2019 09 17 10 23 59

Last week we had a quick visit to Brazil to see the delivery of the first E195-E2 to Brazilian airline, Azul. As part of the trip our host, Embraer, arranged for a briefing with John Rodgerson President of Azul. David Neeleman, founder of the airline was also part of the near one-hour conversation.

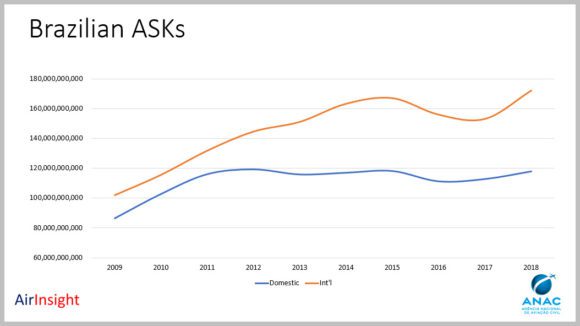

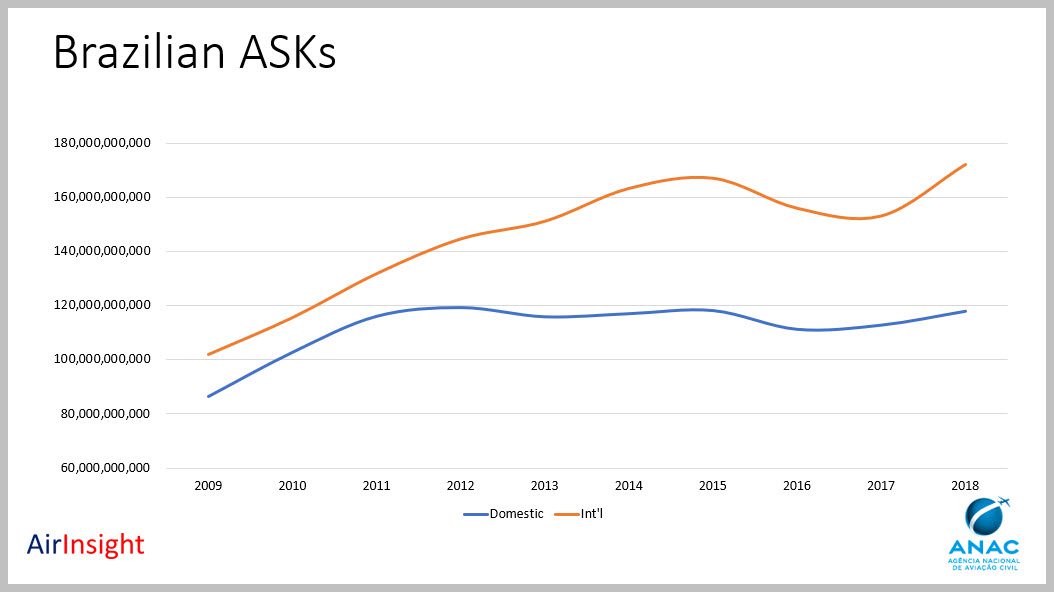

What was especially fascinating about the briefing was the extent to which the Brazilian air travel market has grown. Azul, rightly, feels it is at the center of this growth. David Neeleman did a separate interview with us a few weeks ago where he describes this growth. The chart below lays out the growth. Even though the domestic market has seen slower growth, it started to pick up again at the end of 2018.

Breaking down the international market, we see the following.

Although the market is dominated by non-Brazilian airlines, Brazil’s airlines are growing. Within the domestic market, there are changes that support the bullish views expressed by Azul’s leadership. Avianca Brasil is gone – National Civil Aviation Agency of Brazil (ANAC) withdrew its license. Avianca Brasil had 13.4 % of the domestic and 7.3 % of the international market share in terms of RPK.

