2020 08 31 14 12 26

Between January 2020 and April 2020, the US airline industry went from a pilot shortage to a surplus. And that surplus is big – the US airlines average 12 pilots per aircraft. US airlines parked hundreds of aircraft as traffic froze and international markets shut down for passenger traffic. The pilot surplus numbers in the thousands.

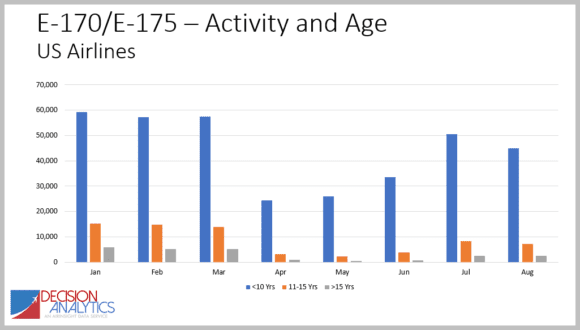

A key part of how the US airlines configure their business is right-sizing their fleets. And that right-sizing starts with 76 seat regional jets. Here’s a chart for the Embraer E170 and E175 fleets. The older and aircraft is, the less likely it is to see activity post-pandemic. For many, that trip to the desert is one-way.

Why focus on the Embraer? This aircraft is the benchmark regional jet. Currently, the US airline industry is carrying 20% of the traffic it has the capacity to handle. Regional jets are the right size for right now. The average load factor per flight has been at approximately 50 passengers since July 11. The peak was 58 passengers on August 16.

Moreover, the typical US domestic flight averages around 1,000 miles. This is within the capability of the E175 which can fly over 2,500 miles. The regional jet (including the Mitsubishi CRJ900 can fly over 1,500 miles) is arguably the most economically effective airliner. Fuel is cheap and these aircraft have good trip costs. They have a capacity that airlines can sell.

But US airlines cannot focus on these aircraft as there’s a thing called Scope Clause. US airlines are very quiet about the restrictions Scope places on their operations. Through the end of September, US airlines are not saying a word – though they are offering early buyouts and sending furlough notices to pilots. Absent more federal support after September, the airline industry is going to see massive layoffs. Essentially, based on traffic, the industry looks to be 80% overstaffed. This is brutal.

When asking the pilots how they feel about their Scope situation, they remain immovable. Their negotiation position is radically different than what it was in January. There is, in no uncertain terms, no longer a pilot shortage. However, the airline industry is in no position to rock the boat either. Even with far fewer pilots needed, those remaining can strike and that would be catastrophic for everyone.

The US air travel market is at least two or more years away from any traffic recovery. That could change fast if a vaccine is found and readily available at a reasonable price point (i.e. flu shot pricing). But without anything to alleviate their fears, US travelers sat out the summer travel season. A very cold and dark winter looms.

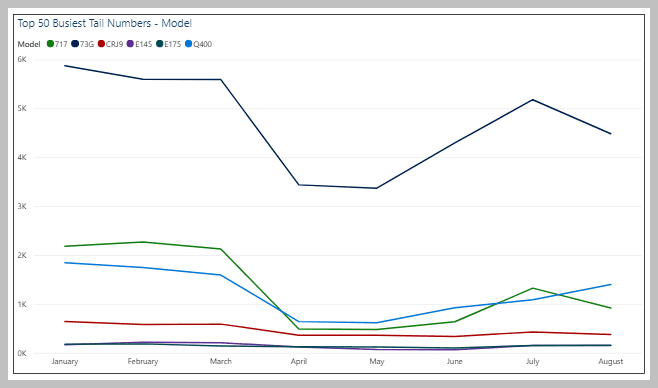

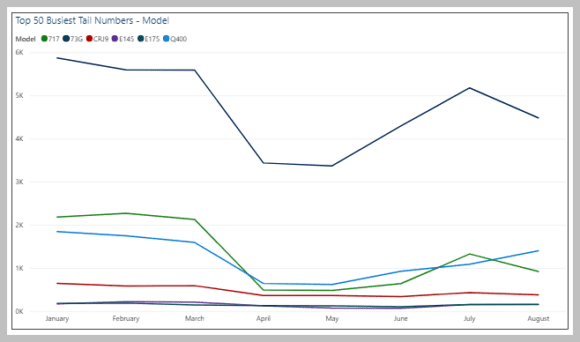

What do we see among US airline flight operations? The following chart shows us the busiest aircraft in airline service. The largest is the 73G (737-700) flown mainly by Southwest Airlines that has 142 seats.

Airlines, to save their businesses, must refigure fleets to be flexible and cost-effective. Currently, that means small aircraft – typically those under 120 seats. That space has two offerings: the Airbus A220 and the Embraer family. Trying to get a delivery slot on the A220 is tough because production is limited, and demand exceeds supply. Once again we can see how fortunate Airbus was to strike a deal with Bombardier. Embraer, on the other hand, has a family of options ranging from 76 seats to 140 wth its E-Jets.

The A220 is currently in service with Delta as a mainline aircraft – so no Scope problems at all. But the airline only has 39 in service. How smart they were to move on this segment when they did!

Embraer does have the production capacity to provide the market with E190-E2 and E195-E2 which both offer excellent economics and are “right-sized” for the current conditions. Moreover, they have the E175-E2 in development. Mitsubishi has their M90 in development as well, but it is unclear how far and what production capacity they could offer. Under current Scope limits, the E175-E2 and M90 are to heavy.

The Conundrum

- Timeline – How long will it take for the market to recover? When can we get that vaccine? The longer these take, the greater is the pressure to reconfigure fleets.

- Finance – While banks probably don’t have the incentive to add more risk to their balance sheets, the OEMs will almost certainly find a way to help airlines. It is not too fine a point to state the future of commercial aviation is at stake. Creativity will close gaps.

- Labor – Here we will also see creativity. Pilots are aware of the stakes. And Scope should not be an issue. After all, Delta is flying the right-sized aircraft in the crisis.

Does Scope even matter now?

It still matters to the pilots and they are as firm on this as ever.

- “(Airline x) can buy and fly heavier E-175 E2 and M90 anytime, however, mainline pilots will fly them and they’ll need to negotiate pay rates. That line/trench in the sand is filled with lava and it will not be crossed. Scope particularly in turbulent times like this is an even more monolithic religious issue. It’s a, you buy’em, we fly’em, situation.”

The way forward, because of the much weaker hand both airlines and pilots have to play, is to focus on protecting what they have left by way of business. Flexibility on both sides is necessary. As the timeline stretches out the need to find a solution that protects airlines from destruction with the dearth of revenues and a given cost structure, means rethinking and recalibrating. Right-sizing the fleet is a crucial step and doing it in collaboration with mainline pilots is the way to accomplish it. There’s no space for hubris and stubbornness. Also, don’t waste time getting this started.

Views: 13

Well this article didn’t age well lol