IMG 2667 scaled

The Covid-pandemic that currently rules the airline industry will result in reduced demand for commercial airliners up to 150 seats in the next ten years. A new market cycle will force airlines to focus on versatility, operating efficiency, and profitability, creating new opportunities for the 100 to 150 seat segment, Brazilian airframer Embraer says in its 2020 Market Outlook published on December 2.

Covid has thrown all previous scenarios out of the window. Compare the 2019-2038 Market Outlook with the latest one of 2020, and Embraer is reporting significant differences. For instance, the OEM is looking only ten years ahead instead of the previous twenty years.

In the next decade, air travel is expected to grow by 2.6 percent compared to 4.4 percent until 2038 in last year’s outlook. Asia Pacific is seeing the biggest growth at 3.4 percent, followed by Latin America (3.0), the Middle East (2.9), Africa, (2.6), Russia/CIS (2.6), Europe (1.8), and North America (1.6 percent). Compared to the previous outlook, growth in Russia/CIS remains much higher than in Europe. A return to 2019 RPK-levels is not expected until 2024, but domestic traffic will recover a year earlier.

By size, Embraer is forecasting a need for 5.500 new airliners with up to 150 seats until 2030, compared to 10.550 until 2038 expected last year. Of these, 4.220 aircraft are for replacement and 1.280 for growth.

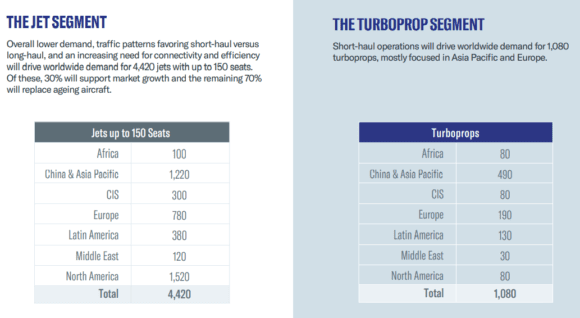

The jet segment accounts for 4.420 new aircraft, down from the previous 8.230 forecast. North America is the biggest market ahead of China and the Asia Pacific.

The turboprop market will also be much smaller: 1.080 aircraft, down from last year’s 2.320. The driving market here remains China/Asia Pacific with 490 turboprops. Although much smaller, the turboprop market is closely monitored by Embraer as it prepares a return to this segment with a new aircraft. As this aircraft – potentially using hybrid-electric propulsion in some sort – is slated for a market entry only in 2029, the outlook for the 2030s could be much brighter.

Look by region

Further looking by region, Embraer sees demand for 100 jets and 80 turboprops in Africa. There is a huge opportunity to right-size, as many airlines operate aircraft too big to meet demand, hurting load factors. With 68 percent of routes served only once a day, there is room for growth.

The Middle East sees demand for 120 jets and 30 turboprops. Embraer has failed to make a serious impression in this region so far, but Covid could result in demand for smaller aircraft to meet regional demand.

The market in China/Asia Pacific would need 1.220 new jets up to 150 seats and 490 turboprops, which could see an increase in air links and the number of origin-destination city pairs. 80-Seaters could play a pivotal role in serving routes between some 200 regional airports in China that have been established in recent years.

Russia/CIS would need 300 jets and 80 turboprops. The biggest growth of these segments should come from network decentralization, with 70 to 150-seaters needed to serve on low-density markets. Despite the pandemic, Embraer sees that demand in this region has remained pretty stable, especially compared to Europe. Here, there is a demand for 780 jets and 190 turboprops. “Re-establishing intra-regional networks will be essential for European mainline carriers in the new, low-demand environment.”

While there are opportunities here, nowhere else the environmental downsides of aviation are discussed as in Europe, resulting in trains to take over from short-haul air routes. Yet, the industry can respond with its state of the art and fuel-efficient airliners, especially when they run on sustainable aviation fuels.

Latin America could cater for 380 jets and 130 turboprops. Like in Africa, Embraer sees a need here for balancing and right-sizing the fleets to prevent overcapacity. New opportunities exist in Brazil, where the privatization of new airports by 2022 could boost travel to smaller cities.

North America remains the biggest market, with a need for 1.520 jets up to 150 seats and 80 turboprops, although RPK-growth will be the lowest of all regions. Driving the growth is a need to replace aging airliners with new-generation jets, but its success depends on the adaption of the scope clause to allow more 70-76 seater jets to enter the scene. So far, the scope clause has hurt Embraer’s fortunes with the E175-E2, of which certification and entry into service have been deferred until further notice. It has also forced competitor Mitsubishi to suspend the development of its SpaceJet-program.

Embraer is expecting traveling behavior to change permanently after the Covid-crisis has ended. (Business) contacts will remain more virtual, leisure traveling at least initially will be short-haul. Airlines have to adapt to this by reviewing their networks, assess their fleets, and respond by what Embraer says will be a “movement to across-the-board right-sizing.”

“The up to 100-seat jet segment is well established. The next cycle will showcase the importance of the 100 to the 150-seat category”, Embraer’s CEO Arjan Meijer says in the Outlook introduction. “New trends, market conditions, and the advent of new state-of-the-art aircraft with excellent cost economics will be the cycle’s hallmarks. (…) . Despite all of the challenges and volatility today, we believe the up to 150-seat aircraft segment will lead us to better times.”

How this will translate into Embraer’s fortunes remains to be seen. New opportunities could arise for the 80-90 seater E175-E2, which is without orders. The E190-E2 (97 to 114 seats) has a backlog of just eight out of 22 firm orders and 63 options, while the bigger E195-E2 (120 to 146 seats) has a backlog of 143 with 151 firm orders and 47 options. The best selling Embraer airliners still is the E175, with 768 firm orders, 291 options, and a backlog of 153.

Views: 20

4,420 jets in 10 years, that’s 442 per year on average. During the golden years of the E-Jet program, Embraer delivered about 100. A220 is proving to be more popular than the E-Jets, but it is still ramping up. With Covid airlines are even more conservative about Capex and the E2 is not selling well. 4,420 in 10 years is Wishful thinking.

Mind you this outlook isn’t about Embraer’s own sales perspectives: 4.220 is the entire market for jets up to 150 seats. Airbus, Irkut, and Comac will take a slice of that too.