2021 02 22 14 38 42

Freight grew in importance as passengers grew less important. The demand for PPE from overseas required US carriers to use long-range widebody aircraft to get to source markets like China. The cargo was bulky but relatively light. Several airlines took passenger aircraft and removed seats and used the space for these bulky packages.

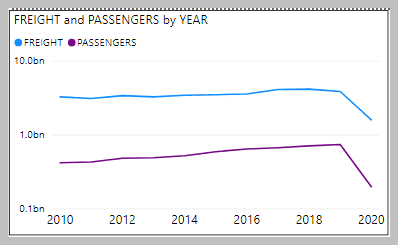

Here we see a chart (based on T-100) that shows how much the traffic declined through 3Q20. The airlines listed are passenger carriers, not dedicated freight carriers. The freight is measured in pounds.

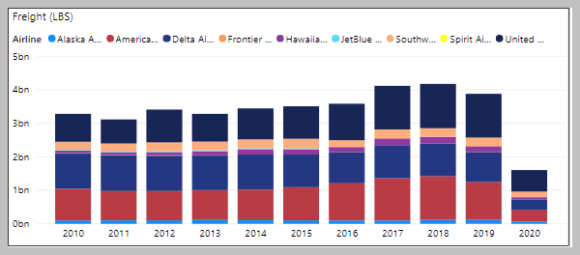

The next chart lists US airlines’ freight loads over the period, and again through 3Q20. We see that freight loads grew steadily over the years, while 2019 saw a small decline and 2020 was a wipeout as expected.

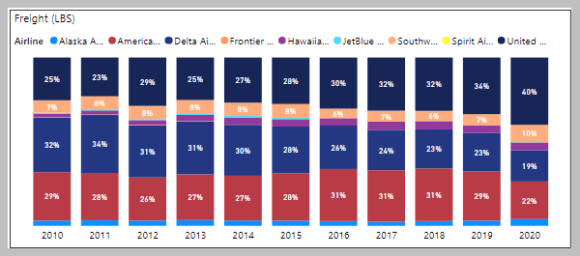

But another aspect is noteworthy. US carriers reacted differently to the pandemic. As the following chart illustrates, United was the quickest mover into the freight business. In fact, United has been growing its freight business steadily. American and Delta were, relatively, apparently caught off guard.

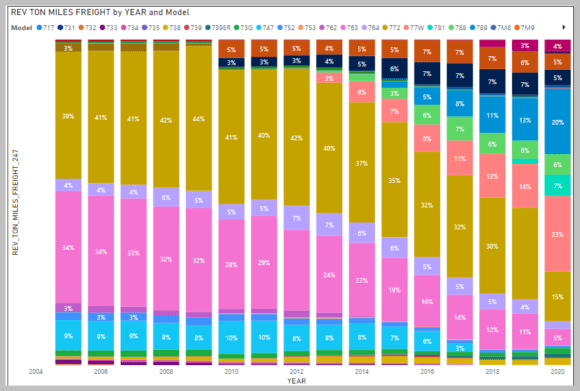

Switching to the T-2 data source, we see how the fleet carrying this cargo changed, especially in 2020.

Freight was mainly a 777-200 and 767-300 business in 2005. Certainly, a mostly “All Boeing” show. From 2013 there were some changes as the 777-300 entered the fleet and from 2015 as the 787 entered the fleet.

Looking at 3Y20 and we see the 787-9 and 787-10 accounting for 27% of the freight. These two models are quickly catching up to 38% of the 777s. It was still an “All Boeing” show. Whereas Airbus has seen its freight share rise to a high of 18% in 2019, in 2020 it declined to 15%.

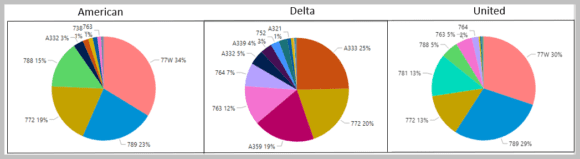

Among the big US airlines, United may have had the right fleet for the 2020 freight demand. Next, we show the big three US airlines with the impact their long-range aircraft had on freight missions.

Of these airlines, Delta had the smallest 777 fleet even though it solely operated the highly capable 777LR. American had a good mix of 777s and 787s but seemed to have missed market demand. United appears to have the optimal mix of 777s and 787s and its early focus on freight allowed it to jump ahead.

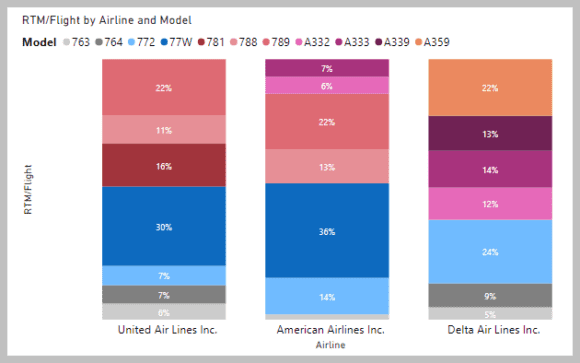

When we break down the 3Y20 data into freight per flight for these three airlines, we can see how the 787-10 proved to be very useful for United. Delta’s new fleet of A330-900s started service during the year but there were too few to make an impact, while its A350-900s did quite well.

Views: 1