united airlines boeing 787

Today’s big industry news is about United’s single-aisle order. The selection of models will be the cause of much chatter and discussion. Big orders are signals of how an airline views the future. The most important item from this order is growing confidence and the entire travel industry needs that, very badly. Kudos to United for sending that signal.

There are also big changes happening at United’s widebody fleet that are probably less apparent because the pandemic has disrupted so much. Moreover, United has a new leader with an established reputation as a go-getter. What does the data show?

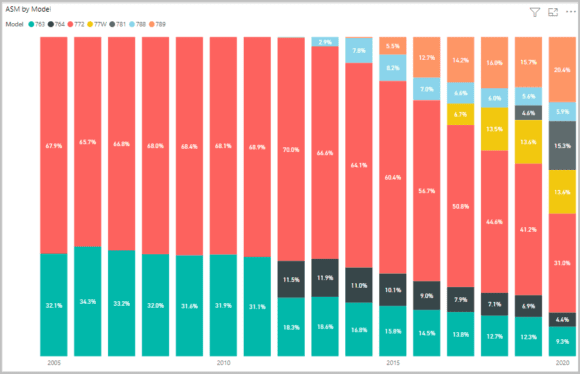

Our first chart is from one of a series of fleet models. Readers will notice that United widebody fleet saw a big change in 2012 with its merger with Continental.

Notice though that post-2012, there has been a steady evolution. The 787 has made steady progress at the airline. By the end of 2020, 787s accounted for 41.6% of widebody ASMs. Even discounting 2020 as an aberration, the trend from before was clear.

United is the only US operator of the 787-10 and this model has seen a sharp rise in activity. Out of United’s 213 widebodies, only 13 at 787-10s. United has 22 777-300ERs and they are less busy than the 787-10s. The airline’s 787-9s have also seen a steady rise in activity as its 777-200s have retired.

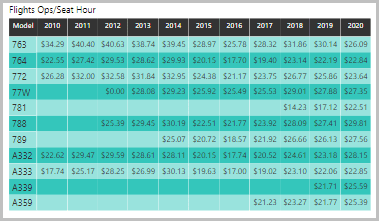

The following table lists flight operation costs per seat hour. The data reflect industry averages, but the 787-10 is United exclusively while the A339 and A359 are Delta exclusively.

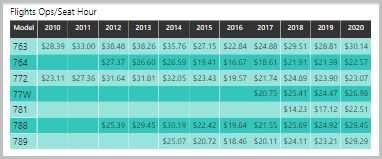

When we filter the table for United only we get the following.

The 787-10 is the star performer at United. Even as United changes up its single-aisle fleet the “big iron” side of its fleet should not be ignored as this is where we are seeing significant impacts from new technology at work. Don’t be surprised if United continues to add 787-10s as it retires older aircraft. The data also suggests why, perhaps, United has held back on the A350-1000. The 787 has proven to be a smart choice for United so far.

Views: 3