2024 03 25 08 01 42

Boeing is an aviation legend. William Boeing’s creation is over a century old, as old as commercial aviation. The first commercial flight was in 1914.

Boeing is struggling today, but this is the time to look forward, not back. The only point, in terms of today, is that tremendous pressure from customers forced these changes. The company announced some significant changes – the largest management shakeup in its history.

CEO Dave Calhoun retires at the end of the year, but no successor has been named yet. Chairman of the Board Larry Keller is set to retire, while Boeing commercial head Stan Deal is to retire and be replaced by Stephanie Pope, currently COO. Current board member Steve Mollenkopf is the new chair and will help seek a new CEO.

Naturally, the focus immediately jumps to Pat Shanahan as a potential new CEO. He has the credentials. Shanahan originally joined Boeing in 1986. In his tenure at Boeing, he had management roles in Boeing Missile Defense Systems and 737, 747, 767, 777, and 787 commercial airline programs. He earned a good reputation as “Mr. Fixit.” It could be argued that he is fortunate not to have come into Boeing’s management via the Jack Welch/GE path.

But Mr. Shanahan is not the only choice. Stephanie Pope is likely another candidate and is taking over from Stan Deal. Ms. Pope’s path at Boeing has been via the financial roles, not aircraft programs. An industry observer noted Boeing needs an engineering type and that Ms. Pope might be “too fresh.”

Several others from outside the company will undoubtedly be considered. We expect that pool to be smaller than expected. One person familiar with the opportunity said the situation is “too toxic.”

Turning Boeing Around

Does Boeing need to turn around? Yes, it does, desperately. Some brief notes on how we got here are helpful.

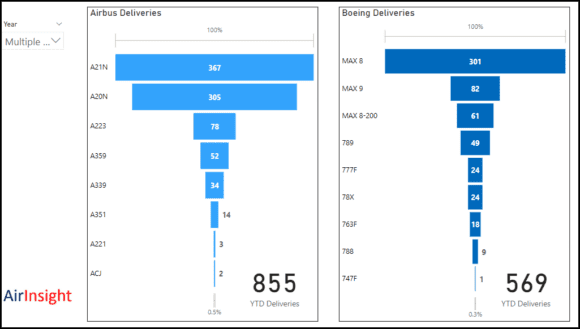

Here are two charts that lay out the case. Since the duopoly accounts for over 90% of the new commercial deliveries, its dominance is paramount.

The first chart lists new deliveries in 2023 and 2024 through March 24. Boeing’s deliveries are substantially different from those of Airbus. We would argue that Boeing started this misstep in 2011. Dave Calhoun joined Boeing as a director in 2009, so the MAX began on his watch.

The MAX 8 sells well and effectively competes against the A320neo; the other MAX models have not done nearly as well. The MAX 9 has excellent fuel burn but cannot compete with the A321neo. Indeed, real-world operational data shows the current MAX models perform well.

We argue that the MAX family is the fulcrum around which Boeing’s current problems rotate. The market moved away from the ~165-seaters to larger models. Airbus kept its A321 and tweaked it relentlessly, enabling it to enter the market vacated by the 757. The last 757 was delivered in 2005, so Mr. Calhoun was not in that decision. But he is central to the lack of a replacement. [A brief reminder: That 757 replacement decision process began in earnest in 2015. The concept went through various iterations, but nothing was done to close the gap that appeared as the A321 took the market. There was money to buy back stock, though. Customers started to defect from Boeing to Airbus.]

There was a disconnect between how Boing’s leadership saw the world and how the world is. That disconnect burned through a mountain of shareholder funds. A decision that puzzles many: shutting down the company’s strategy group. Like the decision to sell Spirit AeroSystems only to repurchase it, there will be a need for a strategy group again. An objective source of market insight is a critical management tool.

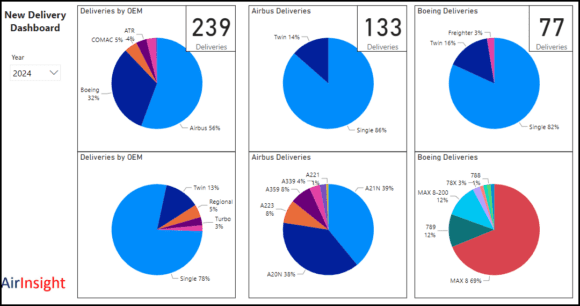

The following chart lists 2024 new deliveries. The gap between Airbus and Boeing is even more comprehensive than in 2023. The MAX 9 was grounded after the Alaska Airlines doorplug came loose. That debacle is now under investigation by the Justice Department.

Airbus is outdelivering Boeing by 1.7:1. Boeing’s MAX 8 is now being delivered to China again, a great relief to Boeing and its Chinese airline customers. But, as noted above, the market has moved. Boeing should be delivering the MAX 10. That model is now the second-best-selling member of the MAX family.

Turning Boeing around is needed because the commercial aviation silo needs a stable duopoly. Airbus does not “win” because Boeing is weak. A strong Boeing pushes Airbus to do better. A strong Boeing is why Airbus is such a strong competitor today.

About 156,000 people work for Boeing. This is a deep and crucial talent pool for the United States. The unprecedented management shakeup today is an opportunity that every one of those employees must embrace. Here is the chance for these people to turn their company around.

It matters less who the new CEO is; it matters most that this person articulates a vision everyone can buy into. The market reacted positively to today’s news. Boeing’s new CEO must take the opportunity to draw everyone into a vision that speaks to product quality, better management/labor relations, and (once again) delivering the best aircraft.

Views: 1