a 29

Embraer announced it is enabling its Super Tucano to take on Unmanned Aerial Systems.

Relying on A-29 features in operation and new sensors, including specific datalinks for receiving initial target coordinates and cueing, the Electro-Optical/ Infra-Red (EO/IR) sensor for laser tracking and designation, as well as the laser guided rockets and the wing-mounted .50 machine guns for neutralizing targeted Unmanned Aerial Systems (UAS), the Operational Concept (CONOPS) defined by Embraer will allow current and future A-29 operators to add counter Unmanned Aerial Systems (UAS) missions to their operational profiles whenever needed.

“We continue to expand the A-29’s capabilities to address the most recent challenges faced by many nations worldwide,” said Bosco da Costa Junior, President and CEO of Embraer Defense & Security. “The continued challenges in modern warfare and the recent conflicts worldwide have shown the urgent need for solutions to fight drones. The A-29 is the ideal tool to counter UAS effectively and at low cost, adding to the aircraft’s already extensive mission set that includes close air support, armed reconnaissance, advanced training, and many others.”

Embraer’s move is perfectly timed. UAS are a threat in several arenas: the Middle East and, of course, Ukraine.

Ukraine is an ideal target customer for the A-29’s new capabilities. There is a customer in plain sight. Embraer would benefit from such a deal because it would showcase the A-29 in action. Supplying Ukraine places the A-29 in one of the most scrutinized and high-profile combat environments. Demonstrated performance there elevates the aircraft’s global credibility, much as Turkish Bayraktar drones gained fame early in the conflict.

Two Wrinkles

- Wrinkle #1. Russia won’t like this at all.

In March 2022, Embraer announced it was suspending the supply of parts and maintenance support to Russian airlines following the invasion of Ukraine. This showed Embraer curtailed its links to Russia early in the conflict.

Since then, Embraer has been actively selling its military C-390 transport to several NATO/European customers (Austria, Netherlands, Portugal, Sweden, etc.), and is expanding its defence footprint in Europe, which signals it is commercially engaged with NATO members rather than supplying Russia.

However, Brazilian defense exports are subject to government export controls and foreign-policy considerations. Any weapons sale to Ukraine, therefore, requires Brasília’s political sign-off and would be affected by Brazil’s diplomatic stance.

- Wrinkle #2: The A-29 Super Tucano line in Brazil and the U.S. (licensed production at Sierra Nevada Corp., Colorado) has been winding down as orders are delivered.

A potential Ukrainian order justifies continued production, stabilizing Embraer Defense & Security’s revenues and jobs. Moreover, even with its new capabilities, Ukraine would spur improvements in avionics, weapons integration, and survivability—enhancing future versions. So, Embraer has significant upside from doing a deal with Ukraine. Then there’s the long tail—sustained logistics and pilot training yield years of aftermarket and service revenue.

Realpolitik

Brazilian President Lula’s government has avoided taking sides in the Russia–Ukraine war. It even blocked transfers of Brazilian-made ammunition to Ukraine. Embraer cannot export the A-29 to Kyiv without Brasília’s explicit approval — which currently seems unlikely.

Russian retaliation risk: Russia could retaliate economically or politically against Brazil (e.g., via BRICS mechanisms or trade), which will pressure Brazíl to veto sales.

Production logistics: Depending on whether Ukraine wanted aircraft built in the U.S. (under Sierra Nevada license) or in Brazil, export control regimes differ. A U.S.-based supply path might make approval more plausible under American rather than Brazilian authority. The EU has been buying a lot of US weapons for Ukraine. According to the EU’s External Action Service, as of October 14, 2025, the EU made available close to $197 billion in “financial, military, humanitarian, and refugee assistance” to Ukraine. Of that amount, over $70 billion is in military assistance.

Summary

If politically allowed, Embraer would benefit from selling the A-29 Super Tucano to Ukraine by:

- Extending the aircraft’s production life.

- Raising its profile as a combat-proven, NATO-compatible platform.

- Strengthening defense partnerships with the U.S. and Europe.

- Securing high-margin sustainment and upgrade contracts.

The barrier is political, not technical — Brazil’s neutral stance currently prevents a deal. But what if the U.S. or another partner re-exported U.S.-assembled A-29s instead? Embraer might indirectly gain (through licensing royalties and parts supply) without formally breaking Brazil’s policy. Embraer is doing well in business, and this would boost its fortunes in new ways that have not been available until now.

Now there’s another wrinkle for the creative types in Brazil, the US, and the EU. Will the attraction of a deal overcome the obvious (and increasingly less threatening) Russian reaction?

The Tradeoffs

The Russian threat perception has changed, meaning Russia may have fewer “easy wins” or axes of advance than previously assumed. Russia’s military capacity has been degraded, its logistics strained, its surprise advantage reduced, and its force quality diminished.

What cards does Russia have to play against Brazil? Russia could reduce fertilizer exports or impose trade barriers. Brazil imports significant Russian fertilizer; disruption could hit its agribusiness sector. A 20-aircraft order ($500 – 700 million) offers limited value compared with Brazil’s agribusiness exports or Embraer’s total revenue, so the macroeconomic reward may not justify political fallout.

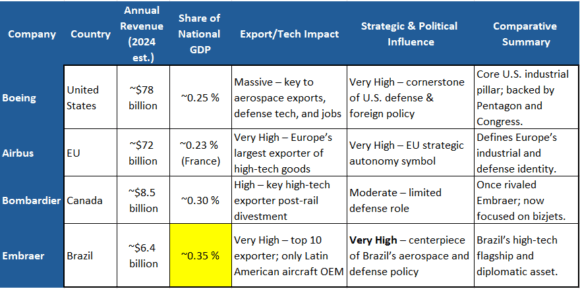

Embraer is arguably one of Brazil’s most strategically essential companies — not the largest by revenue, but highly influential because of its role in high-tech manufacturing, exports, and national prestige. Embraer is Brazil’s most technologically advanced manufacturer. This table provides context on how crucial Embraer is to Brazil.

In Brazil, any Ukrainian interest in the A-29 will spark anxious conversations.

But as we noted, the US has a big say, too. Washington co-owns much of the A-29’s export licensing; if the U.S. later uses that precedent to direct future Embraer exports, Brazil could lose autonomy over its defense trade. Cooperation with the U.S. (through the A-29/Sierra Nevada partnership) keeps defense links warm even when national politics differ. Embraer functions as a diplomatic instrument, as does Airbus for Europe, or as does Boeing in projecting U.S. industrial influence.

Policy wonks will enjoy this back-and-forth if Ukraine decides it likes the A-29 and expresses interest.

Views: 187

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}