2020 08 05 11 01 42

Our webinar yesterday on electrically powered aircraft has set us to thinking a lot more about this emerging aerospace disruption. We summarize our response this way – “The industry is a lot further ahead than we thought”.

With models on sale (from Pipistrel) and deep into testing (ZeroAvia and magniX) a commercial flight using electrical is conceivable by 2025. Not only is this amazing to consider, but there are implications crucial to understand. Small electrically powered aircraft can change the way we travel. An aerial vehicle from Uber can get you to the local airport. You could catch a small regional airliner from close to home to a hub. This looks possible in less than five years. The long haul flights will still be fossil fuel-powered for a long time. But under 500 miles is within reach of electrical power.

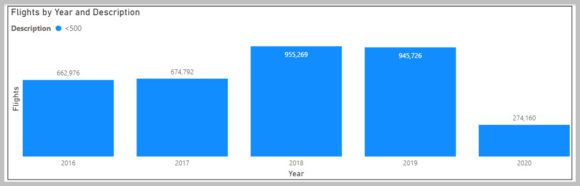

How big is the market? This is a tough number to come up with. Using the number of US commercial flights up to 500 miles as shown in the following chart offers a guide. The 2020 data is through April. To provide you with a scale of the < 500-mile market, it represents ~12% of US commercial flights across the period. An interesting data point to consider is that the 501-999 mile segment accounts for ~25%. Together the <500-999 mile market in the US accounts for about 37% of commercial flights. This is a huge opportunity.

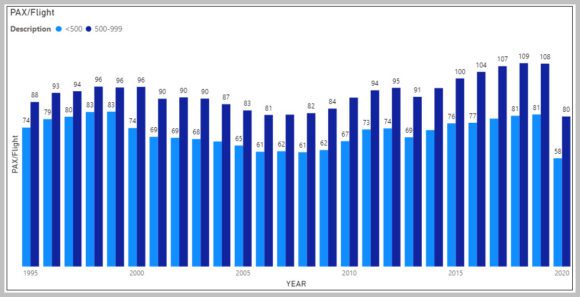

What about traffic? Here we also have something that suggests the market is more than adequate to justify the growing interest in electrically powered aircraft. Bear in mind that the data we have tells us the way it was and is now – but new aero-technologies probably understate these numbers. New technologies will create new markets.

Looking at the stage lengths we see electrically powered aircraft might focus on, US data suggests that ZeroAvia is targeting the right segment of a regional airliner. This was echoed by Pipistrel.

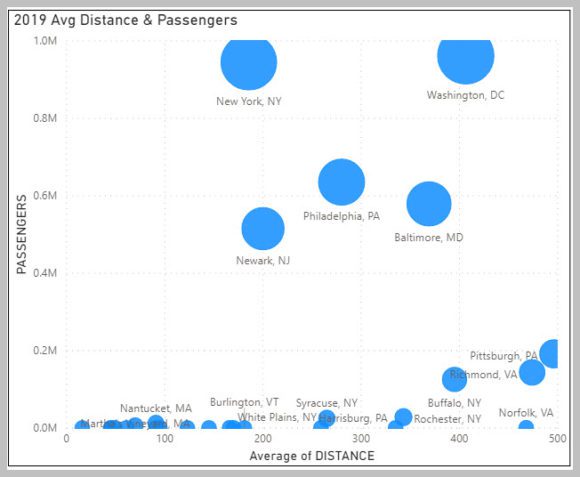

A regional sized aircraft with seating between 30 and 50 looks to be a sweet spot. To get an idea of how a potential deployment might work, let’s use an example of Boston, Massachusetts as a focus city and 2019 as the baseline year. In 2019 US domestic flights departing Boston averaged 1,094 miles and there were 16.3 million passengers. The size of the ball in the chart below indicates the size of the market in passenger volumes.

It turns out that Boston would, potentially, be a great place to operate an electrically powered regional aircraft. No wonder that hometown airline Cape Air plunged into the market. The chart below demonstrates the potential. There are big markets that almost certainly make the economics work. Even if you use a 300 mile cut off, an operator has substantial opportunities. As described in yesterday’s webinar, if operating costs are 80% lower than current aircraft, the potential economics are electrifying (sorry, couldn’t resist).

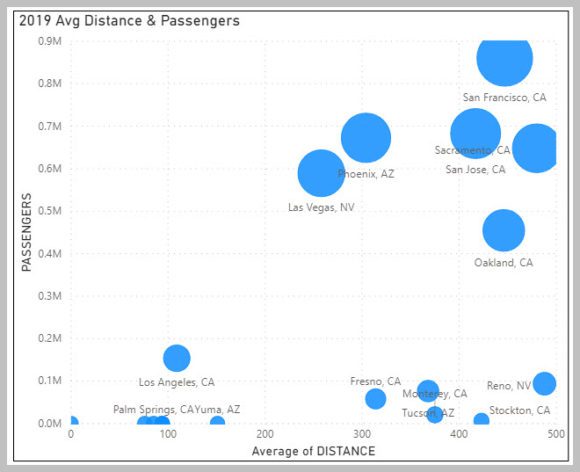

Here’s the example of San Diego. Once again attractive markets are within range.

In summary:

- Electrically powered regional aircraft have excellent market potential.

- Even using existing markets the traffic volumes identify key markets, and with potentially 80% lower operating costs, several new markets should emerge.

- With US regional airlines under great operating cost pressure, it is inevitable they will acquire these aircraft.

- Who loses? The answer to this question uses the auto industry as a guide. Tesla became a force from nowhere. Telsa bears watching by the way. Similarly, the companies we mentioned above (ZeroAvia, magniX, and Pipistrel) are capable of disruption – but not on the industrial scale required. However, we think the likes of GE and Raytheon (Pratt & Whitney Canada) need to be looking at acquiring these firms. Rolls-Royce already has an electrical powered program under test.

- Another area warranting attention: ATR and De Havilland while they are watching Embraer and the E3 chatter. As incumbents in the regional turboprop segment, ATR and De Havilland need to be moving towards testing electrical powered aircraft. Their ox gets gored first if they aren’t ready with a solution by 2025.

- The pandemic makes new aerospace projects very difficult to fund but if an OEM wants to stay in the business, it appears the potential of electrical power requires R&D resources. And we mean right away.

Views: 3

Question – if pax counts on <500 mi flights average in the 60-80 range per the graphic, why is a 30-50 seater the sweet spot? Aircraft size too large for battery capability if the larger gauge?

The size suggested was made by two guests on the webinar. I concur with them that this would be an optimal size. This would be first-generation and the size would grow as better battery technologies evolve or as hydrogen-hybrids develop.