We have been saying things are turning around at Boeing for some time. Today, we want to share another...

Boeing

Another month has passed, and US airlines have continued to take new deliveries. How has this impacted their fleets?...

The first civil trial against Boeing, stemming from the 737 MAX crash in Ethiopia, will begin on Monday, July...

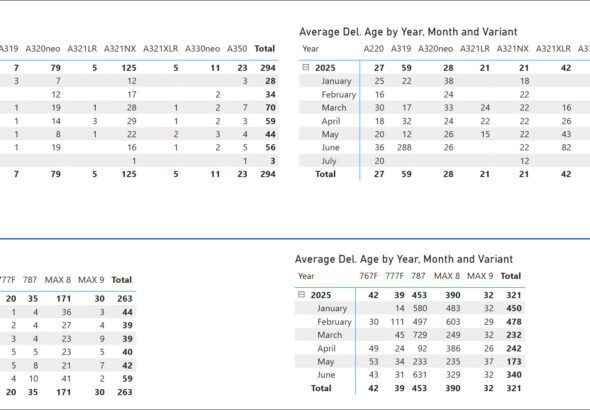

The numbers through June are now settled, and here’s our estimate of the score. As you will see in...

The planned re-acquisition of Spirit AeroSystems by Boeing is now under review by the UK’s Competition and Markets Authority...

This is not the kind of information you’d expect. After all, Airbus has been out-delivering Boeing for years. Our...