11 29 2021 1 03 32 PM

We’ve written about this before. (here and here ) At the risk of boring readers, we have another post on the subject. Why another one? Because we see the heart of the market is moving and becoming less stable. It used to be all about the 737-800 and A320 at the heart of the market at close to 50/50. Remember those days? In Dubai, we saw a shift in orders at Airbus towards the A321neo. Boeing had a good deal from India on the MAX8. The MAX8 is the heart of the MAX family, but not where the market is moving to.

The sustainability movement isn’t going away. It has developed its own momentum and at industry events, executives wax lyrical promising green travel. The reality for sustainability is several years of SAF – if the supply can be increased and price reduced.

But this is only part of the story. Of course, everyone wants a cleaner, greener world. But the path to that future requires a reality check. What can the commercial aviation industry do right now to move in that direction? Here the pandemic has helped. One thing airlines can implement is to change the way they operate. For example, fly fewer but larger aircraft. The pandemic saw airlines doing this as they cut back schedules.

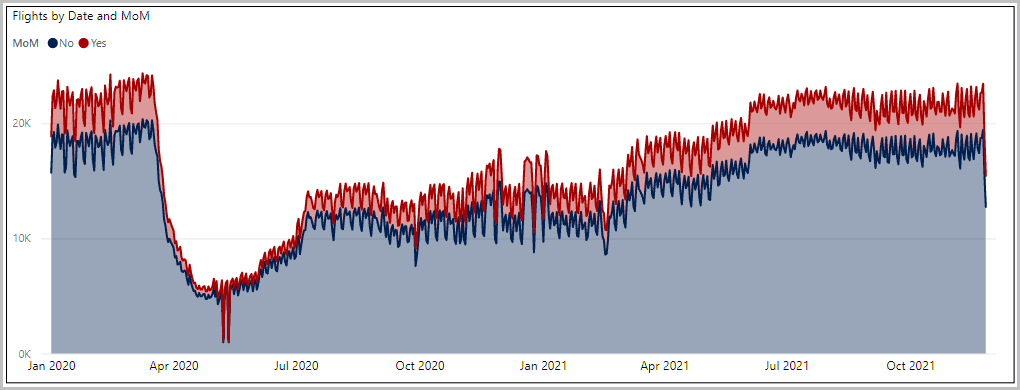

Coming back to the heart of the market – there are fewer single-aisle flights using 165 seaters and more flights using 180 seaters. The history is short but demonstrates that among US airlines this may be happening. The 165-seaters are still the largest part of the market, but the amount of red in the chart is growing, signaling a move to MoM models. Based on orders, we should expect this to keep growing.

There are other data that suggests this trend isn’t new and has been coming for some time. The following two charts list deliveries from Airbus and Boeing. Deliveries are, in our view, the most important metric in the O&D race. The charts show a quite different market reaction to Airbus and Boeing for single-aisle aircraft.

And it is this difference that is at the heart of the instability. If the market is moving to larger models Boeing is not helping to keep the duopoly in balance. Boeing could argue that the imbalance is temporary as the MAX line is reset and production grows again. Perhaps. But the airline industry is under pressure to deliver cleaner travel, ideally at a positive rate of return, right now.

If you started an airline today the chances are your first aircraft selection would be an A321neo. Having made that selection, chances are your second choice would be an A220-300 because Airbus is able to combine the two in a great offer. Take a look at what the market is buying. Boeing would point to their success at Alaska and United to disprove this. After all, these airlines selected the MAX9. An indelicate question: Did they select the MAX9 as a first choice or as a second choice because A321neo delivery slots are way out there, five or more years away?

Let’s take another look at single-aisle MoM deliveries since 2000. Airbus has been on the march in this segment for years. This is not news to anyone by now.

Now take a look at the next chart. Boeing invented the MoM with the 757 and 767 in a brilliant one-two stroke. By 2005 that brilliance was wobbly. The 757 seems to have become more popular after Boeing stopped making it. The lack of a real replacement hurt then and continues to do so now. If the MAX10 helps close the “757 gap”, it comes nearly 20 years late. Many will argue too late and the market did not wait.

For commercial aviation to achieve its sustainability goals, it requires many pieces to fall into place. Among them, SAF supply and pricing. But crucial to this is also a stable duopoly that delivers constant competitive pressure. A strong duopoly is in the best interests of the entire industry. We don’t have a stable duopoly now and don’t see it coming. This should be a cause for concern across the industry.

Views: 0