Boeing MAX 10 Ryanair scaled

Ryanair hopes to grow passenger numbers in Financial Year 2024 by ten percent to around 185 million, up from 168.6 million in FY23. But this will largely depend on new Boeing MAX 8200 deliveries being on time for the peak season. With the airframer expecting lower deliveries as it deals with the tailfin quality issue, Ryanair could receive aircraft outside the peak season, which could impact total passenger numbers by about one million. Ryanair could miss out on FY24 target if Boeing deliveries are late.

The low-cost airline group that includes Ryanair, Buzz Air, Malta Air, and Lauda reported a €1.428 billion net profit attributable to shareholders for FY23 compared to €-355 million net loss in FY22. The profit excludes a €114 million exceptional market-to-market loss on fuel caps. Ryanair’s financial year covers March to March.

While Q4 (January-March) produced a €-154 million net loss and Q1 was also ‘disappointing’ following a slump in air travel after the war in Ukraine, overall, FY23 was a strong year for Ryanair. Total revenues grew to €10.775 billion from €4.801 billion. Passenger revenues were €6.930 billion, up from €2.653 billion. Ancillary revenues increased to €3.845 billion from €2.148 billion, or €23 per passenger.

The airline group benefitted from 74 percent higher traffic and fares that were up by ten percent. Ryanair says that saw particularly strong growth in Italy, where it grew thirteen percent market share to forty percent. Poland jumped by ten percent to 36 percent, while Ireland was up by nine percent to 58 percent. The group operated at 116 percent of pre-pandemic capacity. The load factor reached 93 percent, up from 82 percent in FY22.

Fuel costs hedged eighty percent

Operating expenses grew to €9.202 billion from €5.271 billion, with €130.5 million in exceptional fuel costs in FY23 that in FY22 lowered the fuel bill by the same amount. Ex-fuel unit costs were €31. Fuel costs were 113 percent higher to €3.9 billion, the result of 52 percent more sectors flown and higher prices. Costs were offset by the better fuel efficiency of the MAX 8200s. The biggest gain of €1.4 billion came from hedging, which was eighty percent in FY23. The airline is already hedged 85 percent for FY24, but the bill is still expected to be €1.0 billion higher year on year.

Staffing costs were 73 percent higher to €1.19 billion, also caused by ramping up capacity and the effect of the accelerated pay restoration that Ryanair promised it would do after the pandemic. The pre-exceptional operating profit was €1.573 billion, up from €-470.1 million in the previous year.

Largest-ever summer schedule

Ryanair will operate its largest-ever schedule this summer, with 2.500 routes and 3.000 daily flights with over half a million passengers per day. Demand is expected to be still below pre-pandemic levels, but forward bookings are strong but remain close in. It repeated its forecast that travel in Europe will benefit from the return of passengers from North America and China. Europe will continue to be affected by air traffic control issues, be it strikes are capacity constraints. With low visibility for HY2, Michael O’Leary said he expects only a modest growth of profit after tax for FY24.

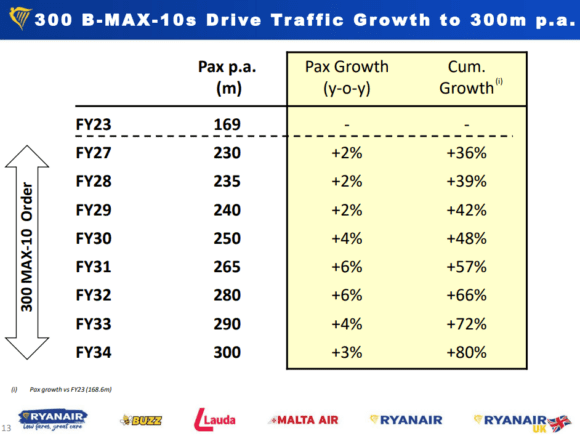

Ryanair is expecting more modest growth from FY27, the year when it will introduce the Boeing MAX 10 into the fleet. (Ryanair)

“The only cloud on our short-term horizon” is the Boeing delivery delays this summer. Ryanair is expecting to be ten aircraft short in May, June, and July as Boeing has to do rework on the tailfin fittings of aircraft in production and inventory. This could cost Ryanair some 250.000 passengers each month. Boeing said that rework will affect Q2 2023 deliveries, with aircraft pushed out into Q3. Ryanair has accepted that it will take new aircraft deliveries in July and possibly August too. The group grew the MAX 8200-fleet to 98 in FY23, which complements 411 737-800s and 28 Airbus A320ceo’s at Lauda. Lower deliveries reduced Capex by €450 million. The group has unfilled orders for 112 MAX 8200s that will be delivered over the next three summers.

MAX 10 order secures controlled growth

As announced on May 9, Ryanair ordered 150 MAX 10s plus 150 options, with the first deliveries starting in 2027. This is subject to shareholder approval on September 14, but this is a formality. O’Leary said this huge order uniquely positions Ryanair for “controlled growth in an environment in Europe when capacity will be constrained. (…) The order secures Ryanair’s growth for the next decade while many of our competitors will be constrained not just by OEM delivery constraints but also by the very full order books.” He is counting on just two percent annual growth for some three years from FY27 instead of ten percent this year.

As the first MAX 10 will join two years after the last MAX 8200 currently on order is delivered, Michael O’Leary expects them to be funded primarily from internal sources. However, the airline remains opportunistic in its financing options.

Ryanair ended FY23 with €4.7 billion in cash. It repaid an €850 million bond in March and in May converted an unsecured €750 million syndicated term loan into a revolving credit facility at a lower margin that matures in 2028. In August, the group will repay a €750m maturing bond and fund over €2.6 billion of Capex for the incoming MAX 8200s while retaining a broadly flat net cash/debt position. “We will continue to preserve cash to minimize financing costs as we face considerable annual aircraft capex of over €2 billion per annum from 2027 onwards.”

Views: 2