2019 05 06 15 50 03

While China and India are the big markets to watch, it is the US market that still gets a lot of attention. To illustrate this we created a data model using the T-100 Segment All Carriers dataset. The model is able to show some rather neat data.

First, select one or more airlines and see how they compare: for example, British Airways and Virgin Atlantic. They operate in the UK-US market and compete vigorously. To do this, select British from the left selection of airline choices and then scroll down until you see V Atlantic. Then use the Ctrl button and select that one. Now you will see both on the model and then press the play button at the bottom left. You can do this for other combinations that allow for comparisons, i.e. Virgin Australia and Qantas. Or the Japanese carriers.

The model provides the scale of traffic (ball size), as well as total seats (Y-axis) and average distance flown (X-axis). The inactive model above shows that it is Ethiopian that flies the average longest flights to and from the US, with an average of over 7,700 miles. Note also how much larger the big four US airlines are compared to the other airlines – typically double or triple the size for this market.

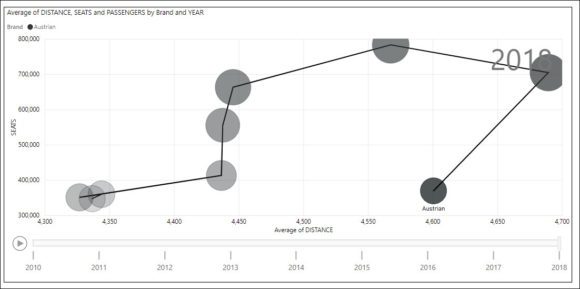

Another neat feature we suggest is this. Once you select an airline, let the model run through the years. Once it has completed that, click on the any of the balls in the model. A line will be generated that shows the growth in the model from 2010 through October 2018. Obviously, the 2018 number of seats will be lower than the previous year as we are missing two months. But what you will be able to see is the airline’s growth prior to 2018. As the next chart illustrates for Austrian.

Between 2010 and 2013, their US traffic flew about the same mileage, but between 2013 and 2015 mileage didn’t grow but average seats did. Then in 2016 distance grew again and distance went up marginally. 2017 saw a bit more growth in the distance but fewer seats. Doing a click on other airlines will offer similar insights.

Views: 3