Airbus GMF

UPDATE – Airbus predicts demand for commercial aircraft to shift from fleet growth to accelerated retirement of older, less fuel-efficient aircraft, resulting in the need for 39.020 aircraft over the next two decades. In their Global Market Forecast that Airbus presented ahead of the Dubai Airshow, the airframer project 15.250 or 39.1 percent aircraft for replacement, with the remaining 23.750 for growth.

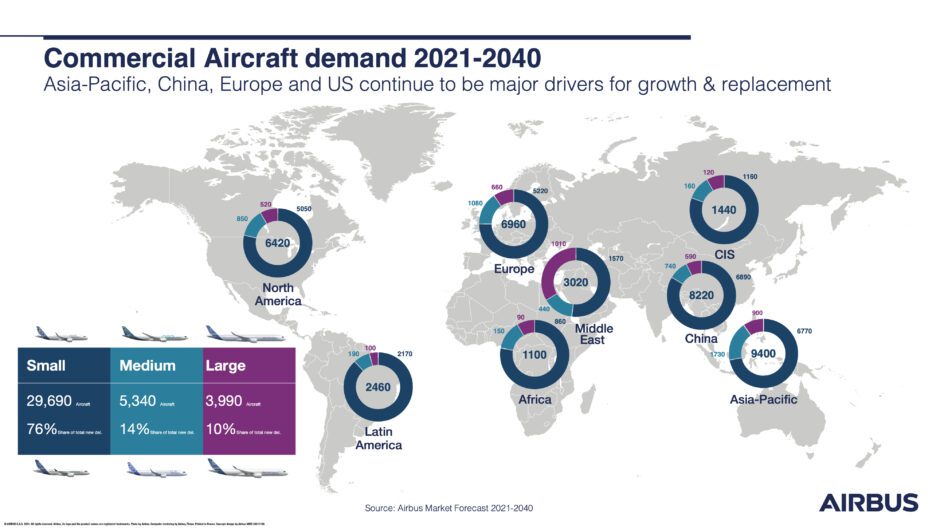

The breakdown is predominantly narrow-body aircraft. Since its 2018 forecast, Airbus uses three main categories. Small includes the segment in which the A220 and A320neo sit. For this segment, it now projects 29.690 aircraft compared to 29.720 in the last outlook of 2019. The Medium segment is where the A321XLR and A330neo sit and accounts for 5.340 aircraft, down from 5.370.

The Large segment is where Airbus offers its A350. With 3.990, its size has shrunk from 4.120 predicted in the 2019 forecast..

As Chief Commercial Officer Christian Scherer said, the number is “surprisingly close to the forecast we published before the Covid-crisis. But what should be said is that we lost two years of growth due to the pandemic, so on average, having lost two years, this forecast assumed a lower economic rate of 3.9 percent compared to 4.3 percent in the 2019 forecast.” An interesting statistic in the market outlook is that only 13 percent of the active fleet is of the latest generation of aircraft. So with 87 percent older ones out there, there is a need for replacement with newer and fuel-efficient aircraft that are more eco-friendly.

Scherer points out that there is “a shift” of replacement and growth. “In the previous forecast, about one-third of the new airplanes were for replacement and two-thirds for growth. Now, it is forty percent replacement and sixty percent growth.” In absolute numbers: 15.250 for replacement, 23.770 for growth, 7.700 aircraft to stay. Another trend is that is aircraft tend to increase in size, except for the Large segment. “Our A350 is pretty much positioned at the sweet spot of the Large aircraft sector, but I say this very humblingly as you know we will deliver the last A380 only in a couple of weeks’ time.”

At the same time, Scherer stresses that this forecast is agnostic of aircraft types and in no way should be interpreted as a means of defining Airbus’ current or future aircraft market portfolio. So don’t draw any conclusions of a potential launch of an A220-500. “That said, I as the sales guy am pretty excited about this forecast because it tells us that our product position is very relevant.”

Not all new freighters are ‘new’ freighters

Where the forecast is more precise is on the full freighters, unsurprisingly as Airbus has launched the A350 Freighter in July and will announce customers “soon.” The current world fleet of 2.030 dedicated freighters will grow by 950 to 2.980 in 2040, of which 2.440 are ‘new freighters’: 1.000 in the small 10-40 tons segment, 900 in the mid-sized segment of 40-80 tons 2019: 499), and 540 in the large segment of 80+ tons (2019: 356).

“Actually, not all are new, as the market will be largely served by aircraft that are converted from passenger service to freighter. The smaller the aircraft, the bigger the tendency for converted aircraft while the larger means it will likely be a newer aircraft. Freighters fly long distances, that’s why their economics and fuel efficiency becomes predominant”, says Scherer. Airbus forecasts 880 newly-build freighters, up from 850 in 2019, which is no wishful thinking but based on solid product forecasts.

Geographically, Airbus predicts the Asia-Pacific region will have the highest demand for new aircraft with 9.400 new aircraft, followed by China with 8.220, Europe with 6.960, and North America with 6.420, as shown in the following infographic from Airbus. The Chinese market takes into account the arrival of the locally produced Comac C919 into effect (“I don’t give you numbers”), but only in a modest way, says Scherer.

“As economies and air transport mature, we see demand increasingly driven by replacement rather than growth. Replacement being today’s most significant driver for decarbonization. The world is expecting more sustainable flying and this will be made possible in the short-term by the introduction of most modern airplanes,” said Scherer. “Powering these new, efficient aircraft with Sustainable Aviation Fuels (SAF) is the next big lever. We pride ourselves that all our aircraft – the A220, A320neo Family, the A330neo, and the A350 – are already certified to fly with a blend of 50% SAF, set to rise to 100% by 2030 – before making ZEROe our next reality from 2035 onwards.”

Airbus predicts ever more efficient aircraft operations around the world to increase the need for commercial aviation services, such as maintenance, training, upgrades, flight operations, dismantling, and recycling. The growth of these sectors is on track with pre-pandemic forecast levels. reaching a cumulative value of around $4.8 trillion in the next 20 years. The services market will rebound triggering the need for some 550,000+ new pilots and 710,000+ highly skilled technicians over the next 20 years.

Views: 53