2024 04 01 11 30 04

Another month’s end brings an opportunity to review the changing US airline fleet. The state we see here started years ago. Airline fleet updates are always big news. Here are some of the trends.

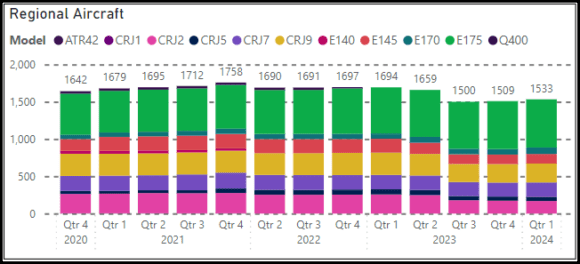

Regional Aircraft

- The fleet saw retirements and some growth. There is a transition from 50-seaters to 76-seaters.

- Given the pilot shortage and communities losing air service, is there an opportunity for new technologies in the 50-seat category?

- In 4Q20, Mitsubishi and Embraer were 50/50. The market has swung to 44/56 in favor of Embraer.

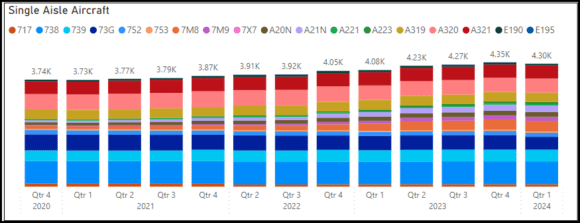

Single Aisle

- The fleet continues to see steady growth.

- The duopoly has seen some movement; in 4Q20, Boeing was 58%, and Airbus was 41%. In 1Q24, the score stood at 57% to 42%.

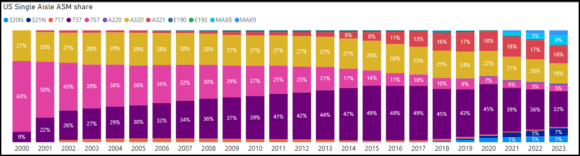

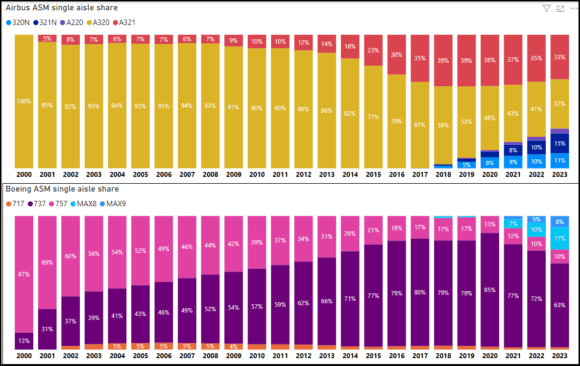

- The story here isn’t about market share but the share of traffic and the move to the MoM. The following chart lists ASMs through 3Q23, and traffic decline on the 757 has been picked mostly by the A321.

- Boeing saw traffic growth from the return of the MAX (primarily 8s), while Airbus traffic is increasingly moving on A321s.

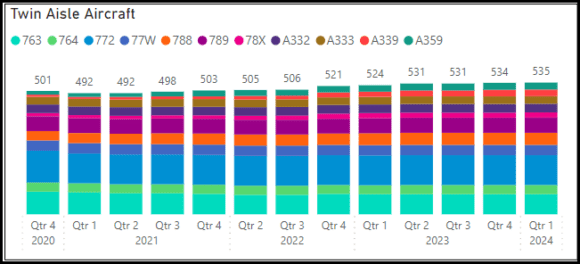

Twin Aisle

- This fleet has also seen steady growth.

- This growth is mostly due to Delta, which has been with Airbus.

- United has the largest twin-aisle fleet at 220.

- In 4Q20, Boeing held an 82% market share, compared to Airbus’s 18%. In 1Q24, the score shifted to 76% and 24%, respectively.

The twin-aisle fleet in the US is aging.

- American Airlines – has orders for 30 787-9s

- Delta Air Lines – has orders for 12 A330-900, 16 A350-900, 20 A350-1000

- Hawaiian Airlines – has 11 787s on order

- United Airlines – has 150+50 787s on order and options

This adds to 239 new aircraft. The US fleet at 1Q24 had 37 767, 16 767-400, and 74 777-200, totaling 127 aircraft.

Orders show a net growth of 122 twin-aisle models. US airlines have growing global ambitions and will have the models to reach any market.

Views: 4