GAMA

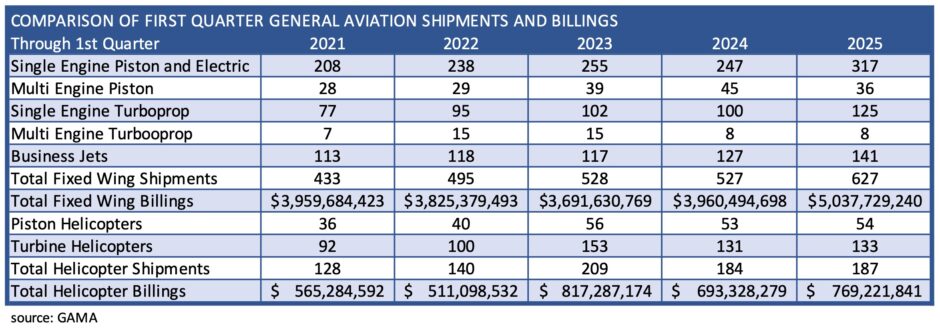

GAMA, the General Aviation Manufacturers Association, released its first quarter report on shipments and billings for the industry late last week. Overall, compared to last year, the industry delivered 100 more fixed wing aircraft in the quarter, 627 aircraft versus 527 last year. Total fixed wing billings reached $5.04 billion, up from $3.96 billion a year ago.

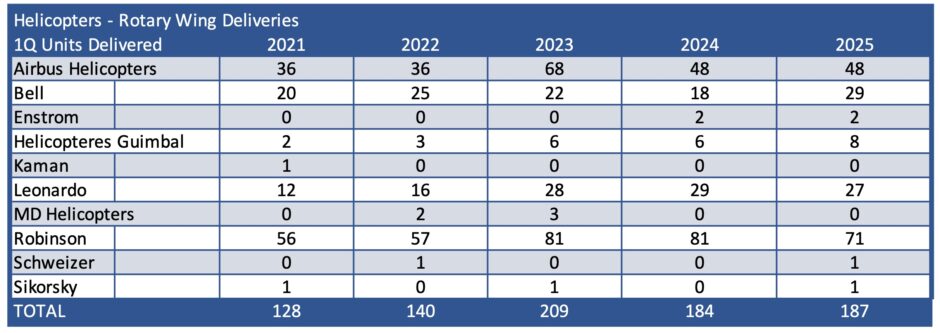

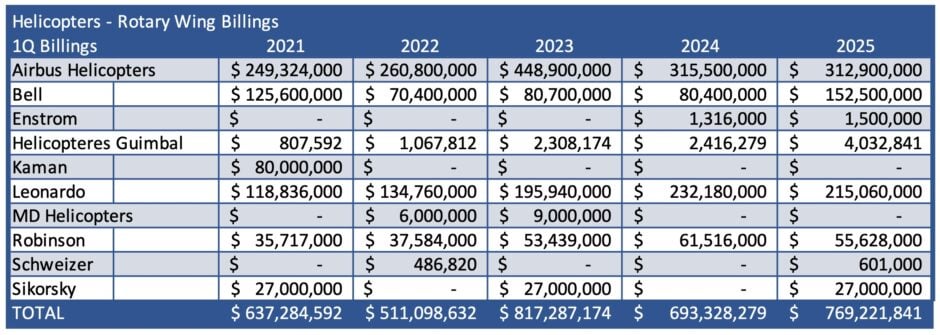

Rotary wing first quarter shipments were slightly higher year over year, with 187 shipments compared to 184. Billings were up to $769 million versus $693 billion in the prior year.

The chart above summarizes deliveries by category. Single engine piston aircraft increased significantly to 317 aircraft, versus 247 last year. Multi-engine piston aircraft fell to 36 from 45 last year, while multi-engine turboprops were flat at 8 shipments. Single-engine turboprops surged to 125 shipments from 100 last year, a significant increase. Finally, business jets rose to 141 aircraft shipped, up from 127 last year.

Fixed Wing Aircraft

A significant increase in business jet deliveries at Gulfstream, with its new G700 model in full production, spurred the increase in both aircraft and especially the surge in billings, given that it competes at the top of the market.

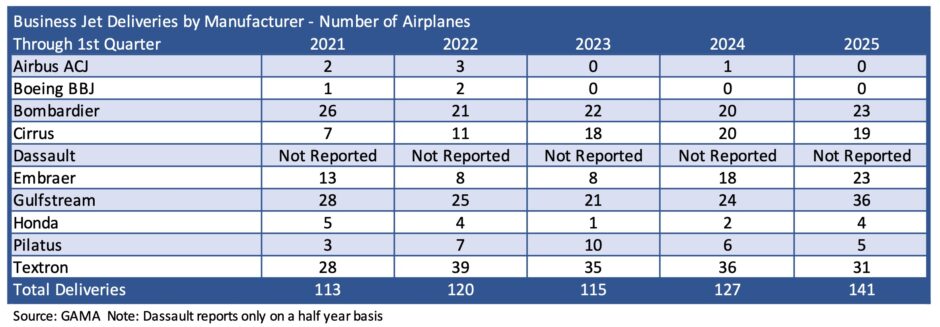

Fixed-wing deliveries by manufacturer are shown in the following chart. Bombardier, Embraer and Gulfstream led the way with increases over prior years.

