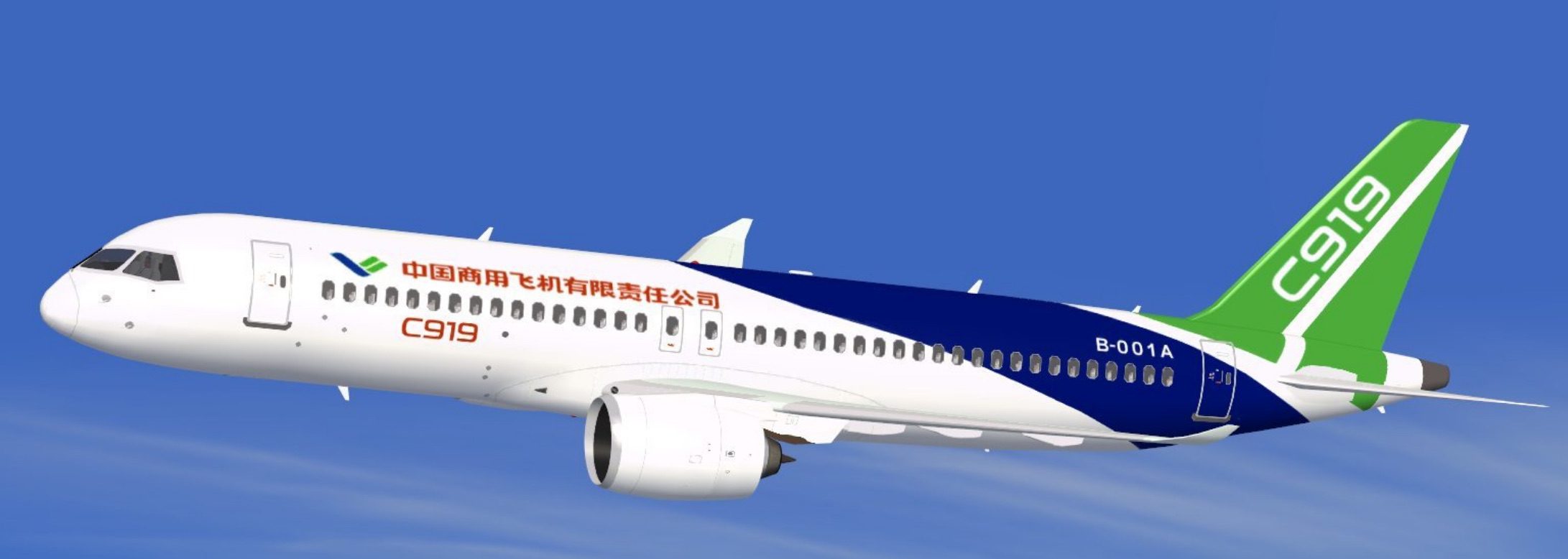

C919

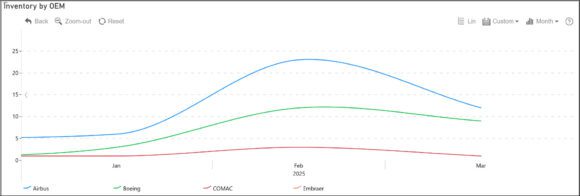

While Airbus and Boeing struggle with negative orders between them in the last three months, China’s COMAC is gaining strength with Chinese airlines. Since every order for a COMAC aircraft is one that Airbus and Boeing will not see, the threat of local production of regional and narrow-body aircraft in China has become more real as we look to the future.

Subscriber content – Sign in Monthly Subscription Annual Subscription