6 16 2022 2 01 35 PM

As part of the pre-airshow briefings at Boeing this week, we heard from Darren Hulst. Mr. Hulst has the role previously filled by the venerable Randy Tinseth. It is a role the media eats up because presentations by Boeing’s Vice President – Commercial Marketing provides clues as to how Boeing sees the market and, if you can read between the lines, provides a sense of what they might be planning. These presentations are listened to closely – every word is parsed for deeper meaning.

Here is the recording of the briefing to provide original context to what was said. What follows are notes on what we think about the briefing in relation to the specific items mentioned. The italics are what Mr. Hulst said and our notes are below each of the points. and we have added his supporting charts to help a reader to follow along.

“…the industry or the recovery is transitioning from a domestic lead recovery to an international lead recovery. And I think that’s an important inflection as we move through 2022 as borders open, as restrictions ease, there are now more international RPKs than domestic RPK in, in the normal world and pre 2020 about two-thirds of all RPK traffic. Passenger revenue traffic was international. And since the beginning of the pandemic that obviously has been significantly upset since March now we’re seeing again, international RPKs are taking the lead and because of the situation in China, we’re actually seeing a much stronger acceleration in international recovery, as we’ve seen through the last couple of months. In fact, if you look more detail at domestic markets and you exclude China around the world, domestic recovery is now past 94% of normal or pre-COVID levels, which is impressive. And I think remarkable in terms of I guess, demonstrating again, the resilience of demand for air travel. So if we go to the next chart, I think that bolsters again, the view of the recovery that we’ve had pretty much in place since late 2020, which is, we still think this is a three-year recovery for entering now. Almost the third year, starting in 2023. So we think that late, 23, early 24, the market will be back to the level of RPK traffic.”

This is an interesting insight as it is likely to drive how airlines respond to the recovery – finding ways to optimize their fleets. Excluding China is also a key point – China is keeping its air travel recovery stymied. China represents about 20% of the market and its absence from the recovery removes a huge segment.

“But if we’re looking for how the market is recovering, this just gets to the value of versatility in the market.  Our customers, the airlines that all of us fly on are being remarkably agile, and how they adjust adapt. Their networks with the aircraft they have. And in the markets they serve. And so, two things here. 97% of the number of city pairs served by single-aisle aircraft in 2019 are served today. What I mean by that is there were just under 17,000 single-aisle city pairs in 2019 in the summer. This year, they’ll be just 3% fewer. The interesting thing is we’ve seen thousands of markets that are no longer served today, back built by thousands of markets that weren’t served years ago. And so, again, I think it reflects the agility of aviation agility of airlines that deploy aircraft, where markets, and where revenue and where demand is located. And so 21% of the city pairs serve, these markets will not have been served three years ago. I think again, in a mature-ish market like aviation, it’s remarkable to see how resilient. But also, how adaptive airlines can be.”

Our customers, the airlines that all of us fly on are being remarkably agile, and how they adjust adapt. Their networks with the aircraft they have. And in the markets they serve. And so, two things here. 97% of the number of city pairs served by single-aisle aircraft in 2019 are served today. What I mean by that is there were just under 17,000 single-aisle city pairs in 2019 in the summer. This year, they’ll be just 3% fewer. The interesting thing is we’ve seen thousands of markets that are no longer served today, back built by thousands of markets that weren’t served years ago. And so, again, I think it reflects the agility of aviation agility of airlines that deploy aircraft, where markets, and where revenue and where demand is located. And so 21% of the city pairs serve, these markets will not have been served three years ago. I think again, in a mature-ish market like aviation, it’s remarkable to see how resilient. But also, how adaptive airlines can be.”

This is another insight into how markets are changing. Essentially 97% of the single-aisle market by city pairs have come back, but nearly 1 in 4 are different. There are significant changes happening. For wide body markets, the recovery rate is 77%, with 55% of existing markets impacted. Both segments show airlines discovering new markets and this suggests aircraft that can be deployed for route proving are going to be useful. The route proving aircraft need to be low risk in terms of economics and with useful range. But we may have lost a number of routes forever if airlines can’t make them profitable with existing aircraft, and we may see downsizing or down-gauging for future growth opportunities. Some US regional markets are a case in point.

