dxbt3ek

The Middle East remains a major aviation hub, with airlines and airports experiencing significant growth in recent months.

This article delves into the busiest airlines and airports in the Middle East, revealing passenger capacity trends and market share trends.

Busiest Airlines: Shifting Sands in the Airline Landscape

Emirates, the long-standing leader in the region, maintains its top spot with a modest capacity increase of 3.3%. This growth can be attributed to its focus on maintaining its established network and brand recognition.

However, the slower pace compared to some rivals suggests room for strategic adjustments to compete in the evolving market.

Meanwhile, Qatar Airways is making significant strides, surging past Saudia (Saudi Arabian Airlines) to become the second-largest carrier in the region.

Qatar Airways’ impressive growth of 17.6% is likely fueled by Qatar’s strong overall economic performance and strategic network expansion, which somehow translates to increased travel spending by its citizens.

Moreover, the budget airline segment in the region is also witnessing a boom. Flynas takes the crown for the highest capacity increase (a staggering 28.5%) compared to May 2023. This low-cost carrier is capitalizing on the growing demand for affordable travel within the region.

Etihad Airways also shows impressive growth of 26.6%, indicating a potential comeback strategy after facing challenges in recent years. Recently, Etihad has focused on more competitive pricing and targeted routes to regain market share.

Top 10 Busiest Airlines

| Ranking | Airline | Seats in May 2024 | Seats in May 2023 |

Change May 2024 vs May 2023

|

| 1 | Emirates (EK) | 3,184,047 | 3,082,626 | 3.3% |

| 2 | Qatar Airways (QR) | 2,669,424 | 2,270,599 | 17.6% |

| 3 | Saudi Arabian Airlines (SV) | 2,656,772 | 2,497,217 | 6.4% |

| 4 | Flydubai (FZ) | 1,167,883 | 1,075,672 | 8.6% |

| 5 | Flynas (XY) | 1,147,473 | 892,906 | 28.5% |

| 6 | Etihad Airways (EY) | 992,088 | 783,896 | 26.6% |

| 7 | flyadeal (F3) | 842,394 | 742,512 | 13.5% |

| 8 | Air Arabia (G9) | 761,153 | 682,999 | 11.4% |

| 9 | Gulf Air (GF) | 532,719 | 466,208 | 14.3% |

| 10 | Oman Air (WY) | 387,471 | 444,295 | -12.8% |

Busiest Airports: Dubai Retains its Crown, Doha Chases Closely

Dubai International Airport (DXB) remains the undisputed king in the region, further solidifying its position with a 7.2% capacity increase in monthly capacity. This growth reflects Dubai’s continued focus on tourism, infrastructure, and its role as a major international transit hub.

However, Doha’s Hamad International Airport (DOH) is hot on its heels. Boasting an impressive 18.7% capacity increase, Doha is benefiting from Qatar Airways’ expansion and strategic location.

This trend suggests a potential shift in the regional aviation landscape in the coming years.

A Hub of Growth, with Exceptions

This month’s capacity reveals positive growth trends across most major regional airports. King Abdulaziz International Airport (JED) in Jeddah and King Khalid International Airport (RUH) in Riyadh continue to report healthy increases, reflecting Saudi Arabia’s focus on religious tourism and economic diversification.

Abu Dhabi International Airport (AUH) also experiences a remarkable 28.3% surge, potentially due to Etihad’s growth strategy.

However, there are a couple of outliers. Kuwait International Airport (KWI) shows a slight decline. This could be due to several reasons, such as regional competition or a lack of significant investment in infrastructure and attracting new airlines.

Moreover, Ben Gurion Airport (TLV) in Tel Aviv experiences a significant drop (almost 45%). This can be attributed to ongoing regional political tensions and travel restrictions that dampen tourism and business travel to Israel.

