2018 12 03 8 38 14

Another flutter of news seems to suggest that Boeing is back at work on the NMA. This project has seen waxing and waning over several years. The industry chatterati agree on one thing – Boeing must do this project.

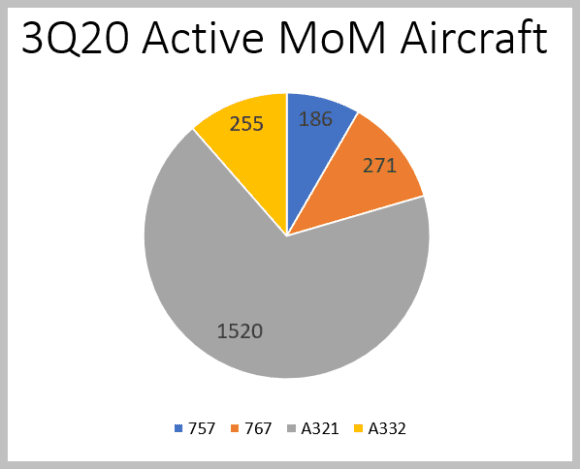

Let’s look at this segment to get an idea of where we are. There are essentially four in-service aircraft that fit in this space: two from Airbus (A321 & A330-200) and two from Boeing (757 & 767). The chart lists the active fleet as of 3Q20.

Over 1,000 757s were delivered and look where we are now with over 1,500 active A321s. The 767, once a benchmark model in its category is almost matched by the A330-200. Airbus has moved into the segment and Boeing has moved out by being inactive. The MAX9 and MAX10 are not going to eat into this space enough to make up for Boeing’s inactivity. The great idea of the 787-3 is virtually forgotten.

The US was always the biggest market for the MoM. This is where the 757 was King. The combination of the 757 and 767 was a Boeing masterstroke. And Boeing wasn’t shy about it either. In fairness, they were entitled to this hubris. Their primary competitor was a fumbling McDonnell Douglas with no vision and no product to match.

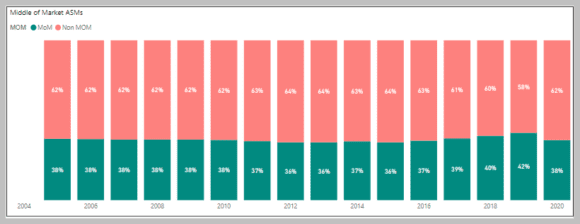

The MoM is an important market, but one benefits from a perspective of just how big it is. Using the US DoT T-2 we developed the following charts. The first illustrates the size of the segment compared to the non-MoM.

As we can see in terms of ASMs, the MoM hovers around 40%. So it is a big market, but perhaps not as big as one might have thought based on the attention it attracts.

Moreover, when we look a the split of traffic between single and twin aisles, we see this.

Boeing’s focus on approaching this market from the 737 MAX is clearer now. The MoM market is primarily a single-aisle business. The MAX9 and MAX10 were logical projects given this is what Boeing had to work with. Boeing could probably make a reasonable argument that these two models can handle the traffic that the 757 once did. Certainly, the 757s great range capability is overkill in the US domestic market. The MAX family can reach Hawaii from the West Coast, which is likely its longest leg.

But here’s the other side of the story that shows the weakness in the MAX family with respect to MoM.

Over the past fifteen years, Boeing has seen a steady market share loss. Airbus A321 clawed market share from the 757. From a paltry 9% in 2005 to nearly half the market by 3Q20. Making matters worse for Boeing, not only are the MAX9 and MAX10 overmatched by the A321, the latter comes in several flavors. Operators can go from the regular A321neo that is capable of any route in the US to the longer-range A321LR that will make short work of US secondary cities across the North Atlantic. For the even more ambitious operator, the A321XLR beckons. Hidden from the public, but regularly discussed, is the mythical A322 waiting for Boeing’s next move.

Airbus appears set to dominate the MoM segment. The talk is that Boeing is considering a solution for the MoM. It is suggested the approach will be a twin-aisle solution. That Boeing is doing more than talk remains unclear for now. History suggests that Boeing still finds the segment a challenge. Former GE Aviation boss David Joyce noted some years ago that from their perspective the market was too small for a split engine NMA.

This suggests the MoM solution is tough from one key consideration: a new aircraft is too expensive and the numbers don’t yet make sense. This means that Airbus retains the advantage because its A321 is a much newer design than the 737 which allows for tweaks to keep it attractive at low development costs. It does not look like Boeing’s 737 MAX can do this. To win back the segment it identified and created, Boeing might need something new.

Unfortunately for Boeing, the MAX crisis ate a lot of cash that could have funded the desired aircraft. Now the FSA and NMA projects that Boeing is said to be considering might allow for crossover if the solution is a single-aisle. Airbus still retains an advantage because its A321 handles 180 to 240 seats and its twin-aisle A330neo starts there and goes up to 260. Can Boeing’s engineers find a single-aisle MoM solution from 180 to 250 seats? Probably yes and the 757-300 could be a good place to start. But then Boeing has to find funding for the FSA.

Boeing’s original MoM vision was the single-aisle 757 and twin-aisle 767 as the ideal solution. Airbus took a long time to get to the same offering. How Boeing works its way through the MoM and FSA conundrum will continue to be watched closely. Boeing has no easy options.

Views: 7