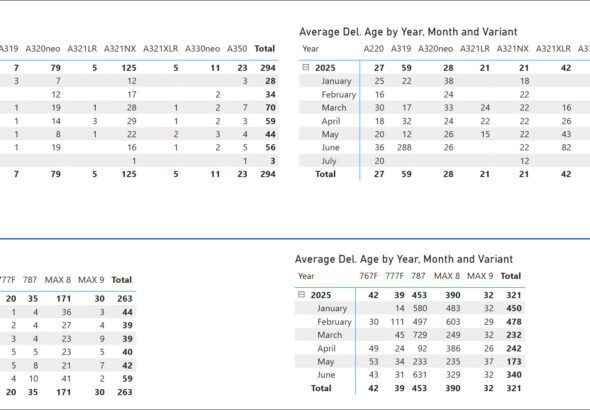

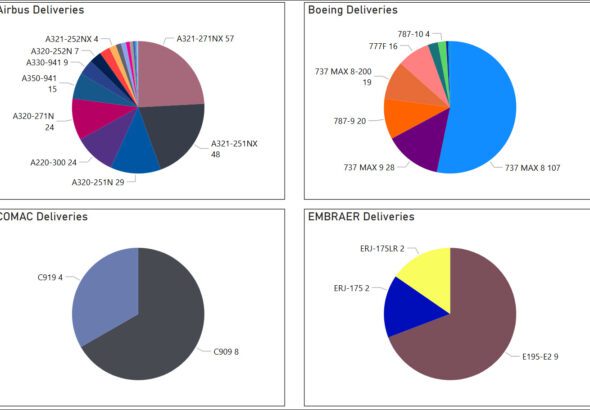

The numbers through June are now settled, and here’s our estimate of the score. As you will see in...

COMAC

With the month-end done, what’s the score look like? We focus on the duopoly as it accounts for over...

The CJ-1000A is China’s first indigenous high-bypass turbofan engine, which was developed by the Aero Engine Corporation of China...

As if world events were not causing enough anxiety, here’s another data point to add to your aggravation. It...

Early this week, the news was abuzz with the news that China is refusing to take delivery of new aircraft...

Vietnam has approved the COMAC C909 for service in the country. Vietnam decided to recognize China’s CAAC certification as...