MAX

“But I think from our perspective, the 737 MAX family represents the most versatile but also the most complete single-aisle family for the needs of the market today and in the future. The heart or the density of the market still, is in the 737-7, -8, and -9 space, in terms of size, but it’s very important for us to complete the family, both on the entry-level  and the low end of the market, as well as the growth side of the market to provide even more efficiency to our customers who continue to need the growth and that space. The reason why I know the 737 is the most complete family in the market is because it is common from the -7, all the way up to the -10 that commonality and enables airlines to leverage different sizes, different capabilities, to address the market without changing maintenance changing, pilots changing other cost drivers, as they operate their, their fleet and their network. And when we think about the installed fleet that exists today, 80% of the fleet is still small and medium-sized single aircraft in the backlog as of late last year, or the end of last year, there was or there continues to be a slow evolution or migration to slightly larger aircraft types. And you can see that backlog was about 60/40 as we looked at the end of last year and our long-term outlook is still somewhere in the neighborhood of the backlog. I actually would say slightly higher towards the mid-sides of the market as airlines look to replace smaller and mid-sized aircraft.”

and the low end of the market, as well as the growth side of the market to provide even more efficiency to our customers who continue to need the growth and that space. The reason why I know the 737 is the most complete family in the market is because it is common from the -7, all the way up to the -10 that commonality and enables airlines to leverage different sizes, different capabilities, to address the market without changing maintenance changing, pilots changing other cost drivers, as they operate their, their fleet and their network. And when we think about the installed fleet that exists today, 80% of the fleet is still small and medium-sized single aircraft in the backlog as of late last year, or the end of last year, there was or there continues to be a slow evolution or migration to slightly larger aircraft types. And you can see that backlog was about 60/40 as we looked at the end of last year and our long-term outlook is still somewhere in the neighborhood of the backlog. I actually would say slightly higher towards the mid-sides of the market as airlines look to replace smaller and mid-sized aircraft.”

Now it gets really interesting because the orders and deliveries we track don’t show the growth segment as being the small and medium aircraft in the single-aisle. Perhaps for Boeing, but not at Airbus. Airbus has seen its A321neo and family variants become among the most in-demand aircraft. Through the latest O&D numbers announced, comparing single-aisle MAX vs NEO, Airbus has the A321neo at 33% of deliveries compared to 9% MAX9s at Boeing. This item became an issue for the media, and several challenged it. Mr. Hulst stuck to his view and described the XLR in particular as serving a smaller niche of the market. It would be fair to say his view was not necessarily accepted by several members of the media.

“As they look at the risks and value drivers going forward. We still think that the heart of the market is right around 180 to 200 seats, and that’s where our aircraft have more seats at a lower cost per seat and ultimately more range flexibility in that space of the market. But as you’ve seen from orders from some of our customers around the world, the value of the Max-9 and -10 to leverage, even more growth and capacity, brings even more value to that family that exists today.  And I think on the next chart, I just want to show what that translates to in terms of value. Well at the top end of the market, it’s just pure savings in terms of emissions somewhere between a million and a half and over three million pounds of carbon dioxide emissions per year per airplane between the 9 and 10. Compared to the A321, then you get into the small and medium size of the market where we actually have a seat advantage. We can get as high as 12% lower emissions per seat on an aircraft, that does more and is more flexible through a network that again continues to evolve over the course of the next decade.”

And I think on the next chart, I just want to show what that translates to in terms of value. Well at the top end of the market, it’s just pure savings in terms of emissions somewhere between a million and a half and over three million pounds of carbon dioxide emissions per year per airplane between the 9 and 10. Compared to the A321, then you get into the small and medium size of the market where we actually have a seat advantage. We can get as high as 12% lower emissions per seat on an aircraft, that does more and is more flexible through a network that again continues to evolve over the course of the next decade.”

