4 5 2022 8 52 37 AM

Commercial airlines’ success depends on many factors, and probably the core factor is seat production cost. The airline with the lowest cost of production in a commodity market wins. For years it was believed this was Southwest Airlines in the US. What do the most recent data (T2 through 3Q21) show us for single-aisle aircraft?

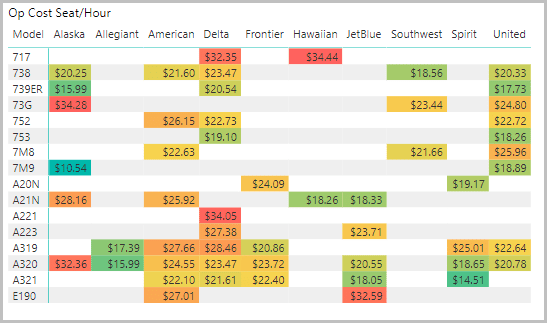

Let’s start with a big picture view, of the data for 3Y21 in the following chart. As we do regularly with this format – the greener the better, the redder not so much.

Based on the data listed, Alaska Airlines and its MAX9 is the low-cost leader. Before getting too excited, note that this data point is based on only 2,337 flights. It is too few to take as firm. For example, Alaska’s 737-900ER number is based on 62,999 flights and is far more statistically reliable. By comparison, United reported 18,235 MAX9 flights and their $18.89 is more plausible.

A quick glance through the rows shows:

- Delta is having a tough time with the A220-100. We did not expect to see that turn out to be more expensive than the 717. Nor did we expect to see the A220-100 is one of the highest-cost aircraft. The A220-300 is also turning out to be more costly than we expected.

- The 737-800 is the nation’s workhorse performing 23% of flights and the next highest is the 737-700 at 17%. Southwest is the low-cost leader here by a good margin, on both the 737-800 and -700. Southwest’s MAX8s is at $21.66. Southwest has a fleet-wide average of $21.56 and with its critical mass still drives market pricing.

- The 737-900ER may be replaced by the MAX9 but delivers a low cost of $18.33. While the MAX9 is still settling in, it currently averages $18.32. Boeing got the -900ER just right.

- Overall Southwest is no longer the lowest-cost producer.

- Allegiant averages $18.50 but is a niche player. What they squeeze out of the MAX will be very interesting to see.

- Spirit also averages $18.50 while Frontier is at $20.67 and these two are best compared against each other.

- Alaska averages $19.68 which is a very good metric as this airline grows its national footprint.

- JetBlue is at $20.42 which is a good metric given its size and footprint. JetBlue’s low-cost tool is, no surprise, the A321.

- Allegiant averages $18.50 but is a niche player. What they squeeze out of the MAX will be very interesting to see.

The data points shown are useful benchmarks for airlines operating outside the US. Despite some flaws, the US DoT databases remain the world’s most granular and useful for comparisons like this.

Views: 2

Any thoughts on why Spirit’s A320neo costs are higher than the CEO model? A function of the smaller fleet size or something more unlikely??

Most likely