100408 56

To bring you more aviation news, Airinsight introduces News in Brief. During August, we compile a rolling story by date with news that is sometimes too small for a deep analysis but still interesting enough not to be missed.

30 – Virgin Australia will grow its fleet with nine Boeing 737-800s it will purchase from Silk Air. The first aircraft is set to arrive in October and the last in February and will bring the 737-800 fleet to 75. VA says it needs the additional aircraft to cope with expected pent-up demand during the Australian summer season when the rate of vaccinations will have increased. Last April, the carrier returned ten -800s back to service as it experienced a steep recovery in domestic traffic. Since July, rising cases of Covid infections from the Delta variant have caused new lockdowns and travel restrictions.

The airline has entered consultations with unions and employees about mandatory vaccinations for frontline employees by November 15. It will make a decision in September, but CEO Jayne Hrdlicka says that vaccination is the only solution to getting Australia out of the Covid-crisis. Earlier, Qantas has requested vaccination of all frontline staff, as have other airlines like SWISS and Air Canada.

27 – TAP Portugal reported a €493.1 million HY1 loss compared €582 million in the same period last year. The operating loss was €377.4 million versus €427.6 million. Revenues were -40.7 percent to €383.1 million. The carrier improved its Q2 results as it reported a €128.1 million net loss compared to €365.1 million last year. The operating loss was €149.6 million versus €227.7 million, with revenues at €233.2 million, up 62.9 percent. It carried 928.000 passengers, an increase of 136 percent over Q1. During the period, TAP completed a €462 million capital increase which assures a direct stake of the Portuguese government of 92 percent. The carrier is still waiting for approval from the European Commission for its €3.2 billion restructuring plan to resize the company, although Brussels re-approved €1.2 billion in rescue aid that was annulled by the EU General Court in May. Thanks to more voluntary measures, TAP has reduced the number of involuntary redundancies to 82.

27 – ITA, the successor to Alitalia, has filed an application with the US Department of Transportation to commence passenger services. It wants to operate between Milan and New York and between Rome and New York, Boston, and Miami as soon as it starts services from October 15. In 2022, the new airline intends to grow the network from Rome to Washington and Los Angeles and to Chicago and San Francisco in 2023.

ITA cleared an important hurdle on August 18, when Italy’s National Civil Aviation Authority ENAC granted ITA its Airline Operator Certificate (AOC) and Air Transport Operating License. “The hope is that the new national reference company will contribute to the restart of the sector, contributing decisively to overcoming the difficulties deriving from the pandemic crisis”, said ENAC President Pierluigi Di Palma. The AOC was granted after all paperwork has been completed and an Airbus A330-200 demonstrated procedural capabilities during a 54 minutes-flight on August 16. Together with and A320, this is the first aircraft that has been transferred from Alitalia to the new airline. ITA is still working on plans to retain the Alitalia name. The carrier can now start selling tickets and plans to launch services on October 15, one day after Alitalia completes its final services.

18 – Qantas and Jetstar have joined the airlines that mandate all its employees to get vaccinated against Covid-19. All frontline employees like pilots, cabin crew, and ground staff need to have been vaccinated by November 15. Only those unable to get a dose for medical reasons will be exempted. The decision to require vaccination follows after a survey sent to 22.000 employees. Of 12.000 who responded, some 75 percent this that vaccination should be made mandatory. Four percent is refusing a dose. CEO Alan Joyce caused a stir last year when he said that Qantas eventually would accept only fully-vaccinated passengers on board its aircraft.

Following a recent surge in new Covid-cases in Australia, various states have imposed new restrictions. This has a deep impact on the country’s airlines, which had been benefitting from a rapid recovery last spring. Qantas expects to resume its international network not until the 2022 summer schedule.

17 – After doing only one day of flight testing on August 11, the Boeing MAX 7 has returned to Seattle from her trip to China. The aircraft went to Shanghai to demonstrate to Chinese regulators that the type is airworthy and safe to fly, so it should be allowed to return to service in China. The MAX 7 performed some tests off-coast to Shanghai on the 11th. Boeing hopes to have the type recertified before the end of the year. Some 100 MAX have been grounded since March 2020, when China was the first country to do so following the two fatal accidents.

17 – Aeroflot has unveiled its first Boeing 777-300ER with an updated cabin. The aircraft has received 28 new Business Class Super Diamond NG seats with sliding doors for more privacy, 24 Comfort Class/Premium Economy seats, and 375 updated Economy seats. This brings the total cabin configuration to 427. Two more 777s will get the update before the end of this year. Aeroflot has twenty triple sevens and will operate the refurbished version on its major international routes as well as to selected domestic destinations.

