IMG 0185 scaled

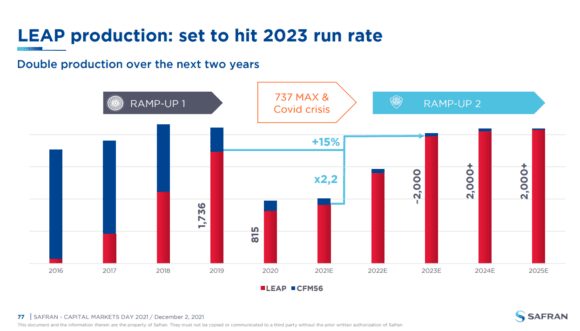

French aerospace giant Safran Group plans to ramp up production of its CFM LEAP engines to 2.000 per year from 2023. This is double the production of 2021 and also well over 1.736 engines it built in 2019, it announced on December 2 on its Capital Markets Day. LEAP production up to 2.000 engines from 2023.

The ramp-up fits within Safran’s strategy of ten percent organic growth of its revenues by 2025, primarily driven by higher production rates and higher income from the aftermarket. Safran says that with each engine sold, the LEAP will reach gross breakeven margins at the latest in 2025 after the first few years of negative margins. Until 2024, variable costs should go down by at least fifteen percent.

Based on cumulative orders and commitments and a backlog of 10.300 engines by late September, the LEAP has now captured a 72 percent market share. The -1B is the exclusive engine on the Boeing MAX (main picture) as it is on the -1C on the Comac C919, which is expected to enter service this month. On the Airbus A320neo-family, CFM has a formidable rival in Pratt & Whitney’s Geared Turbofan but nevertheless has a sixty percent market share. Airbus targets a ramp-up that could go as high as 75 aircraft in 2024, which was questioned by Safran CEO Olivier Andries in July as too high.

Safran still warns of uncertainties in the supply chain and as part of its Ramp-Up 2 scenario is on a risk management strategy to prevent any issues, including a shortage of raw materials. At the same time, it keeps a strict eye on quality through its Supply Capacity and Quality Monitoring system that was introduced in December 2020 as part of Ramp-Up 1.

Aftermarket sees strong growth

The aftermarket should realize even a fifteen percent increase in revenues until 2025. While the CFM56 will be phased out, there is a young fleet of -5Bs and -7Bs out there that needs maintenance, repair, and overhaul. Safran expects the MRO market to return to 2019 levels in 2024, with some 2.500 shop visits of CFM56s expected in 2025-2026. From then, the LEAP will become the frequent visitor for planned maintenance. Until 2030, single-digit growth numbers are expected. Safran sees a trend that more customers opt for maintenance rates per flight hour (RPFH) over the more traditional ‘Time & Materials’ business model, notably on the LEAP. In 2030, some sixty to seventy percent of engines is expected to be RPFH. As it is a somewhat new trend, the OEM doesn’t recognize margins on the rate per flight hour contracts now and will only review its accounting method in 2026 after it has won sufficient experience with LEAP shop visits.

Safran Interiors, the Seats and Cabin segments should contribute to higher revenues with a ten percent increase in 2025. The integration of Zodiac Aerospace and a successful transformation of the interiors business, which included a forty percent reduction in headcount and the closure of two sites, have produced breakeven margins. “With strong market shares, innovation-driven growth and customer confidence restored, both businesses are ready to take advantage of the recovery of a severely hit market”, Safran says. The target is to hit breakeven in 2022 as it can offer customers a renewed product portfolio.

Safran targets an average recurring operating margin in 2025 of 16-18 percent, up to five percentage points from 2021, and produces an EBIT to free cash flow conversion of seventy percent. The propulsion division should produce a twenty percent margin, Equipment & Defense fifteen percent, and Interiors ten percent.

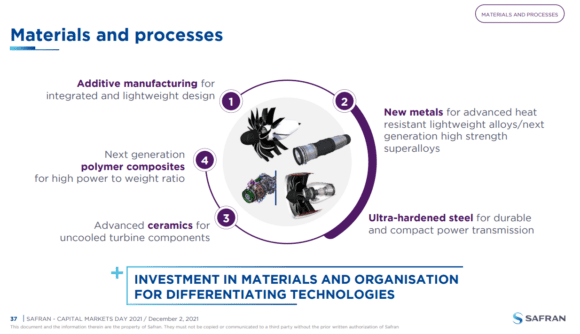

Significant investments in new materials and processes

Besides organic growth, the company plans to invest heavily in technologies that will lead reduce the carbon footprint of its products, notably the RISE technology program together with GE Aviation that was announced in July. Until 2025, it plans to invest €2.8 billion in self-funded research and technology. This includes new materials and processes like additive manufacturing, power and energy, and digital technology. It also plans to raise €1.4 billion in public funding.

Additive manufacturing or 3D printing has already produced ten parts that are certified and in service today, but Safran sees more opportunities to use the technology to drastically reduce lead times. On new materials, the focus is on nickel-based superalloys to improve the thermo-mechanical performance of for instance turbine disks and compressor blades. Nitrided steel is developed for gearboxes for higher durability. Research in ceramics also continues to improve heat resistance within engines, while polymer composites are applicable in engines and aircraft interiors to save weight.

Safran says it is also developing technologies, including fuel cell technologies, for the Airbus ZEROe demonstrator that uses hydrogen as well as electric-hybrid technologies.

The French OEM is still reviewing its portfolio and not ruling out divesting some of its businesses, including one-third of Zodiac that hasn’t been fully integrated yet. At the same time, Safran might ‘bolt-on’ acquisitions through Safran Corporate Ventures.

Views: 100