4AB0BBBA 653E 4F54 9E25 5BAA23B636C1 scaled

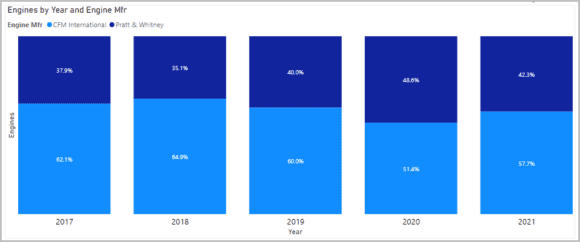

Last week’s P&W presentation saw several media questions about market share. This is a reminder that not only is this interesting, but perhaps there’s a nugget or two in the data. Let’s start with the score through 3Q21. These are engines on active aircraft. That means the Airbus A320neo family, the Airbus A220 family, the Embraer E2 family, and the Boeing 737 MAX.

The totals of active aircraft vary because of the MAX grounding which is explained by the following chart. As the MAX was grounded the number of active aircraft declined and they are now coming back online.

When we look at the engine market shares over the period, we get the following chart. This is the first nugget – P&W is on several programs and we excluded the MC-21. CFM is on two and a large portion of that went offline for some time. There doesn’t look like a big advantage for P&W.

To allow for an even playing field, let’s stick the A320neo and the A321neo only where there have been no groundings and interruptions that make the data uneven. We see that CFM has stayed ahead on P&W consistently.

But wait you ask – the A320neo is being outsold by the A321neo these days. What’s happening there? The short story is that orders being placed now take some time to show up. What does the active fleet through 3Q21 look like? The following chart shows that the A320neo fleet size is far ahead of the A321neo and CFM has done very well on the A320neo – for example winning the last round of engines on the huge IndiGo order.

However, news from Airbus today showing off the first A321XLR is timely. Since P&W is optimizing its GTF Advantage for the A321XLR, you might wonder why P&W is so confident. In one chart, this is why. P&W is making market share gains on the bigger A321 and plans to keep doing so.

If the A321neo is becoming more popular based on orders and we see (in the chart) what the industry has taken delivery of, is there any question why P&W feels confident about the XLR? Now that’s a nugget.

Views: 52

What about Leap 1C if C919 is certified?

Not certified yet: https://www.reuters.com/business/aerospace-defense/china-regulator-says-more-testing-needed-certify-c919-aircraft-2021-12-03/

Thanks for your feedback