EVE Fahari Kenya Airways

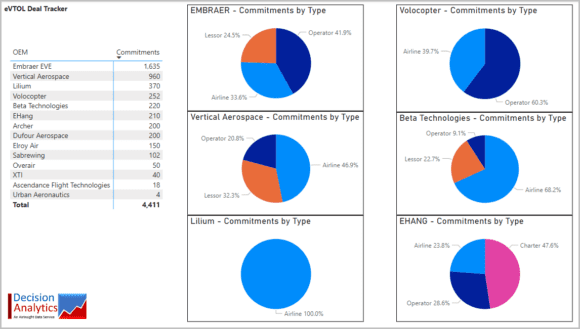

This morning Kenya Airways subsidiary, Fahari Aviation, signed an LoI for up to 40 eVTOL vehicles. This is another important win for Eve, part of the Embraer family. Here is a chart that updates the industry score. The list shows how far ahead Embraer is in the market.

But as in every business, customer quality is an important guide. As is customer type and the charts show what types of customer breakdown for the top six OEMs in the eVTOL space.

Embraer’s lead is more than numbers. Notice that about 25% of their deals are with lessors. This is a very important quality proxy – these are customers that have to place these vehicles with operators, typically airlines. Another third of the deals are with airlines directly. Nearly 60% of Eve’s deals are in these two categories. That tells us that industry experts that operate flying equipment have decided that Eve is likely to succeed which means designing, producing, and certifying its equipment. Given the early days in the eVTOL business and associated uncertainties, this is a big endorsement.

The next biggest player Vertical Aerospace has 80% of its deals in the same categories. A great start. But as it does not have the same pedigree as Eve, its deals are over 40% less. Whereas Eve has a parent with a long-established history in the aerospace industry, several of the other new entrants may end up being acquired by more established brands.

Views: 1