2019 09 26 9 59 58

Boeing invented the Middle of Market (MoM) with its 757 and 767. These two aircraft fit the need and there was nothing to compete with them. Both models developed into families. While the larger 757-300 was an oddball but still operates and is in some demand. However, when 767 was upsized to the 767-300ER it hit a sweet spot. Airbus fumbled with its A300 and then A310 to respond. Neither came close to being competitive.

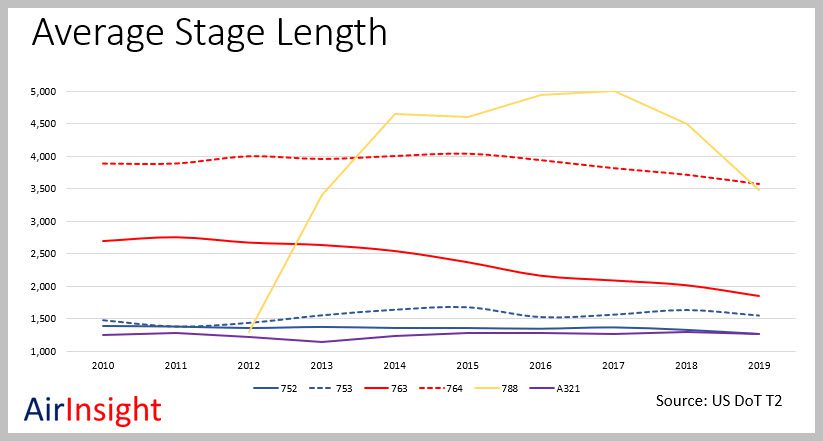

But Airbus learned from that bruising encounter. Boeing, on the other hand, seemed to forget about this segment. It seems that Boeing imagined it could stretch the 737 into a 757 replacement. That has not gone well. Trying to shoehorn the 787-8 into the 767-300ER space has not proven a success either. What is interesting is that the larger 767 outsold the 757 suggesting the MoM is better served with a >230-seat aircraft. While our data are from US airlines, we need to think about the Global market looking ahead.

The 787-8 has more range than MoM requires, making it something of overkill for MoM. Dare we remind everyone about the 787-3, a real MoM airplane? At the high end of the MoM range requirement, US airlines appear to require about 4,000 miles – which means US east coast into Europe or to South America.

But we have seen that US airlines are increasingly attracted to aircraft that have more range because of the flexibility this provides, i.e. the A321neo/LR/XLR and the A220. What we see here is that Airbus has a current offering that meets market needs at the smaller end of the MoM. Sales of these aircraft tell the story. The reason the 757 was so well-loved was its versatility and 4,000nm range – a sweet spot for US and European operators. As we look out 20 years, what will be the sweet spot not only for the US and Europe but for China and India and their intra-Asian routes? These last two are two very large potential NMA markets.

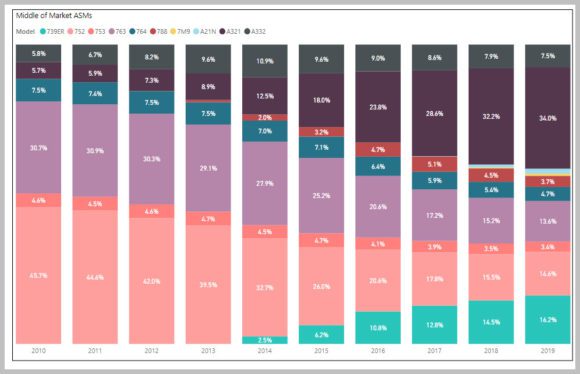

This chart illustrates the ASMs for the aircraft that loosely fit into the MoM as deployed in the US. The data source is the US DoT T2.

At the higher end of the MoM, we have a much more intriguing selection. Airlines could start to deploy the new A330neo which offers near 787-8 range. While the 787-8 has the right seating capacity, it may be too heavy to be effective on sub-5,000-mile routes. The A330-800 has (probably) too much range for MoM. The A330-900 is a very attractive option to replace the A330-300s in service.

There is a big opportunity here to replace aging 767s. Airbus’ A330neo, perhaps, requires less economic compromises than Boeing’s 787. Compromise is the keyword here. Airlines routinely deploy aircraft in ways that are suboptimal – you use what you have. Running an airline requires constant fleet compromises. No airline can afford an end to end “horses for courses” fleet.

US airlines have been waiting for the NMA. Having seen Boeing’s vision with the 757 and 767 they expect something just as clever again. Delta has talked about 200 NMAs. It is not hard to see where Boeing has opportunities – American, Delta, and United all need a solution.

But, given the MAX situation, NMA is unlikely to appear as soon as needed. Meaning, the current 767s will age faster than a Boeing replacement is available. We read about 767 delays and maintenance problems frequently.

The net result is that Boeing is losing market share to Airbus in the middle of the market sector that it invented and owned for three decades. The following charts show Airbus inroads into the MoM segment in the US market, particularly with the success of the A321neo variants. The pattern is even more pronounced globally.

Look at how MoM ASMs are growing in the US, and crucially, how Airbus is winning nearly half the market.

Boeing needed the NMA two years ago and may have already lost too much market share to make the business case work as well as they would like. But without it, the segment moves from a Boeing monopoly to a majority Airbus position, something Boeing cannot afford to let happen.

The MAX crisis has taken their focus from long-term competitive positioning to short-term cash flow, which often leads to sub-optimal decision-making.

The cost to Boeing not having the NMA ready is already significant and is rising. It may be that with the NMA still six years away, the US big three network airlines will have to decide on the 787 or A330neo as a 767 replacement. Neither is ideal for the MoM segment but the question of aircraft age and increasing maintenance cost will be balanced against available alternatives. As the Mad Hatter said to Alice, “I’m late.”

Views: 3