5 28 2021 12 23 51 PM

With the highly useful T2 dataset updated through year-end 2020, we now can share pictures of how fleet changes impacted US airlines.

The biggest impact we see is the rise of the A321 and the shrink in the 757. Notice that this change occurred in 2015. Notice also how the 737-900ER came on strong from 2015, but not nearly as much as the A321.

By comparison, the 737-800 saw a steadier market share compared to the A320. This reflects the penchant at Alaska, American, Southwest, and United to focus on the 737-800. Although American is the largest Airbus operator, its current management group decided to pursue the MAX over the NEO, reflecting a bias in favor of Boeing. Similarly, Alaska absorbed an Airbus fleet and showed low enthusiasm for it. United’s merger simply grew its Boeing fleet. Delta’s merger on the other hand brought in an Airbus fleet that has grown steadily.

When we filter the above chart for Airbus only, the change is really interesting.

Airbus has seen growing market demand for the A321. This trend has been discussed before, and even during the pandemic, we see it has remained consistent. The primary success here has been across the US industry with United the sole outlier among the majors. United has an A321XLR order but its status is probably doubtful. Even Alaska with its “Proudly All Boeing” philosophy, has not seemed to rush to offload its A321neos. American has been taking deliveries of A321neos and Delta has taken delivery of its A321ceos and added to its A321neo orders. Then we have Hawaiian using A321neos where it used to use 767s.

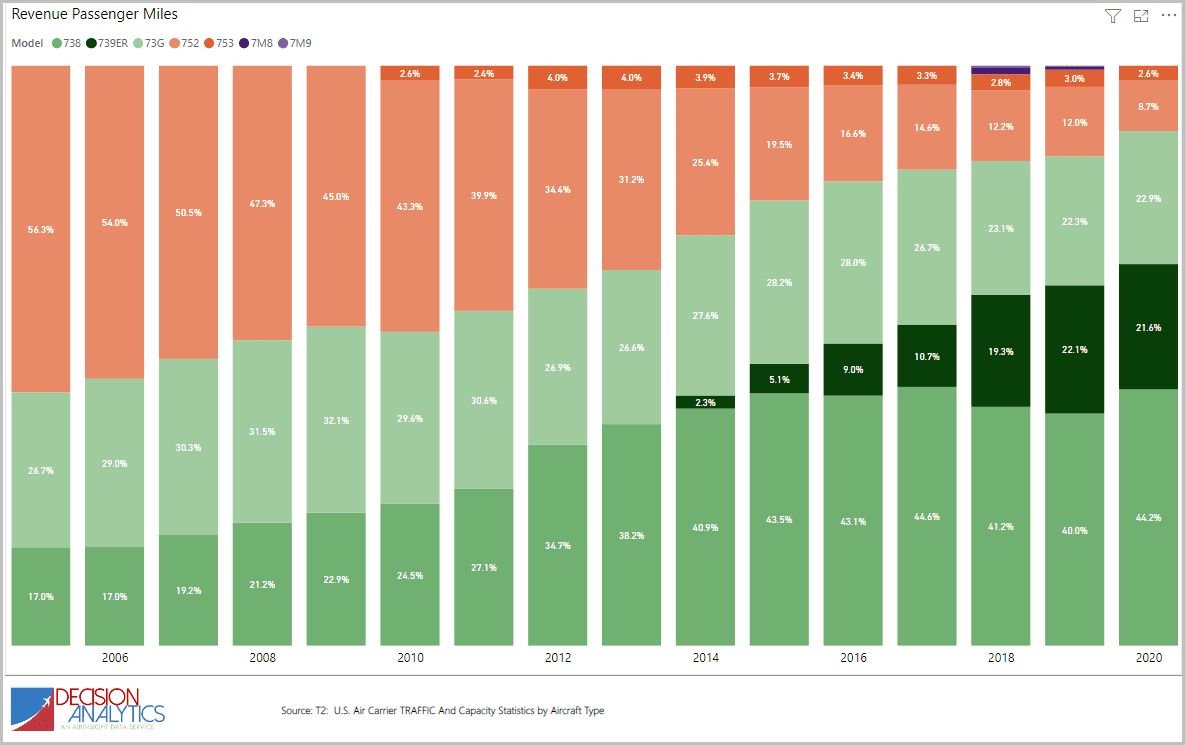

Here’s what filtering for Boeing looks like. We changed the colors a bit to make the trends easier to follow.

The most obvious item here is the shrinkage of the 757. Starting off at over 56%, the 757 ended 2020 at about 10%. Even if we add the 737-900ER the share has been shrinking. The 737-900ER has not been able to make up the shortfall. At the upper end of the single-aisle market Boeing has lost share. Will the MAX9 help claw back share? Alaska and United have opted for this model so we should see some growth. But that may come at the expense of the MAX8.

At the bottom end, the 737G or 737-700 has also seen a shrink. The key operator is Southwest, which is increasingly taking -800 and now MAX8s. Although the airline placed a big order for MAX7s, one has to wonder if it will replace the -700s with MAX7s on a one-for-one basis. Acquiring the MAX7 at a bargain price may not help over 20 years and a low residual value. As fuel prices rise, the more economical A220 and E2 must impact Southwest.

Summary

The pandemic’s main impact in fleet terms was the removal of the MAX from service. This put a dent in the operations of big operators. Not only could these aircraft not operate, but Boeing also could not deliver those produced. Airbus A321neo and A220 deliveries largely stayed on course. The combination of pandemic and MAX grounding handed Airbus a significant advantage in the US market. Even with MAX8s replacing -800s and A320neos replacing A320ceos, US airlines will end up favoring Airbus because the A321neo has no competitor.

Since US airlines operated some 70% of the 757s produced, this might indicate Airbus moving into an even stronger position with the sole offering as the market continues to upsize in single-aisles.

Views: 1