Following industry media one comes to the conclusion that the NMA is going to be the biggest story of the year. Every day we hear another tidbit about a lessor or airline goading Boeing to “just do it”. It is now a foregone conclusion among industry analysts that Boeing will just do it – and is doing a lot of it already quietly. But as we have stated the case for the NMA is complicated. It is a huge bet and the market forecasts vary from around 3,000 to 4,000. Since Boeing will not capture more than 50% (airlines and lessors will keep it balanced to keep pricing sharp), so is the program worth half that? Even if Boeing develops a new production system and manages to squeeze the supply chain even harder, can they get to breakeven on 1,500 aircraft?

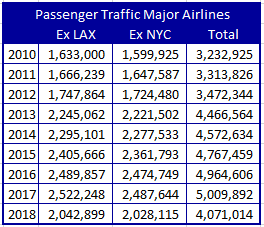

We took a look at a target market for the NMA, the US transcon segment from Los Angeles to New York. What do we see in the data? Note this chart shows one-way traffic.

Since you’re asking, here is what the T-100 reports for both ways.

For simplicity, we are going to focus on one route – from LAX to NYC. To reiterate from the first chart, 2018 data is through November.

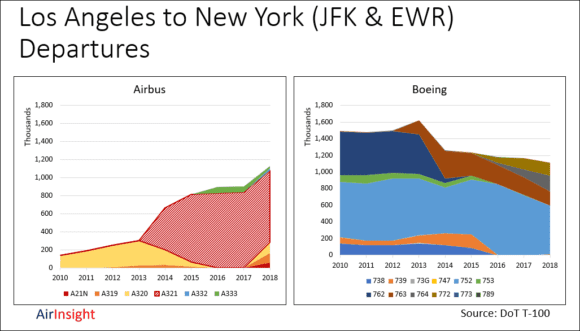

This chart above illustrates a key point – the transcon market has swung away from Boeing. Most departures today are on Airbus products.

Airbus is winning in departure because of the A321. We can see on the left chart in the bottom right corner, the A321neo is getting started. The benchmark transcon market has become the A321’s hunting grounds. In terms of Boeing products the 737-900 barely gets a showing. The biggest Boeing participant in the market is the 757-200. Indeed the trends on the Boeing products is declining across the board.

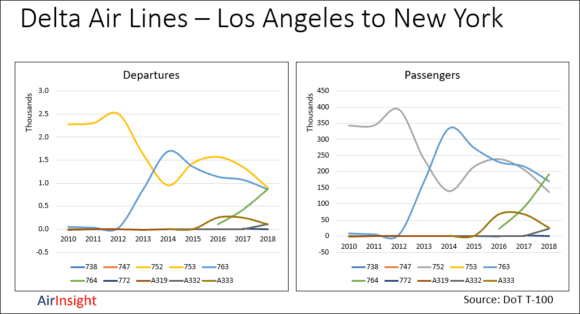

Are you surprised Delta is encouraging Boeing to do the NMA? Take a look at the next chart.

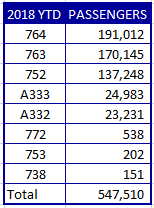

Delta depends a lot on the 757 and 767 for transcon markets, especially LAX to JFK. They are not using their A321s in this market. They are also not using their 737-900s. Of course, they want the NMA. The table shows passenger traffic volume from Los Angeles to New York for 2018 YTD, and that Delta is focused on aging twin-aisles to serve this market.

Although the A321 is king of the transcon market, perhaps Delta can’t get deliveries fast enough. Maybe Airbus can’t even keep up with the retirement rates on 757s. Of course, Delta wants the NMA. But we think they also want more A321s, stat.

Views: 1