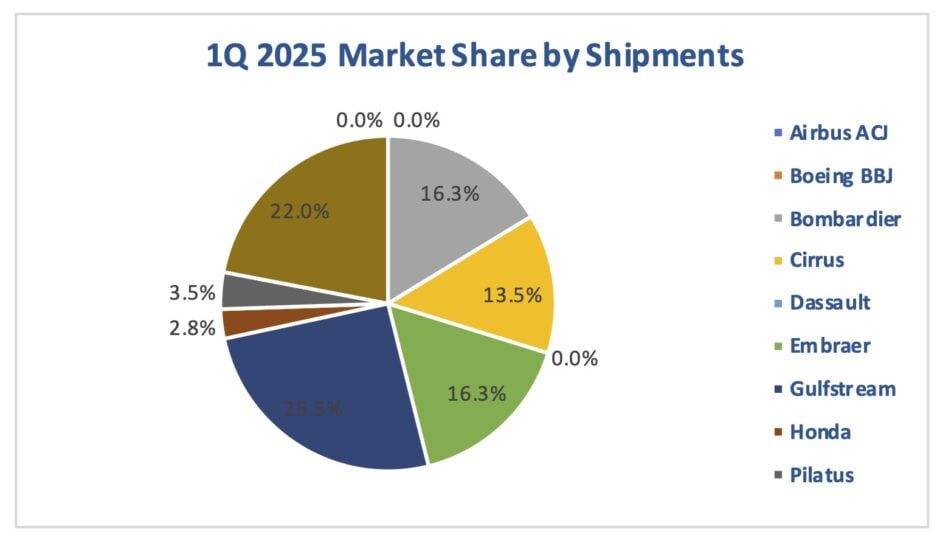

Market share in 2025 showed Gulfstream in the lead, with 36 business jets, followed by Embarer and Bombardier with 23 each. The following table shows 1Q 2025 market share in shipments for business jets by manufacturer.

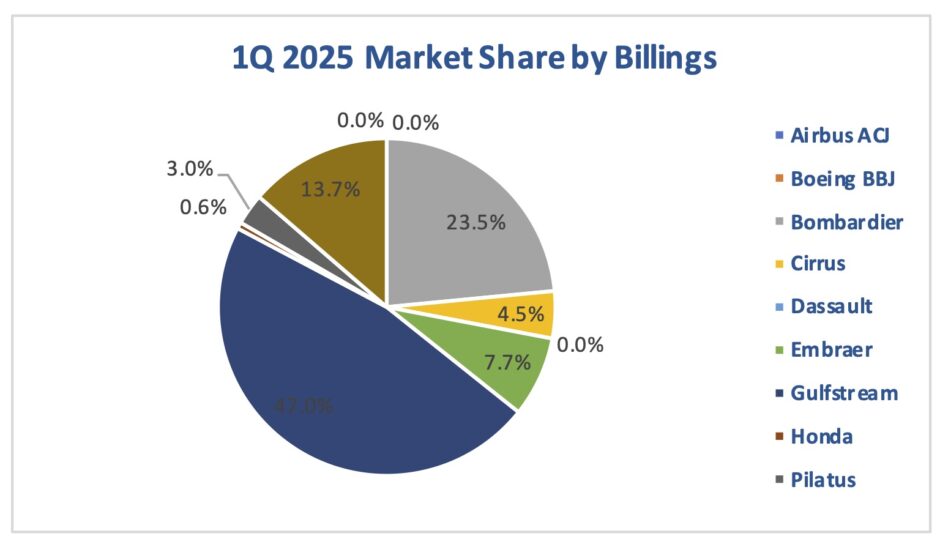

That data is also shown in the following pie chart.