Note the focus is up to 200 seats. From the data we have analyzed, he is correct on the emissions point. The MAX9 has the lowest carbon emissions levels of the single-aisles we’ve seen. This is a point Boeing needs to hammer home at every opportunity given the growing focus on ESG. They have a distinct advantage here benefitting from the inherently lighter 737 airframe with its relatively lower fuel burn. But the A321neo remains the market leader by a wide margin in this segment.

“And so these just represent the orders by minor model that we’ve taken over the course of the last year and a half and I can again going back to my heart of the market type conversation. I mean between the eight the high capacity 8 and the 9, you can see two-thirds of our orders in that space, But complemented, well, both with the 737-7 and also the -10. So, again, the value of the family I think is going to only accelerate as we move through this year and into next, even these numbers don’t include, for example, that IAG order or the announced order for 8s and 10s in recent weeks.”

For Boeing, the heart of the market is the -8 and -9. But Airbus has shown (JetBlue, Qantas, AF/KLM) that the heart of the market is larger. Large enough to beat Boeing at the smaller end with the A220 (which isn’t a part of the A320 Family) and the high end with the A321. With these two models, Airbus has managed to win key battles and fend off Boeing and Embraer. Family is important but at a certain fleet size, it becomes less important. Airbus has Boeing flanked at both the top and bottom of the single-aisle market.

“Now, on top of that, the -10  going up to 230 seats, can help push the revenue opportunity even more on a much lower risk than what the competitor’s offering can be. So I think the combination of the -7, -8, and -10 in the low-cost carrier space is really a demonstration of how we continue to adapt these aircraft to be optimized for really a growth segment of the aviation market going forward.”

going up to 230 seats, can help push the revenue opportunity even more on a much lower risk than what the competitor’s offering can be. So I think the combination of the -7, -8, and -10 in the low-cost carrier space is really a demonstration of how we continue to adapt these aircraft to be optimized for really a growth segment of the aviation market going forward.”

So with the -10 going up to 230 seats isn’t this beyond the Boeing “heart of the market”? Note the comparison of the MAX10 range to the CEO at Airbus. Also, it is important to see LCCs are buying the A321neo, from Latin America, Iceland, Europe, and India. Perhaps the market is wider. We highlighted the MAX7 seating – Southwest wanted it to go to 150 from 143. We had not seen 175 before and please notice in the third slide the -7 shows 153 seats. One would think Southwest calls the shots on the MAX7, but higher-density seating apparently will be available.

787

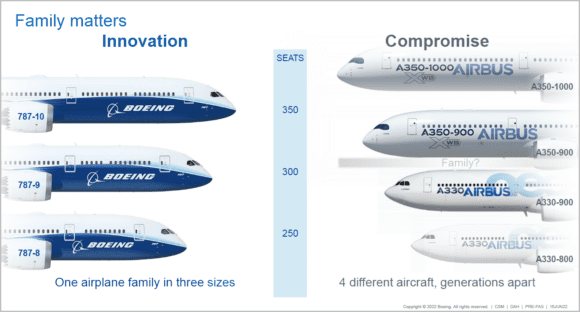

“The 787 family and … gotta keep using the word family because I think it’s important is I would say demonstrating what I said earlier in the long haul space. So in other words, airlines need to be agile, they need the versatility of a fleet that can do a lot across a family, and it is the only wide-body family for the future. In terms of technology. It’s the only one that has three types. It’s the only one that has the common engine across the whole platform and it can do anything from short-haul shuttles, all the way up to ultra, long-haul services and everything between. Let’s go to the next chart and I guess maybe I could have just said that on this chart. If you look at what, we have to offer the -8, -9, and -10 fit, where the market needs, are in terms of demand. But also do so with common maintenance, common flight deck, common engine …. Over 325 new city pairs that weren’t served before are now connected with or have been connected with 787 aircraft, whether it was the -8 or the -9. And then, even in some cases, -10, What’s even more impressive? I think is and we talked about innovation through a crisis.  There have been over 50 new city pairs connected, with 787s since the pandemic began, whether it’s because they wanted to overfly hubs that were closed during the pandemic due to travel restrictions, whether it was because of new revenue opportunities, that airlines have seen because it’s shifting leisure or business travel, That’s impressive to me. Because look at that 50 out of 320, that’s like about a sixth or almost a sixth of the new city fairs over the last decade came during the pandemic with 787. So I think again it’s a testament to how versatile airlines can be. If they have the right tool, go to the next chart. And here’s a little bit more. This is kind of a microcosm because this is just taking one month over one month. We talked about how international traffic is starting to gain the lead in terms of acceleration through the recovery.