17 – The Latvian government has approved the plan to invest €90 million as equity in airBaltic. The investment is to compensate the carrier for losses caused by the ongoing pandemic and de economic crisis. It is subject to approval from the European Commission, which will have to check if the investment is in line with its guidelines for Covid state aid. The investment increases the government’s share to 96.14 percent, with the remaining 3.86 owned by Lars Thuessen’s Aircraft Leasing 1 SIA. The government will recoup the investment with a planned IPO.

16 – Swiss Airline Helvetic Airways has taken delivery of its fourth Embraer E195-E2 on August 15. This completes the fleet renewal that started with the arrival of the first of eight E190-E2s in October 2019. The E2 replaced some E1s and also older Fokker 100s. The renewal required an investment of almost $750 million. Helvetic operates the new aircraft on its own network and on behalf of SWISS, although the carrier has cut back its wet-lease contracts to reduce costs. Helvetic holds options on another twelve E2 but has no plans to exercise them soon.

16 – The German Economic Stabilization Fund (WSF) is to reduce its 20 percent share in Deutsche Lufthansa AG by five percent. The share will be reduced over the coming weeks until it reaches 15 percent. The decision has been made as the German flag carrier has produced improved results and reduced its losses. Following the serious impact of the Covid-crisis, the German government’s Wirtschaftsstabilizierungsfonds provided €5.7 billion in loans and €0.3 billion in silent participation that was equivalent to a 20 percent share. The government provided another €3 billion in loan guarantees. During last month’s HY1-results presentation, Lufthansa confirmed its intentions to repay the loans as quickly as possible. It will prepare a capital increase for a date that has yet to be confirmed.

14 – Thai Air Asia reported a Baht 1.692 billion Q2 net loss compared to 1.141 billion last year, on revenues of Baht 1.081 billion. The HY1-loss was Baht 3.556 billion. With most of Thailand heavily restricted by Covid measures, the airline did only limited operations. At 721.797, passenger numbers were up by 155 percent. Thai Air Asia continues a strict cost reduction plan and says it is working on a capital restructuring plan that it hopes to conclude this HY2. It also is in discussion with the government about soft loans to maintain employment. All domestic flights have been suspended in July and August after the Covid-situation worsened.

9 – According to media reports from Sky News and the BBC, Virgin Atlantic founder Sir Richard Branson plans to bring his airline to the London Stock Exchange to raise liquidity. The airline posted a £659 million net loss for 2020 as it was hit hard by the Covid crisis, which affected its important transatlantic network. If Branson would float some of his shares, this would mean that his current 51 percent share would become a minority position. This situation was suggested before the pandemic in 2019 when Air France-KLM had offered to buy 31 percent in Virgin Atlantic. Little later, Branson back-tracked from the idea as he wished to keep his majority position.

VA received a £160 million capital injection in March but now seems to be in talks with institutional investors about an IPO. The airline is unwilling to comment. Delta Airlines own 49 percent.

9 – Boeing has awarded the production of the MAX fan cowls on the CFM LEAP-1B to two new suppliers. From the financial year 2025 onwards, Tata Advanced Systems in Hyderabad (India) and Turkish Aerospace in Ankara (Turkey) will each produce fifty percent of all fan cowls, which are the doors of the nacelle. The cowls are currently produced by an international supplier of which Boeing is unwilling to share details. A spokesperson tells Airinsight that Boeing will change suppliers as “we are always evaluating our supply chain and needs across the business, and it’s not unusual for us to move work across suppliers based on business needs. Timing can be based on a variety of factors, all of which are taken into account in order to ensure a smooth transition of work.” Tata and Turkish Aerospace have been long-time suppliers to Boeing on various programs.

6 – Wizz Air CEO Jozsef Varadi has extended his contract for another five years under a new CEO Service Agreement. The extension was announced by chairman Bill Franke, who also owns Indigo Partners. He applauds Varadi for being the driving force behind the development of the Central Eastern European ultra-low-cost airline, which targets aggressive growth in the coming years. The new agreement includes a new long-term incentive if the Wizz Air share price will grow by twenty percent or more in the next five years. If he succeeds, Varadi is entitled to £100 million in shares. During the July 27 shareholders meeting, one-third of all shareholders opposed the scheme.