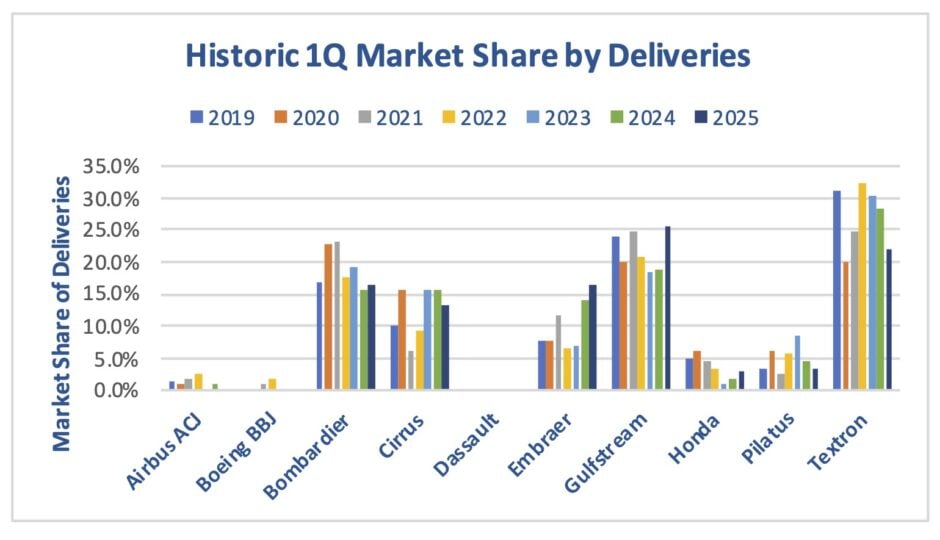

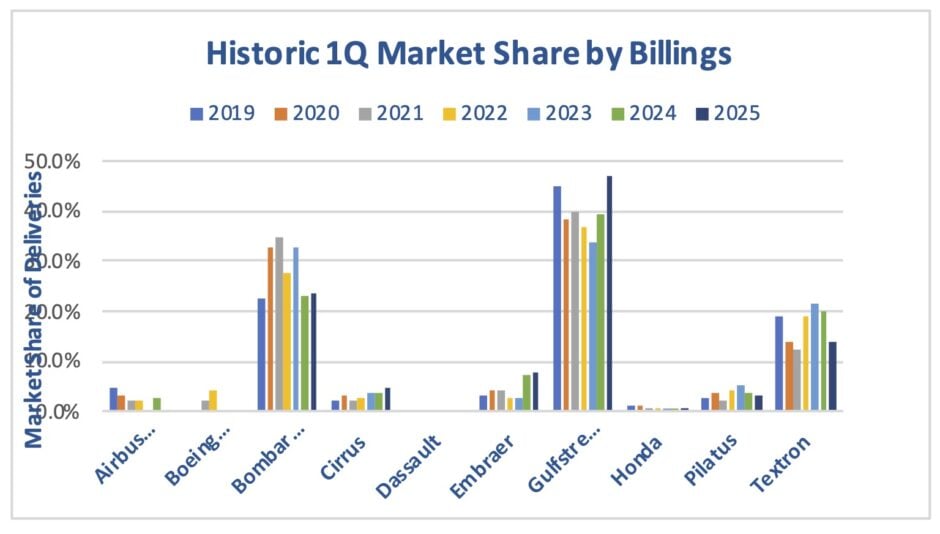

Historic market share for shipments is shown in the following chart from 2019-2025. Gulfstream has now overtaken Textron in market leadership in 2025, despite the average price being significantly higher for the former. This has been an unusually strong quarter for Gulfstream. Embraer continues to rise as well, with Bombardier being consistent with past performance.

Fixed wing billings are shown in the following chart. Gulfstream’s increase of more than half a billion during the 1st quarter drove the increase in industry billings during the quarter. Bombardier and Embraer also had strong quarters, while Textron performance lagged 2024.

Business jet billings in Q1 of 2025 were dominated by Gulfstream, which billed nearly $2.2 billion during the quarter, accounting for 47% of the total business jet billings. Clearly, Gulfstream deliveries have not been impacted by the economic uncertainty at the beginning of the year, as customers have been waiting for their new aircraft to be produced. The remaining players in the industry also performed well, with Bombardier, Embraer, Cirrus, Honda, and Pilatus all showing higher billings. Only Textron underperformed last year’s numbers in what appears to be a good year, so far, for the industry.

The first quarter billings data in pie chart form illustrates Gullfstream, in dark blue, market dominance in early 2025.

Historically, Gulfstream has been near the top of the market in billings in recent years, battling with Bombardier for the top spot. The following chart shows billings market shares in the first quarter from 2019-2025.

Rotary Wing Aircraft

With respect to billings, the segment was stronger in 2025, with nearly an 11% increase over the same quarter last year. Bell led the way with a significant recovery in billings during the quarter, while Airbus and Leonardo were slightly down from last year.

The Bottom Line

Despite the threat of global tariffs and economic uncertainty, the general aviation segment held its own in 2025, with the success at Gulfstream responsible for much of the strong performance during the quarter. Clearly, there has not been a recessionary impact in early 2025, and the industry is hoping to continue its strong performance for the rest of the year.

The industry has a strong backlog, and achieved positive book to bill ratios of over 1:1 last year, reflecting an upward trend. Nonetheless, economic uncertainty is just that, and it is difficult to plan when potential tariffs and tax considerations remain unclear. The industry remains hopeful, as do we, that tariffs on aircraft and aircraft parts will once again remain free of tariffs and the provisions of current international trade agreement continue.

In a year with few new programs emerging, the focus at EBACE and NBAA will likely be on the larger macroeconomic issues driving the global economy, rather than new aircraft or engine program in the near term. Stay tuned for what, so far, looks like a good year. The question we need to ask is if we are climbing the mountain, or on a roller coaster waiting for the inevitable plunge. Stay tuned.

Views: 227

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}