Wallpaper 18 scaled

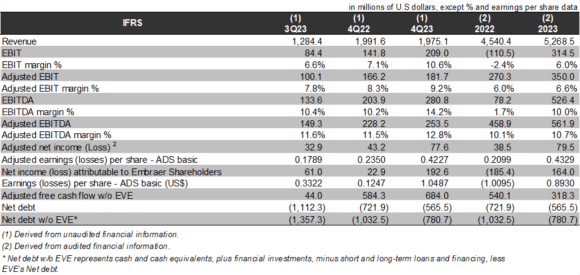

Embraer reports a good 2023 and guides it to a strong 2024. In 4Q23, the adjusted EBIT was $181.7 million, with an adjusted EBIT margin of 9.2% excluding special items. Meanwhile, in 2023, adjusted EBIT was $350.0 million, and adjusted EBIT margin was 6.6%, an increase of $79.7 million YoY because of higher volumes across all business units and other operational income (taxes efficiencies in 2023 and higher corporate expenditures in 2022).

These results confirm the encouraging news from the company’s Media Day late last year.

Embraer’s net income attributable to shareholders and income per ADS were $192.6 million and $1.0487 per share in 4Q23, compared to $22.9 million and $0.1247 in 4Q22. If we exclude extraordinary effects, adjusted net income was $77.6 million for the quarter compared to $43.2 million a year ago, representing an 80% increase. In 3Q23, EVE development costs began to be capitalized as intangible assets as the program reached sufficient maturity.

Embraer’s net debt without EVE declined to $781 million in 4Q23, compared to $1,357 million QoQ and $1,033 million YoY. The positive free cash flow generated in the quarter helps explain the sequential improvement in the company’s net debt position.

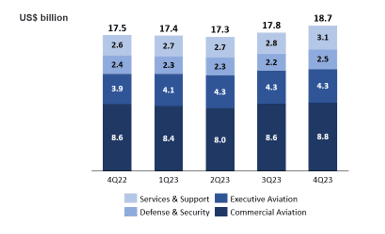

The company’s backlog rose by $1.2 billion YoY, reaching $18.7 billion in 2023 – the highest number recorded over the past six years. Services & Support was the highlight with a $3.1 billion backlog, or $400 million higher YoY and the highest recorded level.

Meanwhile, Executive Aviation ended the year with a book-to-bill over 1.3:1 and a $4.3 billion backlog, or $400 million higher YoY. In Defense & Security, South Korea was in the spotlight with the victory of the C-390 Millennium. Commercial Aviation ended the year with a book-to-bill over 1.1:1.

Embraer delivered 75 jets in 4Q23, including 49 executive jets (30 light and 19 medium), 25 commercial jets, and one military C-390. In 2023, Embraer supplied 181 aircraft, an increase of 13% year over year from the previous year’s 160 units. However, the company continues to face supply chain delays, negatively impacting 2023 deliveries.

Focusing on Commercial, Porter Airlines exercised its purchase rights by placing a firm order for 25 E195-E2s, which added to its 50 existing firm orders. The deal, valued at $2.1 billion at list price, entered the backlog in 4Q23 and increased the airline’s firm orders with Embraer to 75 aircraft, with 25 purchase rights remaining.

Embraer’s E190-E2 and E195-E2 attained type certification from the Civil Aviation Authority of Singapore (CAAS). Scoot, the low-cost subsidiary of Singapore Airlines, should begin operating the E190-E2 in 2024.

In Europe, the E195-E2 received certification for a Steep Approach to London City Airport from EASA (European Aviation Safety Agency). This significant development allows airlines to operate the E195-E2 at London City Airport (LCY), known for its challenging approach and short runway. Together with the E190-E2, which received Steep Approach certification in 2021, both members of the E2 family are now approved for operations from LCY.

The following chart lays out Embraer’s forward-looking statements, including EVE.

Views: 5