There have been over 50 new city pairs connected, with 787s since the pandemic began, whether it’s because they wanted to overfly hubs that were closed during the pandemic due to travel restrictions, whether it was because of new revenue opportunities, that airlines have seen because it’s shifting leisure or business travel, That’s impressive to me. Because look at that 50 out of 320, that’s like about a sixth or almost a sixth of the new city fairs over the last decade came during the pandemic with 787. So I think again it’s a testament to how versatile airlines can be. If they have the right tool, go to the next chart. And here’s a little bit more. This is kind of a microcosm because this is just taking one month over one month. We talked about how international traffic is starting to gain the lead in terms of acceleration through the recovery.

So again, this is the aircraft airlines are choosing to restore service, increase frequency, and add new city pairs, And that has continued. And I think we’ll continue to accelerate as we move through this decade The other thing. I think you would not be surprised to see is as a result of these uses, the 787 remains the most used aircraft in the market if that makes sense.

The 787 has been a great success and because of its capabilities (long-range, its lightweight, good economics), it has become a long-range- route prover. For example, new markets such as Tokyo – San Diego, or – Boston. Larger aircraft would have been too risky. British Airways started service to Austin, Texas with the -8 and now uses a 777. As good as the 787 has proven to be, it is also clear how frustrating it is for Boeing that deliveries have been held up. Also, one has to consider if the A350-1000 is a compromise, why did Qantas (a long-time Boeing customer) make the switch? Or Delta which canceled the Northwest 787 order and selected the A350 and A330neo – with rumors of more to be ordered. It is also a bit odd to see the A350-1000 compared to the 787 when it is aimed at the 777.

“The the 787, as we track it has received over 700, repeat orders. Meaning now about half of the order total for the 787 program has been from airlines and companies ordering the aircraft. Again, a second, third fourth, or they’re even a fifth time in some cases. 47 of our customers are repeat customers. This is I think just as important and maybe also, I think reflective of the value of them of the aircraft in the market, The 787-9, in terms of its sustainability, in terms of the efficiency going forward, You can see how it compares per aircraft in terms of carbon emissions on an annual basis. What I don’t have on this chart is that the 787-10 which is even larger than the A350-900 in terms of seats actually, also uses less fuel and therefore produces fewer emissions on an annual basis. So that’s kind of like the double win in terms of that.”

Another strong data point for the 787. We believe he means the number of aircraft, rather than 700 specific orders, but understand his point. Moreover, we can verify that among the aircraft we track, the 787-10 has the lowest carbon footprint, whether per seat or revenue-ton-miles payload. That means Boeing has two emissions winners, the MAX9 and 787-10. The previous link to a carbon model lists the 787 and its competitors.

777X

“You know, I always like one-liners, but in the case of the 777X, I would say you have a jumbo jet capacity at twin with twin-engine economics. And I think it’s that’s really important because, in terms of what the industry is going to need going forward, we’re not going to run out of big city pairs that need to be connected. You know in terms of demand there was the traffic demand for an aircraft like the A380 but it needed the right platform and I think going forward this becomes the larger aircraft of the future. Connecting these large city pairs around the world and I’ll just kind of let this step kind of sit there for itself in terms of its sustainability. It’s going to use or sorry. Generate some are around 90,000 tons fewer CO2 emissions per aircraft annually compared to an A380. So this is significantly more efficient because of the technological innovations in the aircraft. I know it’s a little smaller, but in terms of what it does for history, in terms of cargo, in terms of passenger payload, it’s incredible.  I would say completion to our wide-body family in the near term. Let’s go to the next chart. I think this helps explain the demand dynamics, It’s really hard. I mean, the pandemic made a really difficult to talk about replacement, right? Because, you know, for a while nobody needed any wide-body aircraft.

