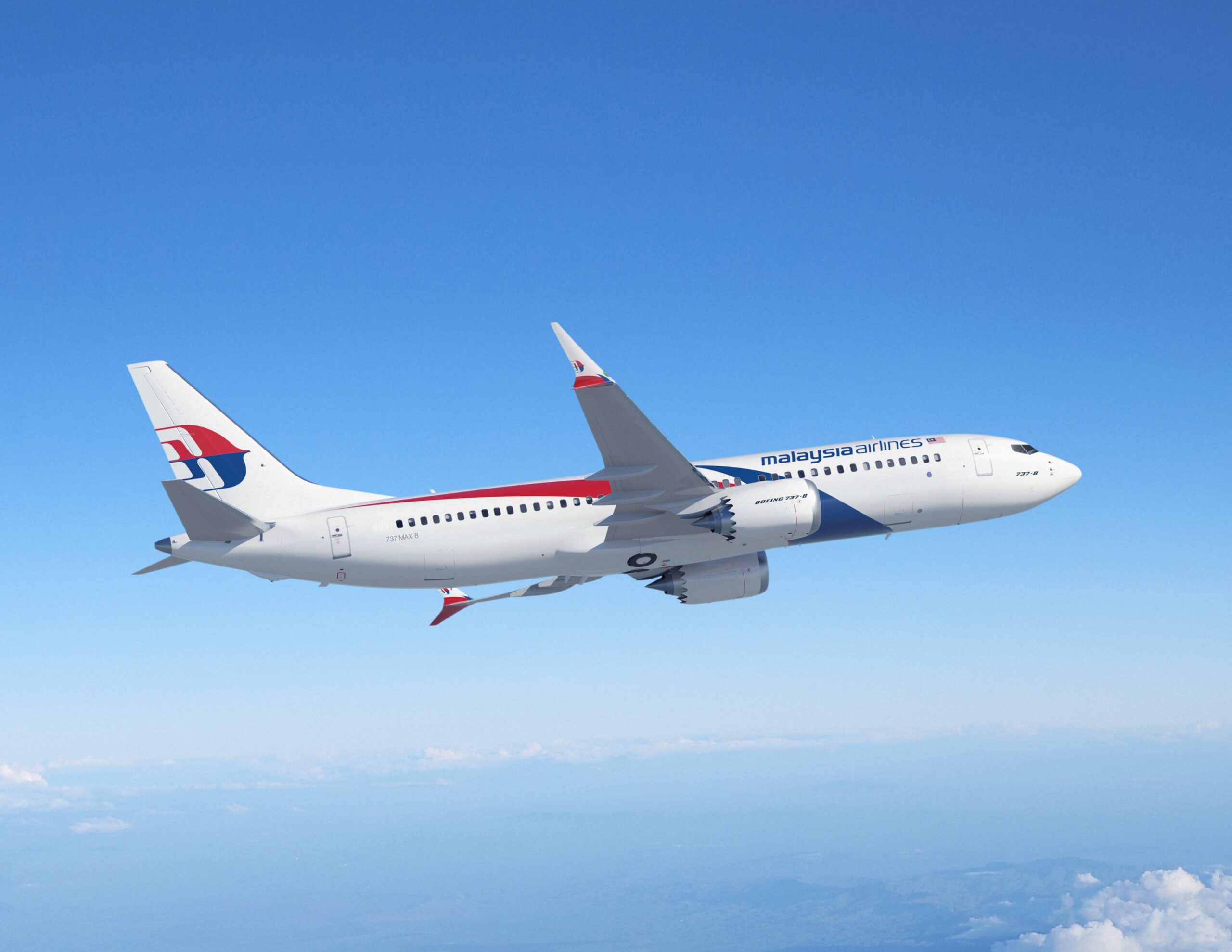

The narrowbody fleet of 47 Boeing 737-800s (average age 9.3 years) is up for replacement from the second half of 2023 when MAS will take delivery of the first of 25 MAX 8s. That’s two years later than originally planned, but the carrier opted to defer deliveries in 2019 after the grounding of the MAX in March that same year. MAS ordered 25 MAX 8s at the 2016 Farnborough Airshow, with purchase rights on another 25 -8s of -9s.

Views: 7