2023 07 10 12 50 46

The US airline fleet is seeing some significant changes – some you expect and others perhaps, not. Take a look at the data for the big three for a start.

- Look at that drop in the regional fleet on the left chart. We expected to see a shrinking fleet, but this is rather alarming. The right side chart shows the decline is for CRJs. This is a surprise, and the rate of decline is something we were not expecting to see.

- The single-aisle fleet is growing, and as the right chart shows, this is because of the Beoing fleet growth. The MAX is having a large impact and is principally driven by Southwest.

Regarding regional jets, Embraer has a monopoly and is starting to show itself. At the Paris show, we asked Embraer about this, and Arjan Meijer, President & CEO of Embraer Commercial Aviation, demurred – noting that there are so many parked aircraft that pricing remained sharp. However, time is on Embraer’s side. Embraer wins as long as market aberrations like Scope Clause remain in effect. No new entrant will enter this market. And, absent a US scope-compliant solution, no OEM will enter the space globally.

In single-aisles, Boeing is dominant. As MAX deliveries accelerate, Boeing’s share is back near 60%. Airbus is below 40% for the first time in years.

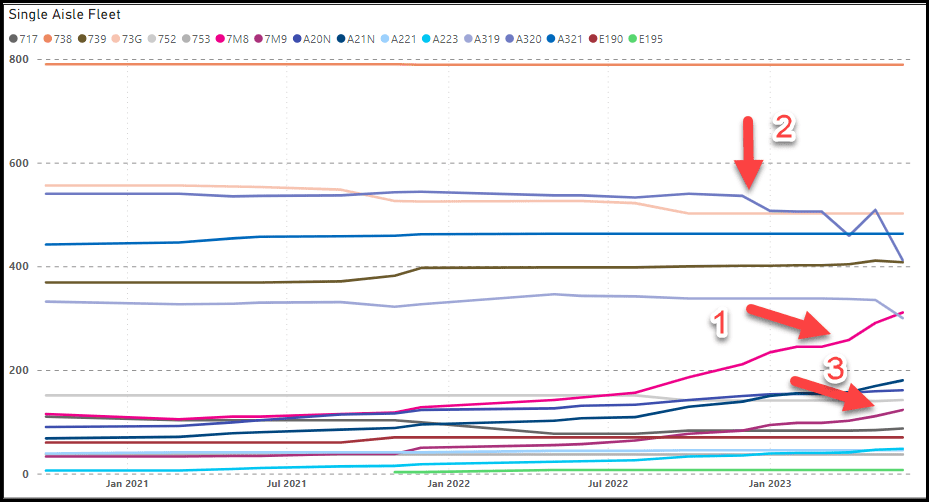

What can we see in the data about the various models in this largest market segment? Take a look at three key data points.

- The first data point to notice is the MAX 8’s success., Southwest drives this, which takes about one new delivery every three days. Possible a record.

- The second point is the decline for the A319 and A320ceo. Even as Airbus delivers A320neo family aircraft as fast as it can from Mobile, the older models are retiring faster.

- The third data point is the rapid rise in MAX 9 deliveries.

Bottom line – it’s tough to out-produce the Renton plant. However, the US situation is quite different from the global one. Globally the A321neo outsells the MAX 9 by more than five to one. That said, Boeing has a lock on the US airline industry that is hard to break.

To demonstrate the A321neo’s resurgence, we offer this chart. Note the US was the 757’s biggest market. But those were the days. What is interesting to see is that for Boeing, Alaska turns out to be the biggest MAX 9 fan. Alaska focuses on this model, whereas American and United deploy MAX 8s and A321s. Alaska is going to replace its sub-fleet of 10 A321neos with MAX 9s.

Moreover, the middle of the market segment continues to grow. As noted before, the MAX 10 can’t come fast enough. The pilot shortage is not going away, and traffic is growing fast. With a given number of crews, aircraft have to become bigger to accommodate the traffic. Two-thirds of the US fleet is single aisle or about 4,000 aircraft, so a one percent move equates to 40 aircraft.

Views: 1