Here is an update on commercial aircraft transactions through May 2018. Note transactions include new and pre-owned aircraft.

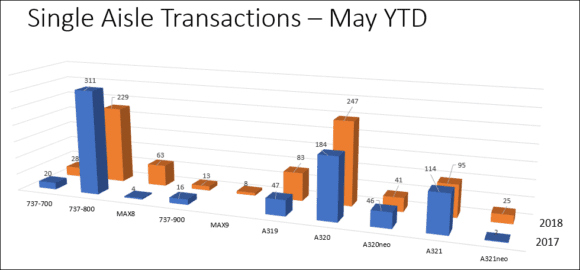

- Airbus has had a more active year compared to Boeing. The 2018 numbers also show more activity at Airbus compared to last year.

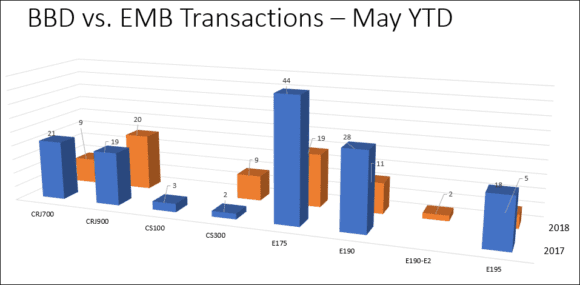

- ATR, Bombardier, and Embraer are all having a much slower 2018 compared to 2017.

- Sukhoi seems stable this year compared to last. IRKUT makes its first showing.

- Boeing saw some lift in 737-700 transactions, but the 737-800 declined as the MAX8 picked up briskly.

- The 737-900 remains comparatively weak but the first MAX9s are showing up.

- The A319 also (like the 737-700) saw good comparative activity. The A320 also saw improved activity. But the A320neo didn’t see as many transactions – and note the 201841 compared to 63 for the MAX8. Boeing is outproducing Airbus.

- The A321ceo did fewer transactions this year compared to last. But the A321neo saw good growth. In this case, note the difference between the A321neo and MAX9.

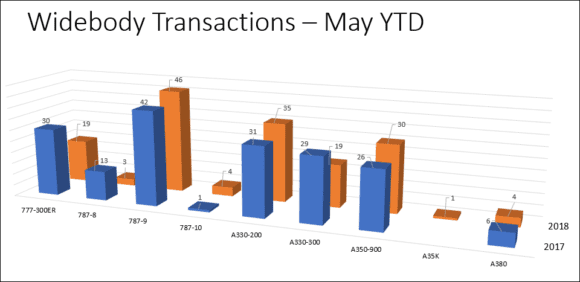

- Boeing saw the 777-300ER and 787-8 slow down but .the 787-9 saw more activity. The 787-9 is clearly a winning solution for the airline industry.

- The 787-10 saw more transactions as deliveries have started.

- The A330-200 saw more transactions than the A330-300 – perhaps the market is waiting for the A330neo?

- The A350-900 saw more progress as deliveries grew. The A350-1000 looks like it is running slower.

- The A380 bumbles on. The recent news of the IAG deal being on hold is not helping.

- The CRJ700 saw a big decline in transactions – this is something of a special aircraft since it has no direct competitor and is a low-risk step from 50-seater to 80-seater.

- The CRJ900 continues to be the preferred CRJ model.

- The C Series line is running very slowly. Too slowly, but that is likely to change with new management which is “weeks away” we understand.

- Embraer’s best seller, the E175, is seeing a slower 2018 compared to 2017. It is now neck and neck with its competitor, the CRJ900.

- The E190 also has seen a slower 2018. But the first E190-E2s have reached the market and, according to the launch customer data, are performing very well.

- The E195 is also seeing a slower 2018.

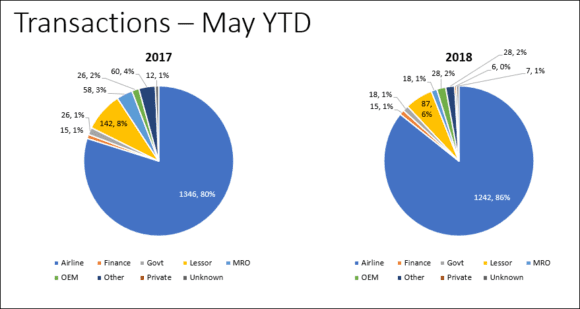

- Even though 2018 is looking slower than 2017, airlines and lessors are the main areas of activity.

Views: 1