Pegasus AirbusA321NEO

Without any fanfare, Turkey’s number 2-airline Pegasus has taken delivery of its first Airbus A321neo last week from Hamburg. Yet, this is an important milestone for the rapid-growing low-cost airline, as 42 more of the type are to follow to make the type together with the A320neo the foundation block for the years to come.

The first A321neo arrived with some delay. Pegasus ordered the aircraft back in 2012 as part of a 100-aircraft deal, which included 57 A320neo’s and 18 A321neo’s on firm order plus 25 options. On December 21, 2017, the airline converted the 25 options into firm orders for the A321neo, all of which will have a 239-seat Airbus Cabin Flex-cabin. It was one of the last deals done by Airbus’ John Leahy before his retirement.

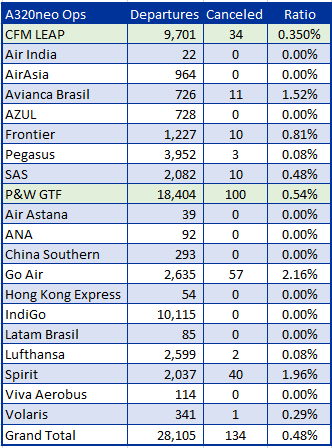

The arrival of the first three A321neo’s was originally scheduled for 2018, with 11 to follow in 2019, none in 2020, five in 2021, seven in 2022, and ten in both subsequent years. The plan went out of the window as Pegasus itself wished to defer deliveries, while Airbus has been struggling (and still is) to meet its A321neo-rate. At first, engine issues with both the Pratt & Whitney GTF and CFM LEAP were to blame but the complexities of the ACF-cabin and other production issues have caused delays that Airbus is still trying to get to grips with.

No worries about delays

However, Pegasus President and CEO Mehmet Nane is not too worried about the delays when Airinsight briefly spoke to him recently at the World Aviation Festival in London: “Delays are normal because there is a huge demand for the A321neo’s. The cost per seat is the best in the world at the moment. There is a delay of five to seven months, but we will begin to receive them now”. A second aircraft is due for delivery before the end of the year.

The A321neo is part of Pegasus fleet transition-plan, one of the biggest in the airline industry. The Turkish airline used to operate a 60-strong Boeing 737-800 fleet, but in 2012 Leahy’s sales team dealt a major blow to Boeing by getting the Pegasus order in preference over the MAX.

At its Q2-presentation, Pegasus listed 39 737-800s and a single -400 in the fleet, down seven from March. Only four Boeings are owned, the others are on operational (20) and financial (16) lease.

Also on operational lease are twelve Airbus A320ceo’s. The A320neo-fleet, which started to arrive in 2016 as Pegasus became the first LEAP-1A-operator, has grown to 31: 27 are on financial lease, four on operational lease. This means there are still 26 to come.

Pegasus’s latest fleet plan foresees deliveries of 15 A320neo’s and five A321neo’s in 2020, eight and five respectively for 2021, seven and eleven in 2022 and ten A321neo’s in 2023 and 2024. By then, it will have only four 737-800s, while all A320ceo’s will have been phased out.

Pegasus will keep only four Boeing 737-800s in 2024. It used to operate 60. (Pegasus)

Pegasus has been around since 1990, founded by Turkish Silkar Yatirim ve Insaat Organizasyonu, Net Holding and Aer Lingus. In 2005, it was bought by Esas Holding which is owned by the Sabanci family, who since 2013 together own 65.5 percent while 34.5 percent is listed on the Istanbul stock exchange.

The airline has seen strong growth in the last few years. In 2018, revenues increased 55 percent to TRY 8.297 billion compared to 2017, EBITDA by 57 percent to TRY 2 billion, and net income without exceptional items to TRY 507 million, up from 502 million. Passenger growth was 7.7 percent to 30 million on an average load factor of plus 1 percentage-point to 85.

The trend has continued in 2019. HY1-revenues were up 20 percent to TRY 697 million or even 25 percent in Q2. EBITDA was up 104 percent to TRY 173 million, including 21 million to IFRS-16 accounting adjustments. The airline turned a net HY1-loss of 25 million in 2018 into a net profit of 17 million. The number of passengers slightly decreased from 14.1 million to 13.8 million, mainly due to lower domestic demand.

Back to basics

During his keynote interview at Aviation Festival, Mehmet Nane explained how he and his team have adapted to numerous challenges that Pegasus came across in recent years. These include the political tensions within Turkey following the attempted coup by (according to the Erdogan-government) Gulen-supporters, the resulting weakening of the Turkish economy and reduction in air travel, and the devaluation of the Turkish lira. It ended 2016 with a KRY 143.6 million loss before tax.

“What we have done in 2016 is turn back to basics. That means: flying people from A to B at affordable prices, we cleaned the company in-house. To have the financial means instead of borrowing money we sold our assets and aircraft. At the end of the crisis in 2016, we had a clean house, with cash in our accounts. Back-to-basics was the main strategy we applied and thanks to our team we had a really prosperous 2018, with first-half this year being really promising and Q3 also going very well”. The privately-owned airline implemented various contingency-plans since 2017 to steer it through the crises, Nane said. Part of this was keeping the fleet stable around 82 aircraft.

CEO Mehmet Nane (left) discusses Pegasus’ situation with moderator John Strickland at Aviation Festival. (Richard Schuurman)

One of the biggest changes Sabiha Göcken-based Pegasus has done to steer clear of the Turkish crisis is to shift its income position: “When I started in 2016, 45 percent of our income was coming from international traffic and 55 from domestic. By the end of this year, the 45 will be 80 percent and 55 will be 20. Because there still is a high demand for tourism in Turkey, I expect double-digit growth on this again this year”. This is partly confirmed in the traffic figures presented in the Q2-presentation, which shows domestic traffic shifting in HY1 2018-2019 from 28.2 to 24.2 percent and international from 41.5 to 45.2 percent. Within this period, international market share has grown from 12.5 to 13.7 percent.

From domestic to international

The shift is also reflected by Pegasus’ route network, which now includes 76 international and 35 domestic destinations. In 2016, the airline served 68 international routes and 32 domestic.

Added to the network this year have been Venice, Manchester, and Eindhoven in Western Europe, but also Baku, Casablanca and new routes to the Middle East including Basra, and Riyadh. “There is a huge potential in Saudi Arabia for Turkish destinations. During the summertime, it is not comfortable to stay in Saudi Arabia because of the heat. People like forests and mountains and The Alps were their favorites. In Turkey, we have our Black Sea-coast and nowadays they are coming there. That’s why during the summer we have direct flights from there to the Middle East”.

This is where the neo’s come in nicely. There additional range over the ceo’s and 737s plus their low cost per seat/mile makes the A321neo a ‘game-changer’, says Nane, although this title has been claimed frequently by others (Boeing, Embraer, Mitsubishi) as well. “Our radius is a 5-6 hour flight. With this, we can go to Iceland, Bishkek in Kyrgyzstan, up to Sint Petersburg in Russia or down to Kenya. Wherever there is demand, we’d like to be within this 6-hour radius. We are not a cherry-picker, there is a demand to go there”.

Views: 1