2024 09 03 10 19 45

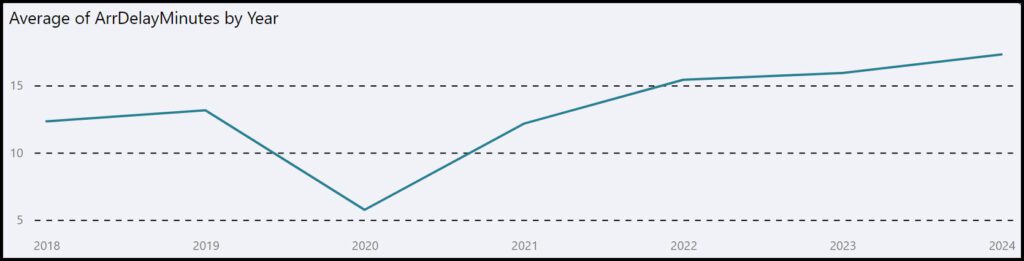

As the travel industry continues to recover from the shock of the pandemic, air travel is also returning to its old trends, which means arriving later than scheduled.

Here’s our updated model. Use the menus on the left to select airlines and aircraft.

The concern and focus on schedule performance are straightforward: time is money. Delays aren’t free. Airlines don’t compensate passengers for wasting their time—the infamous contract of carriage ensures that. However, shareholders also have skin in the game and must be concerned. The following table shows why.

The table above lists our estimates of flight operation costs per minute. (Our numbers differ slightly from Airlines for America.) Industry costs have risen 59%, while airfares have arguably not kept pace. Those huge labor cost increases are going to hit soon, too.

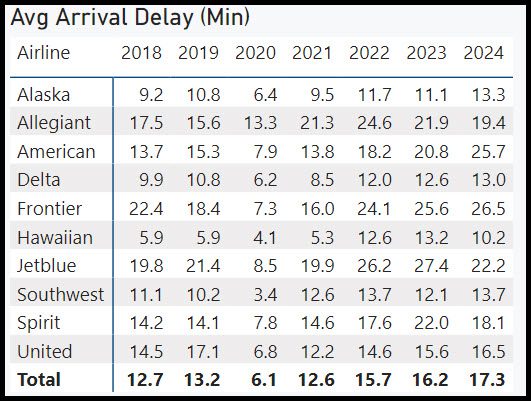

The following table lists the average arrival delay minutes by these airlines.

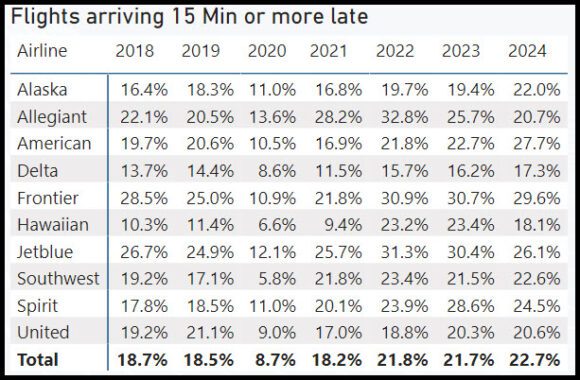

Now consider how many flights arrive 15 minutes or more later than scheduled.

Passenger delay costs are lost, with no hope of recovery. But what about airline operational costs? Why is it acceptable for this industry to perform so poorly? After all, it’s schedules they’re selling. Does any other industry deliver this poorly?

Views: 0

Highly regulated industries (e.g. banking, airlines) don’t worry about competition the way that highly unregulated industries do (e.g. technology). With no threat from new entrants, existing players jockey for position at the margin but largely tolerate each other.

It should surprise no one that regulation kills competition, especially when unelected bureaucrats wield that regulatory power for political purposes, aka. DoJ blocking the Jetblue/Spirit merger after blocking the Jetblue/AA joint venture. Everyone suffered, except the incumbent players and, of course, regulators.