2024 04 25 13 35 46 1

Airbus announced lower-than-expected operating profits and cash flow. The OEM had previously announced hiring more staff to prepare for rising aircraft demand, reaffirming its 2024 financial targets. Airbus also announced a higher target rate for the A350 program, from 10 to 12 per month from 2028.

Airbus reported €577m in adjusted operating profits, down 25% year over year. Revenue was €12.83bn, and free cash outflow was €1.8bn. The consensus among analysts expected an operating profit of €789m.

These numbers were announced as the OEM announced a huge order from India.

Airbus confirmed its delivery target of about 800 commercial aircraft this year, higher than the 735 planes in 2023. For 2024, Airbus says it expects adjusted EBIT between €6.5bn and €7bn. The closely watched metric of free cash flow before customer financing is projected at around €4bn.

But there are questions

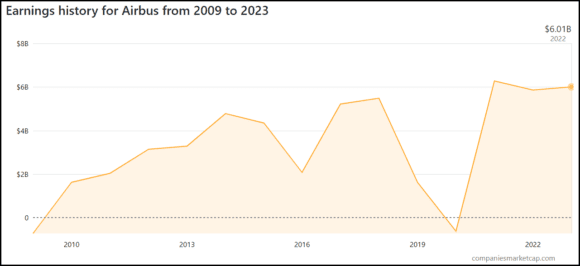

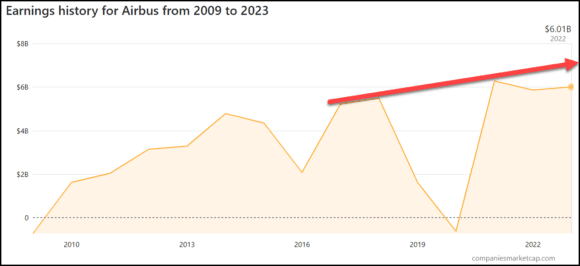

The chart shows that Airbus has not earned the expected level from Boeing’s ongoing challenges. The big question is why?

Could it be that Airbus is pricing its deliveries so that Boeing faces price pressure across the board at a time when it can least afford this? This will hobble Boeing further, depriving it of crucial cash flow to fund R&D.

After all, Airbus has over 60% market share and delivers as fast as possible. If it delivers 800 aircraft this year, it could be nearly double what Boeing can accomplish. There is no price pressure on Airbus as there is on Boeing. Airbus does not have to offer customers future discounts on delayed deliveries at nearly the same rate as Boeing.

It’s not just about delivering 800—the makeup of that number is very important. Note how the A321 volume has crept up steadily. That model has great pricing. Don’t take our word for it, read what Gary Crichlow at AviationValues says. Crucially, “The centre of gravity of this core has been gradually moving upwards. The backlog for the A21N has surpassed that of the A20N backlog, which is a feat the A321 never came close to accomplishing versus the A320. Boeing’s competing B3XM (737 MAX 10) also has a strong orderbook, although it is yet to be certified and its timeline for entry into service remains a question mark.”

Why are Airbus’ earnings lower than expected? That is probably not the question Airbus wants people to ask.

Views: 2