Air Lease Corporation

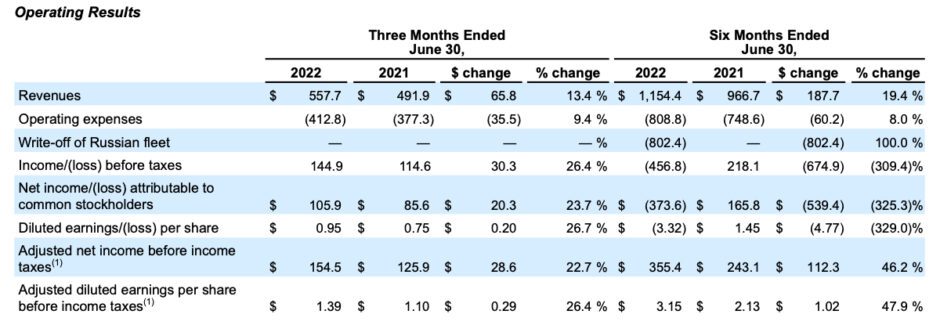

Air Lease Corporation announced its second quarter 2022 results today, with revenues up 13.4% and pre-tax income up 26.4% over 2021. The write-off of the Russian fleet in the first quarter in the wake of US imposed economic sanctions during the Ukraine war amounting to $802.4 million will place the company in a pre-tax net loss position of $456.8 million for the six months ending June 30th. This translates to a loss of $3.32 per share through the first half of 2022. The second quarter provided pre-tax income of $144.9 million or $0.95 per share.

Air Lease Corporation is upbeat about its second quarter. “We had a good second quarter with higher than expected aircraft deliveries and strong aircraft placements. Aircraft shortages and concerns about future new aircraft delivery delays are causing many airlines to secure lease extensions on existing aircraft as pandemic recovery is well underway with airline struggling to meet significant passenger demand,” said John Plueger, CEO and President.

The following table summarizes operating results:

The company took delivery of 21 aircraft from their new order pipeline and one incremental aircraft during the quarter. As of June 30th, the company had 392 aircraft in their owned fleet, with a net book value of $23.5 billion and a weighted average lease term remaining of 7.1 years. The company has placed 99% of their contracted order book positions on long-term leases for aircraft delivering in 2023, and 58% of their entire order book. The company ended the quarter with $31.3 billion in committed minimum future rental payments for the existing fleet and $16.3 billion in minimum future rental payments for aircraft on order.

“Passenger traffic growth remains on a very strong recovery trajectory, with international volume gaining meaningful momentum so far in 2022 – accordingly, lease placements from our orderbook are stretching further out into the future. Lease rates are strengthening, reflective of diminishing aircraft supply, increasing interest rates, and higher aircraft values,” said Steven F. Udvar-Hazy, Executive Chairman of the Board.

ALC’s fleet as of June 30th was 392 aircraft, as shown in the following chart:

John Pleuger indicated that supply chain issues are preventing rapid ramp-up from Airbus and Boeing for narrow-body aircraft, with some delays in delivery positions expected. The ramp-up at Boeing, for example, is constrained by the lack of availability of engines. ALC is pleased to see the end of the 787 delivery freeze, but continues to expect to take only one 787 aircraft for the remainder of the year.

The company has arranged for additional liquidity for 2022 at attractive rates, and continues to focus on having the lowest cost of capital to improve both its profitability and competitive position in the marketplace. Their latest transactions average a 2.2% rate, providing low financing costs.

The Bottom Line:

AirLease Corporation had another solid quarter, is working through the complexities of insurance regarding the written-off aircraft leased to Russia, and has positive expectations for the remainder of 2022 as the industry continues to recover.

Views: 1