a380newlivery2

Emirates returned to a solid profit in its financial year 2022-2023, reporting its highest-ever net profit and revenues in the history of the UAE airline. This follows after two years of losses during the Covid years, but a strong recovery of demand and growth has changed things for the better, the airline said on May 11. Emirates reports its highest-ever profit.

Emirates Group, which includes dnata, reported a net profit of AED 10.912 billion ($3.0 billion) compared to an AED-3.807 billion loss in the previous year and an AED-22.100 billion net loss in FY2020-2021. Never before, the net profit surpassed AED 10 billion, with AED 8.179 in FY2015-2016 as the next-best result. Revenues also soared to new levels, reaching AED 119.8 billion last year versus AED 66.2 billion in FY2021-2022. The next-best result was achieved in FY2018-2019, with AED 109.3 billion in revenues. The airline said in November that it was on track for a strong full-year profit.

Emirates Airline reported a net profit last year of AED 10.581 billion versus AED-3.917 billion in FY2021-2022 and AED-15.021 billion in the first Covid year FY2020-2021. The AED 8.330 billion profit of FY2015-2016 comes the closest to this result. Revenues to AED 106.7 billion, up from AED 58.3 billion in 2021/2022. Again, 2018-2019 is the next-best at AED 96 billion. Transport revenues contributed AED 102 billion to the total, produced despite AED 5.3 billion in negative foreign currency effects. EBITDA was AED 33.3 billion versus AED 17.7 billion.

Passenger revenues

Passenger revenues were AED 84.8 billion, up 158 percent year on year, and ancillary revenues grew by 88 percent to AED 5.1 billion. Thanks to the strong demand for premium cabins, the yield improved by seven percent to 37.5 fils per revenue passenger kilometer. Record-high revenues were “the result of strong demand for air transport services globally and the quality of our services, propelled by the further easing of pandemic-induced travel restrictions,” the airline says in its annual report.

The airline carried 43.6 million passengers, up from 19.6 billion the year before but still some way from the 58.6 million in 2018-2019. Capacity as in available seat kilometers (ASK) was 284 billion, up from 160 billion the previous year but down from 390.6 billion in 2018-2019. Capacity was 77 percent of pre-pandemic levels. The passenger seat factor reached 79.5 percent, the highest level in recent years, while the overall load factor was 65.4 percent, well above the breakeven load factor of 57.2 percent. Australasia and East Asia saw the highest revenue growth, while the Middle East and the Americas were down.

Emirates SkyCargo carried 1.849 billion tonnes of cargo, the lowest number in the past five years. Of this, 1.335 billion was carried as belly cargo and 514 billion tonnes with the full-freighter fleet of eleven aircraft. Freight tonne kilometers were down 23 percent to 9.8 billion. “As air cargo demand weakened this year due to macroeconomic and geopolitical uncertainties, high inflation, the consequential supply-related issues, and the end of the inventory restocking cycle, we shifted capacity from our ‘mini freighters’ back to passenger operations. Although this contributed to an increase in volumes for ‘scheduled operations’, overall, SkyCargo revenue declined by 21 percent this year.”

Fuel costs were only hedged in Q1

Costs were up by 53 percent to AED 96.7 billion last year, of which 72 percent can be attributed to the increase in operations. Emirates spent AED 33.7 billion on fuel due to increased services and higher fuel prices. Fuel costs were 35 percent of all expenses. The airline only benefitted from an AED 349 million gain on fuel hedging in Q1 but was unhedged for the remainder of the year.

Emirates Airline grew its workforce to 44.733, up from 36.173 the year before. The number of cabin crew was up by almost 4.000 and that of pilots by just over 500, while Emirates Engineering recruited some 400 extra people. The total workforce including dnata grew by twenty percent to over 102.000.

Dnata, whose business is airport operations, catering and services, and travel services, produced an AED 331 million profit, up from AED 110 million in FY2021-2022. Revenues grew to AED 14.6 billion from AED 8.4 billion, of which AED 7.238 billion was from airport operations around the world, AED 4.796 billion from catering and services, and AED 2.267 billion from travel services.

Leases extended as deliveries are uncertain

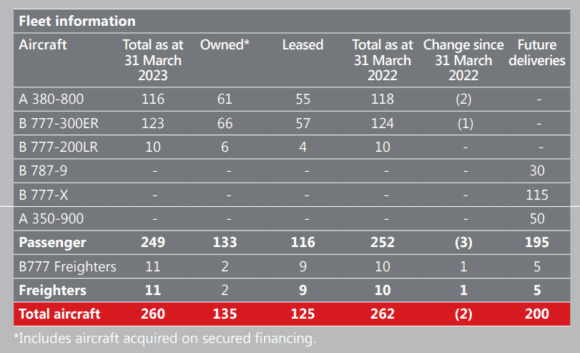

The Emirates fleet totaled 260 aircraft, but this includes Airbus A380s in storage. Two A380s were phased out during the year, bringing the current fleet to 116. One Boeing 777-300ER was also retired, leaving 123 in active service while the number of ten 777-200LRs remained unchanged. The freighter fleet grew by one to eleven 777Fs. Emirates announced this week that it is wet-leasing two Boeing 747-400Fs for additional capacity. Due to the supply chain issues and later deliveries of the Boeing 777-9s, leases for 25 777s and three spare engines have been extended.

Excluding options, Emirates has 115 Boeing 777X on order, but the airline doesn’t specify the split between -9s and -8s. The latter variant has yet to be officially launched by Boeing, which will only follow after the 777-8F freighter is on track. Next year, the airline expects to take delivery of the Airbus A350-900s, of which it ordered fifty at the 2019 Dubai Airshow. The first of thirty Boeing 787-9s is expected in 2025. The order book also includes five 777Fs. Emirates is committed to AED 7.2 billion in investments in new aircraft, facilities, people, and equipment.

The carrier started retrofitting and upgrading the cabins of its A380s late last year to include the new Premium Economy seats. A total of 120 A380s and 777s will get the upgrade, which had been completed on six A380s by the end of March.

Emirates Group ended the year with AED 42.5 billion in cash, its highest-ever level, and will pay a dividend of AED 4.5 billion. Total debt stood at AED 81.5 billion after AED 3.0 billion was repaid. The net debt to EBITDA ratio was at the lowest level ever at 132.8 percent.

The airline group isn’t giving guidance for the current financial year, but Chairman Sheikh Ahmed bin Saeed Al Maktoum remarked in a media statement: “We go into 2023-24 with a strong positive outlook and expect the Group to remain profitable. We will work hard to hit our targets while keeping a close watch on inflation, high fuel prices, and political and economic uncertainty.”

Views: 47