Top 10 Busiest Airports

| Rank | Airport | Seats in May 2024 | Seats in May 2023 |

Change May 2024 vs May 2023

|

| 1 | Dubai International Airport (DXB) | 5,022,967 | 4,685,576 | 7.2% |

| 2 | Hamad International Airport (DOH) | 2,685,557 | 2,262,600 | 18.7% |

| 3 | King Abdulaziz International Airport (JED) | 2,306,175 | 2,150,996 | 7.2% |

| 4 | King Khalid International Airport (RUH) | 1,906,180 | 1,711,984 | 11.3% |

| 5 | Abu Dhabi International Airport (AUH) | 1,401,626 | 1,092,791 | 28.3% |

| 6 | Kuwait International Airport (KWI) | 873,156 | 882,310 | -1.0% |

| 7 | Ben Gurion Airport (TLV) | 753,508 | 1,362,710 | -44.7% |

| 8 | Sharjah International Airport (SHJ) | 750,089 | 652,282 | 15.0% |

| 9 | Muscat International Airport (MCT) | 702,034 | 663,684 | 5.8% |

| 10 | King Fahd International Airport (DMM) | 692,394 | 621,265 | 11.4% |

Looking Ahead: A Competitive and Dynamic Market

The Middle Eastern aviation market is dynamic and competitive. While established giants like Emirates maintain their presence, the rise of budget carriers like Flynas and the impressive growth of Qatar Airways indicate a shifting landscape.

Airlines that can adapt to changing market dynamics by offering competitive pricing, strategic network expansion, and catering to diverse passenger needs will likely soar even higher.

Just look at Emirates. The DXB-based carrier recently announced that it would refurbish another 43 Airbus A380s and 28 Boeing 777-300ERs, expanding its retrofit program to 191 aircraft. The original plan was to refurbish 120 aircraft, including 67 A380s and 53 777s.

Similarly, airports that continuously and strategically invest in infrastructure attract new airlines and cater to the specific needs of different passenger segments (business, leisure, transit) are well-positioned to maintain or improve their standing.

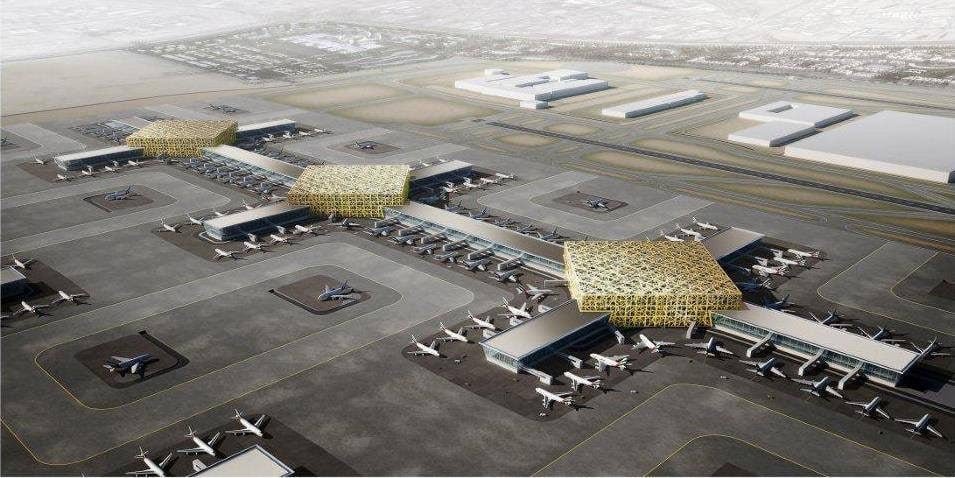

Recently, Dubai unveiled a groundbreaking plan to transform Al Maktoum International Airport (DWC) into the world’s largest airport with an annual capacity of 260 million passengers. DWC will feature five parallel runways and 400 aircraft gates.

This ambitious project, estimated to cost AED 128 billion ($34.85 billion), is expected to solidify further Dubai’s position as a global leader in aviation and logistics. The future of Middle Eastern aviation promises continued growth and innovation, with the potential for new leaders to emerge.

Data Source: OAG

Views: 626