4 – British Airways has signaled a boost of confidence for the Airbus A380. The airline has extended its contract with Lufthansa Technik for Base Maintenance Services for all its twelve A380s. The extension starts in August 2022 and runs for over five years. CEO Sean Doyle indicated earlier that BA intends to resume A380 services when the worst of the pandemic is over. The aircraft are now in storage at Madrid Barajas and London Heathrow but could be rescheduled later in Q3 or in Q4 on routes to initially the US. British Airways used to operate the doubledeckers to Los Angeles, Washington, Vancouver, Hong Kong, Singapore, and Johannesburg. Base maintenance will be done at LH Technik’s facility in Manila as has been done before.

British Airways is one of the few airlines that keep supporting the A380, the aircraft that has been hit the hardest by the effects of the Covid-crisis. Emirates operates around thirty of its 113 A380s, China Southern all five in its fleet, and Korean Air just a single aircraft and only on Wednesday’s to Guangzhou. All Nippon Airways has scheduled some A380 services to Honolulu again for later this month but until now has only been doing sightseeing tours of Japan.

3 – Japan Airlines reported a ¥57.9 billion Q1 loss after-tax, compared to ¥93.7 billion for the same period last year. Revenues improved by 74.1 percent to ¥133 billion. Domestic revenues accounted for ¥38 billion, up 100 percent over 2020. Like at All Nippon Airways, international operations were limited as travel restrictions continued. Also, Tokyo was placed under a state of emergency for the fourth time. International revenues were ¥11.2 billion, still an improvement of 315 percent over Q1 last year. Cargo and mail revenues improved by 79.3 percent to ¥47.6 billion. Operating expenses were 4.7 percent higher to ¥215.4 billion, but JAL continues its strict policy on cost reductions. The carrier ended June with ¥357 billion in cash, thanks to ¥30 billion in new bonds and ¥24.4 billion in a new bank loan. Including an unused credit line, JAL’s total liquidity position is around ¥650 billion.

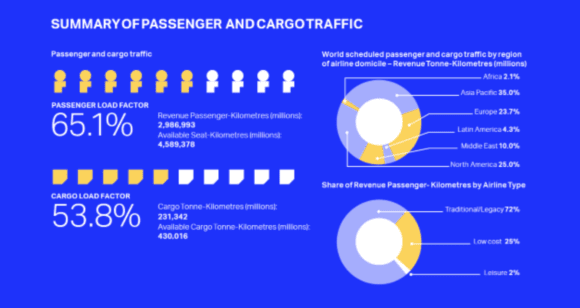

3 – Final figures for 2020 compiled by IATA confirm that this has been the worst year in the history of aviation. The number of passengers that boarded an aircraft was down by 1.8 billion compared to 2019 to 4.5 billion. Domestic travel performed best, but revenues per passenger kilometer (RPK) were still down by 48.8 percent. International RPKs even dropped by 75.6 percent. As services were suspended, the number of connecting airports dropped by 60 percent in April 2020 compared to April 2019. The Middle East was hit the hardest by this and lost 71.5 percent in RPKs compared to 69.7 percent for Europe, and 68.8 percent for Africa.

Cargo saw a reduction of 21.4 percent in the capacity as belly cargo on passenger flights was suspended. It drove yields and load factors up, the latter to a record-high 53.8 percent. The combined loss for the airline sector was $126.4 billion.

2 – Norway’s newest long-haul low-cost airline Norse Atlantic Airways has yet to commence services, but it has already announced a further expansion of its fleet. The carrier has signed an agreement with BOC Aviation to lease six Boeing 787-9s on 16 year-contracts. The aircraft will be delivered to Norse in December when it launches operations. They are additional to the nine Dreamliners that have been leased from AerCap in March.

Norse hasn’t disclosed where the 787s are coming from, but it is likely that they are former Norwegian aircraft, as are the ones sourced from AerCap. Norwegian had six 787-9s leased from BOC out of a total of 37.

Norse will unveil its livery on August 10.

2 – Mitsubishi Heavy Industries reported improved results for its Aircraft, Defense & Space activities during the first quarter of Q1. It booked a ¥3.5 billion profit compared to a ¥62 billion loss in the same period last year. This was mainly due to a ¥68.8 billion loss on the SpaceJet regional jet program, which has been mothballed in 2020. Mitsubishi hasn’t provided any updates on the program, although it said in May that it would reassess a potential restart.

Revenues in Q1 were lower, ¥130.8 billion versus ¥155.1 billion last year, although those of Commercial Aircraft were up from ¥30.3 to 31.5 billion. Order intake dropped to ¥61.8 billion compared to ¥76.5 billion. Mitsubishi said it benefitted from the recovery of maintenance of the CRJ fleet. The Japanese OEM delivered five 777 shipsets to Boeing compared to three in Q1 last year, two for the 777-9 compared to three last year, and fourteen compared to eighteen 787 shipsets.

Views: 1