7 12 2022 9 34 39 AM

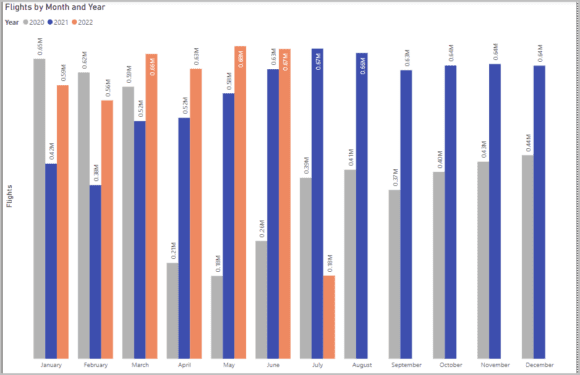

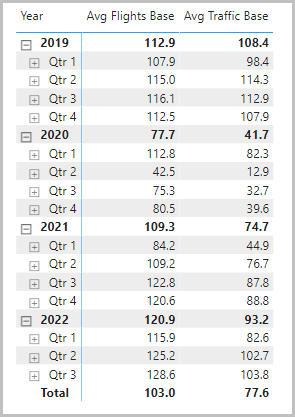

Air travel in the US looks like it has recovered, in many ways, to the previous “normal” levels. The following chart shows flight volumes are substantially higher than in the past two years. Here are some ideas on understanding US summer air travel pressures.

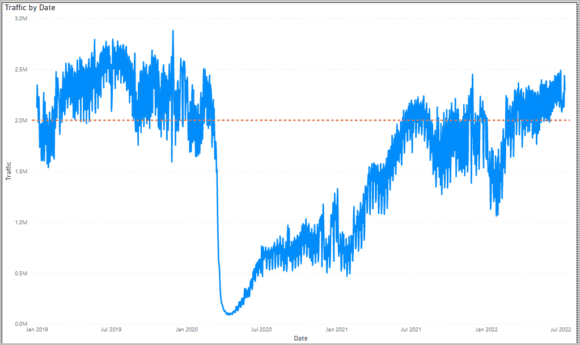

When we look at the traffic trends over the period we see the following. The 2 million line is what was a typical daily air traffic volume for the US. We all recall 2019 was the blockbuster year, but see how traffic recovered since the pandemic. We are well over what was the daily “normal”.

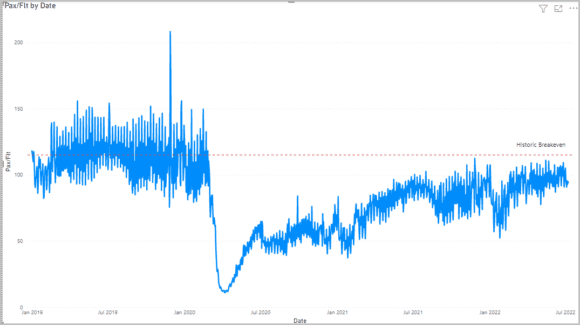

When we combine the number of flights with traffic we get the following chart. The chart shows that flights, on average, are at lower passengers/flight levels than before and have not recovered from the pandemic. Anecdotally this is hard to square with anyone’s flying experience now – every flight seems oversold.

Yet here are the numbers based on daily TSA counts. Our base period is 1/1/2019.

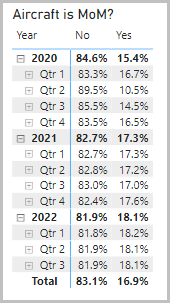

Has been any variation in how this traffic is being moved? Actually, there has been and although it is still small, the trend is growing. Airlines are starting to deploy larger aircraft.

Looking at the traffic moved by single-aisle equipment type gives us this view. The redder the color, the busier the aircraft type. Noteworthy, in MoM terms, is the relative stability of the 757-200 which has been removed by American but remains at Delta and United. Equally important is the rise of the A321ceo and neo – only United does not have this model – yet. The A320ceo/neo and the 737-800/900 hold their share, sort of. The MAX8 and MAX9 are seeing growth.

The way out of the current conundrum of a pilot shortage, airport staff shortages, and squeezing more people than expected is to move to larger aircraft. It’s just physics. But the MAX9 can’t come fast enough and A321 production is running flat out. The MAX10 could play a role in helping here, too. But that aircraft’s certification remains uncertain at this writing.

The bottom line is this: Airlines saw bookings months ahead and did not plan to add people fast enough. They no doubt have reasons for not hiring up, whether plausible or not. But even if they did bring in more people in time, the right size fleet is insufficient. Fleet decisions are long-term calls and could not have accounted for the pandemic. That said, could network planners have foreseen the current squeeze? We’d think so.

Views: 0