Consolidation among US airlines has seen a sharp rise in the market power of a few very big companies.

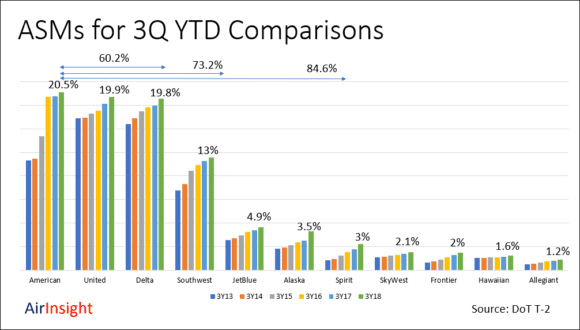

Looking only at the 3Y18 numbers we see the following. The big three account for over 60% of the market. Adding number four takes the concentration to over 70%. The top seven account for nearly 85% of the market.

It is a very close race between the top three. They are essentially the same size in terms of ASMs. This should ensure they behave according to oligopoly rules. That is, essentially, they will not compete on price. But they will seek the lowest costs of seat production. They must because they want to stay viable, and Southwest forces them to do this.

Note that all the airlines show ASM growth, year after year. So much for capacity discipline; though this growth may be in line with traffic growth ensuring high load factors. (Oligopoly rules say that members will try to cheat. Look at OPEC for another example) Also worthy of note, SkyWest is now the 8th largest passenger airline.

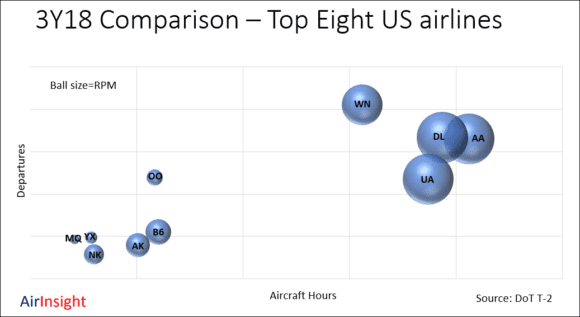

Looking at 3Y18 alone and focusing on the top eight airlines comparing the number of departures, miles flown and RSMs, we get the following chart.

The differences are large. The big four can set prices and have no fear of price competition. Their critical mass is unassailable. The four smallest balls are regionals whose business is dictated by the majors buying their capacity. It is also important to realize just how big these regionals have become. Alaska, JetBlue, and Spirit are no threat to the four big airlines in any form. Any cheeky move in a specific market can probably be swatted away by the big three.

However, imagine how hard it is going to be for Moxy to enter this space. How disruptive can it be and how long can it remain free of any competitive threat? This is going to make that startup very interesting to watch.

What we see is a market that is going to be run according to the biggest players’ needs. No risky business. No price wars. No expensive moves to attract traffic (forget triple miles). Also no big concessions to labor. If you want to go to another airline, see ya. Pilots, of course, are a special situation – but union rules that make switching companies tough. That seniority list is a bind. So even that labor market is sticky.

What do you need to offer an airline to win their business as a vendor? Show them where you can cut costs without compromising anything else. Under no circumstances will the big three upset their situation. But driving down costs is a logical and key area of focus.

Views: 0