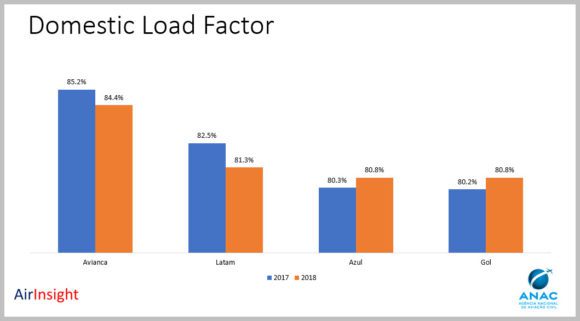

Domestic flights are operating at high load factors and this compares well with the US.

The industry average load factor for 2017 was 84.4% and for 2018 was 82.1%. Despite ongoing economic pressures in Brazil, more people are flying than before. This is impressive because Brazil has onerous fuel taxes and poor infrastructure to move Jet-A to its airports around the country. Jet-A must be trucked everywhere as there are no good rail networks or pipelines. Bear in mind that Brazil is a vast country. Airlines are operating in a “POP” environment – Prisoners of Petrobras.

The next chart lists the average real airfare in the market between January 2016 and December 2018 (the most recent published data). The trendline shows a steady rise.

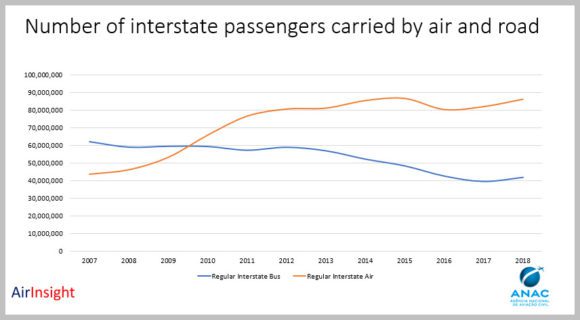

Precisely because Brazil is such a large country and roads are poor, people are flocking to airlines to save time and travel more safely. The following chart demonstrates the move away from busses to airlines.

Having laid out the case that the Brazilian air travel market is growing as people change the way they move about the vast country, we can now explain why Azul is well placed to outgrow its domestic competitors. The case rests on the ATR72. In 2012 Azul bought Trip, the largest regional airline in Brazil. Azul wanted the turboprops to support its reach into the hinterland. This airline is now the world’s largest ATR operator.

With the low-cost turboprop operation, Azul is able to build its traffic feed from the smallest communities around the country and move this traffic to its hubs and “hublets”. At the larger airports, Azul switches from Embraer E-Jets to A320s as needed. At the largest hubs, the airline switches traffic to its growing fleet of A330s or passes traffic onto partners like TAP for international service. What Azul has been able to create is a system that competes with bus fares but saves travelers a lot of time. It is also able to connect outlying communities to the national economy.

We were told by the airline that it now has the highest market share of business travelers in Brazil. Which means Azul is able to generate better revenue per passenger. Moreover, by connecting the outlying communities it is picking up a growing amount to cargo. This is especially important from the agricultural hinterland to deliver fresh agri-products to the big coastal cities.

Remarkably, competitor airlines remain fixated on Boeing 737s and Airbus A320s. This means they do not have the ability to develop low-cost feed to and from smaller communities. Instead, they seem to be depending on feed and distribution from bus services.

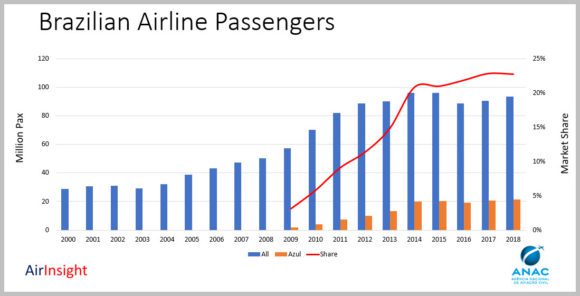

The next chart illustrates that even as the market has waxed and waned, Azul has kept growing its share.

Given that Brazil has hundreds (if not thousands) of communities that benefit from air service, it is a wonder that the two main competitors, Gol and Latam, have not acquired turboprops to compete. Even with the cost of airfares rising, people are leaving busses and moving to aircraft. Azul is going to win more traffic and, in our view, will become the de facto Brazilian national airline within the next five years. Azul’s management speaks of doubling in size within five years. The claim is totally plausible.

Views: 1