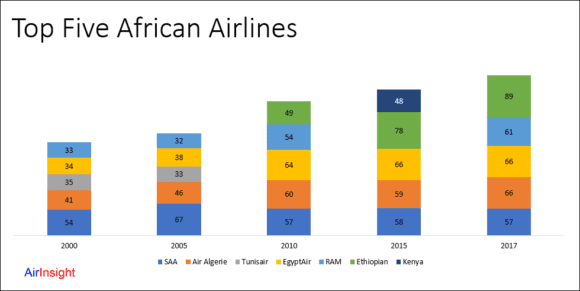

Take a look at a brief history of Africa’s biggest airlines at a few points in time. It wasn’t until only a few years ago that Ethiopian even was among the top five. Today it is the uncontested biggest African airline. Kenya Airways made a brief appearance and Tunisair was eclipsed.

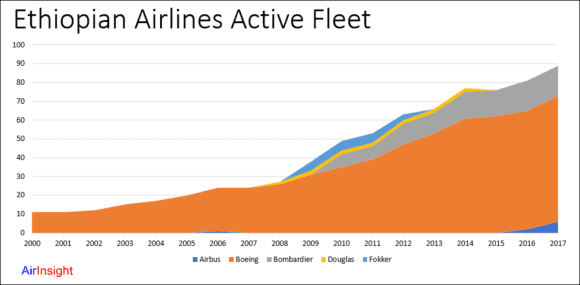

Ethiopian has made a success of turning its base into an African gateway by building a fleet that could reach far across the world. While the airline has been Boeing-focused, it has started to branch out to Airbus and Bombardier.

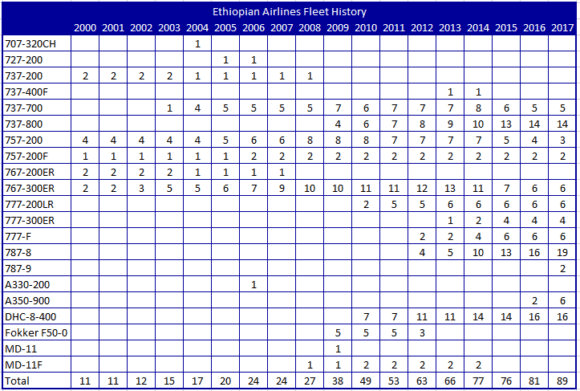

The next table shows how the airline’s fleet has evolved. It seems that up until 2009, the fleet growth was limited. We can see that the airline tried out the A330 briefly. But its long hauls was focused on the 767-300ER and -200ER. From 2010 it added the 777LR and by 2013 the -300ER as well. The airline has operated a small number of freighters. In 2012 it showed it wasn’t shy about trying something new when it added the 787. As it added 787s, it started retiring the 767s.

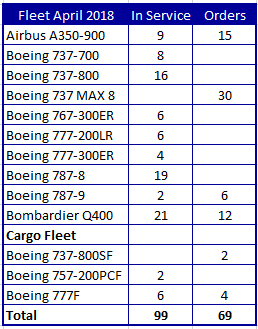

As of April 2018, there has been more growth. The airline has now an additional ten aircraft. The single-aisle focus seems to be on the MAX8. There has been chatter about an order for the E2 or CSeries to fit in below that segment, and essentially replace the 737-700. In terms of the widebody segment, the focus appears to be on the 787 and A350-900. The selection of the A350 was clearly a big step away from Boeing. Focusing on the A350 makes a 777X sale less likely. For Airbus, this was a significant win at a coming airline in a growth market.

Looking at the cargo fleet, the 777F is the focus and this seems to fit with the airline’s 777 ops. In terms of regional lift, prior to the E2 vs CS decision, the selection of the Q400 is noteworthy. The airline flies these turboprops on some long legs across the continent to gather up or distribute traffic. The Q400 will be the airline’s biggest fleet component and clearly has a role in ensuring O&D support for its long-haul services.

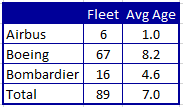

Finally, we look at the fleet age profile. The airline’s fleet is young and offers it a powerful set of tools to continue to dominate its market.

However, there is clearly a big gap in its fleet between the Q400 and the 737. The gap is between 78 seats (Q400) and 118 (737-700). That gap will draw both the airline’s attention and that of Bombardier and Embraer. Both these two OEMs will want to be part of this airline’s growth curve. Perhaps the airline is waiting to see how the dust settles from the pending merger/deals the two OEMs have the duopoly. Fortunately for Ethiopian, time is on its side. There is no African competitive threat in sight.

Views: 4