I would say completion to our wide-body family in the near term. Let’s go to the next chart. I think this helps explain the demand dynamics, It’s really hard. I mean, the pandemic made a really difficult to talk about replacement, right? Because, you know, for a while nobody needed any wide-body aircraft.

But if we get back to the reset of the long haul market, you know, which I think is going to be in a 2024 or 2025 timeframe, then you start to look again at the age of fleets that still exist in the market and when they need to be replaced and it’s not just a flat 20 or 25 years, it depends on the type of aircraft in the efficiency of each of these models.

But we see an acceleration of replacement demand starting in the second half of this decade and continuing. Well through the 2030s, This is the aircraft that will replace aircraft from the 300ER and even some remaining A340s. All the way up to the A380s. That will exit service over the course of the next 10 and 15 years.

There are about a thousand worldwide that continue to serve in airline fleets today. So again, if we just look at how these aircraft compare, you could look at it two different ways. One, the A350-1000 was launched around 2007, and its current form. And since that time, the combination of the 300, ER, and the triple 7X of sold about five times more than the A350-1000, or if you want to be more quote, unquote fair, you could say, take out the 300ER.”

Which are already, was in service and existed. Well, before 2007, it was about a two-to-one comparison. If you look at the triple seven X compared to the A350-1000, obviously, the 777X has been offered much more recently than the A350-1000.

Boeing has a lot riding on the 777X. The demise of the A380 hurt Airbus and they responded with the A350-1000. While Boeing can point to a bigger backlog, there was scant mention of delays and their potential impact on orders. Emirates has expressed growing dissatisfaction with delays. As good as the 777X promises to be, the delays have possibly impacted orders. The recent Lufthansa 787 order might have been part of compensation for the 777X delays. Meanwhile, the maligned A350-1000 is being delivered.

Bottom Line

Both OEMs are a bit liberal with market claims and it is the job of those attending the media briefings to parse the word salad into a cogent story. Make no mistake these briefings are practiced and messages nuanced. The message crafting is top class and the briefers are industry experts and highly persuasive. Mr. Hulst follows one of the best in this field. His message essentially is that Boeing has the best product range in terms of range, payload, and economics. Moreover, a Boeing buyer has the advantage of a second life for aircraft as a freighter. This is something new to Airbus while Boeing has decades of experience.

We have the sense that Boeing is going into the Farnborough show with a strong message. The MAX is in demand, the 787 numbers are impressive. The 777X is delayed but looks to be a highly capable aircraft that should deliver what Boeing says it will. Moreover, Boeing can point to their aircraft being the greenest.

The delays? Yes, these are an issue, but this impacts the entire industry on new production. Airbus may see its A321XLR also face a more detailed certification process – this is the new normal.

Views: 122

Nice, thanks, tons of info to discuss.

I really hope Boeing executives internally are presented a more complete, realistic picture and numbers. In the past it sometimes felt Boeing executives had started to really believe the fancy PR slides and perceptions they created, but they loved the projections. But hit the wall some later.

What other details to add. Among other things, they say that 777’s have sold 5x more than A350-1000s launched earlier. For us it is very clear. You just have to accept it and lose like a good loser…

Checklist, A350-900s are replacing 777s everywhere. No passenger 777 deliveries 2020-2025. Everyone is free to believe what they like. Ignoring reality is free too, but risky.

Correction to what’s written above about British Airways and Austin. Yes they started the route with a 787-8, but quickly upgraded it to a daily 747-400. They have never used a 777 on the route, it re-started after the pandemic with an Airbus A350-1000