Russian airlines won’t be flying their Western jets for long. The uncertainty surrounding Russia’s Western fleet is causing lessors...

Iran

Western thinking and views on InterJet and SuperJet may not be fully informed. The status at Air Italy may...

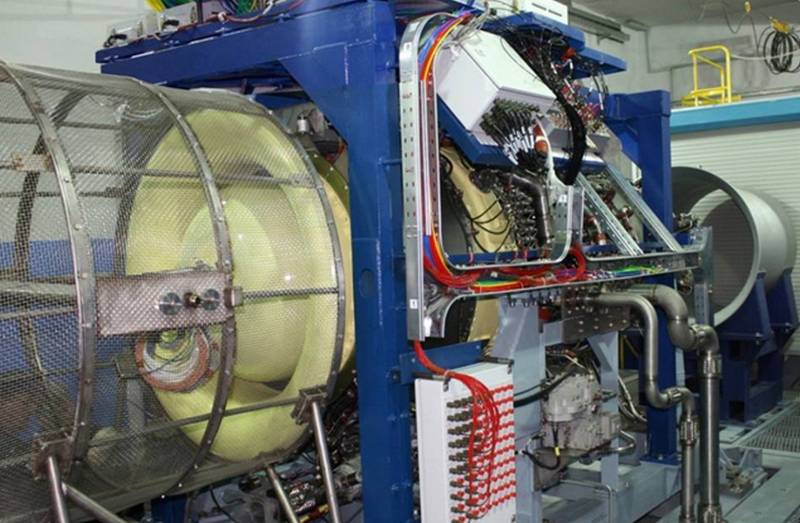

Rostec provided the following PR yesterday. “Rostec’s United Engine Corporation successfully completed the first stage of testing the PD-8...

Status Ante There is a great need for new commercial airplanes in Iran. Iranian airline safety is a critical...

News It isn’t a secret that Joe Biden will have a much different administration than Donald Trump. Among the...

It has not been a good year for Superjet. First, it was the news from Mexico, where Interjet is...