ACG A220 300 A320neo A321XLR rendering

Japanese-owned but California-based lessor Aviation Capital Group (ACG) has placed a last-minute 2021 order with Airbus for forty A320neo-family aircraft. This includes five A321XLRs. It also signed a Memorandum of Understanding for twenty A220s, both ACG and Airbus announced on December 30. Airbus gets last-minute 2021 order from Aviation Capital Group.

The A320neo-family is a familiar type in ACG’s portfolio, which according to the Airbus backlog list includes 46 A320neo’s on order (of which 35 were placed with airlines on December 1) and 39 A321neo’s (twenty placed). However, the XLR is new to ACG. In a press statement, ACG President and CEO, Thomas Baker, says: “We are delighted to expand our portfolio with additional A220 and A320neo Family aircraft. These highly advanced aircraft will enhance ACG’s strategic objective to offer our airline customers the most modern and fuel-efficient aircraft available.”

An investor’s presentation says the lessor in Q3 has seventy owned and four managed A320neo-family aircraft plus 39 commitments, or 113 in total. According to the same presentation, ACG has 86 owned and 33 managed A320ceo-family aircraft, or 119 in total. Airbus lists four A319ceo’s, 41 A320ceo’s, and 22 A321ceo’s for ACG.

ACG also owns four A220-300s which are all part of a sale and leaseback deal with airBaltic, so the type is a familiar one for the wholly-owned subsidiary of TC Skyward Aviation, a Delaware-based company that itself is owned by Tokyo Century Corporation. Until December 2019, it used to be owned by Pacific Life Insurance Company. ACG’s portfolio also includes three A330-200s and two A350-900s.

The lessor also owns 91 and manages 27 Boeing 737NG, including the -700s, -800s, and -900ERs, plus seven MAX 8s, as well as eleven owned 757-200s, a single managed 777-300ERs, and six owned 787-9s. This brings its total owned and managed fleet to 348, with another 56 commitments until today’s order and MoU. According to Boeing, ACG placed orders in 2012, 2017, and 2018 for a combined 83 MAX. ACG’s 2019 financial statements say that before the grounding of the MAX, it had taken delivery of seven and placed them with four airlines, while the lessor had another 97 on order. A year later, this had been reduced through cancelations to just 21. The investor’s presentation shows commitments for just seventeen, while Boeing’s list of undelivered orders shows only twenty on November 30.

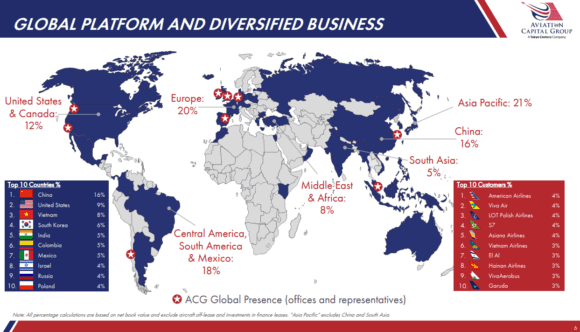

ACG’s top ten airline customers (85 in total) in placed aircraft are American Airlines, Viva Air, LOT Polish Airlines, S7, and Asiana Airlines. By region, 21 percent of the fleet is placed in Asia-Pacific, twenty percent in Europe, eighteen percent in Latin and South America, twelve percent in North America, eight percent in the Middle East and Africa, and five percent in South Asia. The average fleet age is 5.6 years. In Q3, it sold ten aircraft with an average age of fifteen years.

In September, ACG announced that it had raised $750 million through the sale of secured notes. It said back then that it would use the proceeds to repay debts and finance the purchase of new aircraft. Unsecured debt maturities will be around $1.0 billion in 2022, increasing to $1.6 billion in 2023 and remaining at some $1.4 billion in 2024. ACG had $2.8 billion in cash and through an undrawn revolving credit facility that was Tokyo Century.

Like other lessors, ACG entered into lease restructurings with lessees that were unable to meet their payment schedules. By September, the deferrals of lease rental payments stood at $159.2 million, but the company was expecting $76.1 million back before the end of that month.

ACG says that this order supports the multi-million dollar ESG (Environment, Social, Governance) fund that was initiated by Airbus. The fund was launched by Airbus and Air Lease Corporation (ALC) when the US lessor announced its MoU for 111 aircraft at the Dubai Airshow in November. ALC has confirmed this order this week and added four A321neo’s and one A330-900 to its backlog.

Views: 1