0b7b2ac08e0980b919a7e7ba4639630d2b8ff6fb5bd7ac2279d29e69de6f559d9639a3029ca9afebc2375a324b8514e48b496935a2d2eff70f41765166b1d015

With tensions between Russia and Ukraine, what might be the impact if a conflict should break out in the region? Looking at the largest western airline groups, the percentage of operations into Ukraine is relatively low, under one percent for each of the major airline groups with the exception of Wizz Air, which has roughly three percent of its flights into Ukraine.

The direct results of a potential conflict are already being felt, as several carriers, including KLM, Lufthansa, SWISS, Austrian, Vueling, and Emirates have suspended flights to and from Ukraine, with additional suspensions of service likely. Other than Ukrainian operators, who are based in the country, the remaining carriers have little exposure.

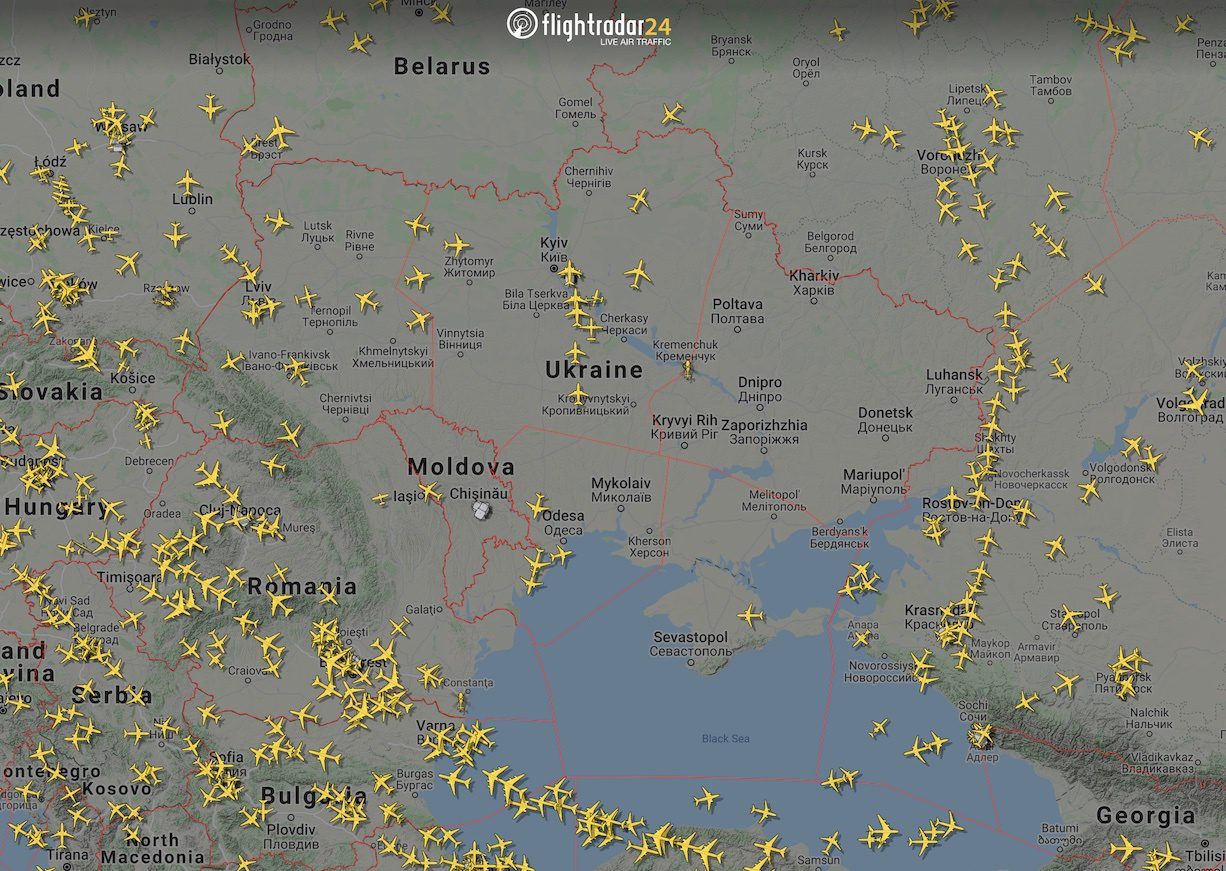

Given that direct impacts from schedules are not particularly significant, the question then turns to other impacts. Ukraine is directly on the main route utilized for Europe- Asian flights and was the site of the shoot-down of Malaysian Airlines flight MH17 in July 2014 at the start of the conflict over the Eastern regions of Ukraine. Further hostilities or outright war will likely cause severe disruptions with routing for aircraft away from Ukrainian and Russian airspace near the conflict zone, extending both the time and costs for long-haul flights. It could even result in total blocking, hence the suspension of civil air traffic via Russia. But given the current restrictions in Japan and China, frequencies on many of those routes have been temporarily reduced, although other Asian carriers use Russian airspace to and from Europe. Given Covid restrictions, the impact of route restrictions seems to be minimal.

A conflict in the region, which could spread into Europe, could significantly destabilize the continent and have a far-reaching impact on the world’s economy. In the build-up to the conflict, global oil prices have already gone up. They could increase from 10-25 percent, depending on the length and severity of a conflict. Fuel costs account for nearly 50 percent of costs for ultra-low-cost carriers like Ryanair and Wizz Air, and about 35 percent for network carriers like IAG (British Airways, Iberia), Lufthansa Group, and Air France-KLM. While most of the airlines in Europe have fuel hedges for on average about 50 percent of their needs, it is notable that Wizz Air has not yet hedged fuel in 2022, and could be negatively impacted by the rise in fuel prices.

Overall, the impact of a Ukrainian conflict should be relatively mild for European carriers and limited to the economic impact of higher fuel prices. Unless an extended conflict spreads to other regions and into Europe and the safety of air travel becomes a factor.

Views: 4