Despite the continued impact of the pandemic on its operations, Russian flag carrier Aeroflot’s domestic air travel has returned to...

A320NEO

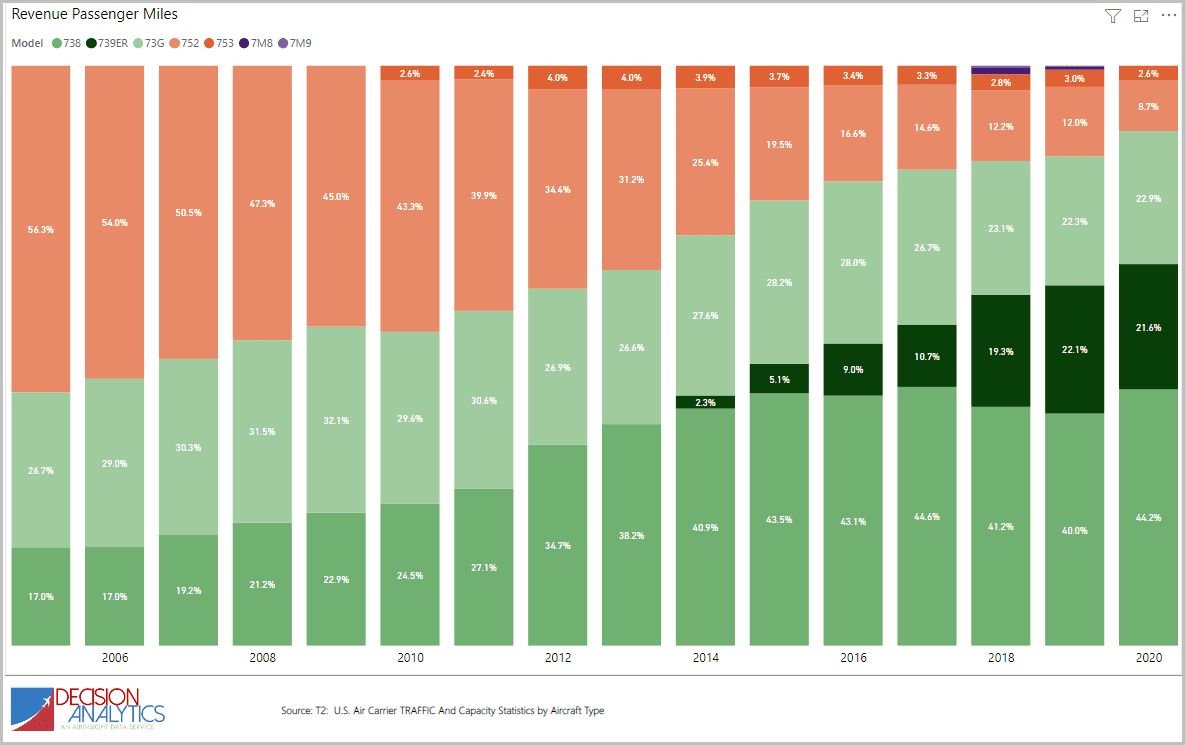

With the highly useful T2 dataset updated through year-end 2020, we now can share pictures of how fleet changes...

Scandinavian Airline Systems (SAS) reports a slight improvement in Q2. It reduced its losses during the first six months...

Airbus plans an aggressive production ramp-up. The European airframer has disclosed more details on how it intends to grow...

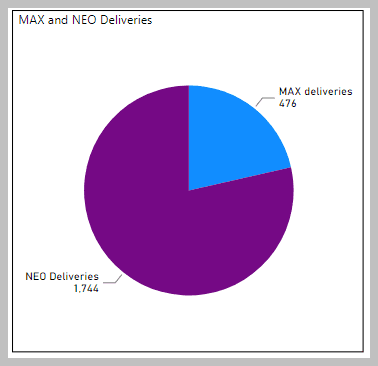

Now that the MAX is back being delivered how is the delivery competition between these two families doing? We...

Airbus dusts off its plans for a new A320 final assembly line (FAL) in Toulouse. A year after the...