1 scaled

It has been a while ago since airlines have complained of oil prices, but that is about to change. Jet fuel prices are on the rise again, notably since May, and continuing to rise through June into the third quarter. IATA warns that oil prices will cast a shadow over the effects of the summer recovery, it said in its June 30 financial update.

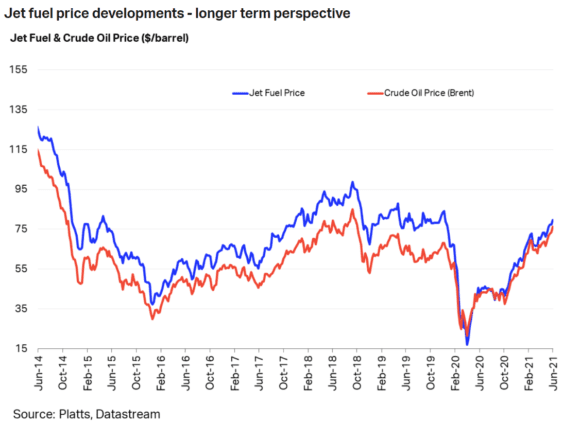

The graphic from IATA’s jet fuel price monitor confirms that prices have been rising since October 2020, when in some areas the first signals of recovery from the Covid-crisis became evident. Prices hit the bottom in March/April 2020, when worldwide traffic collapsed but they recovered around June after the first wave. A further increase in price happened between October and March this year. Since then, crude oil has been going up as worldwide economic activity recovered. This trend has continued in June, with jet fuel prices even outpacing crude oil since May.

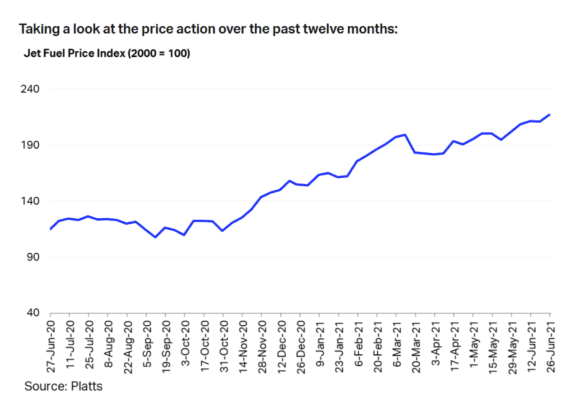

A fuel price index shows how jet fuel has become more expensive in the past year. Compared to an index of 100, fuel prices have gone up to 208.8 on June 4 and continued to climb to 217.6 on June 25. The weaker dollar has also had an impact, with a barrel in US Dollars being more expensive than one in Euros. While this has been the trend since 2014, the price difference between the two has grown again since the start of 2021.

“Although steady vaccination rollouts and falling Covid-19 cases in Europe and North America raise hopes for summer recovery, airlines will be challenged by rising fuel costs as the traffic resumes”, IATA’s financial monitor says. Fuel prices will become a significant factor again when airlines report their Q2 results later this month and will eat into their Q3 results even more.

Fuel will cost airlines at least $43.2 billion

With an average fuel price of $69.4 per barrel, IATA calculates fuel to have an impact of $43.2 billion on the airlines’ fuel bill this year. This is subject to changes if prices will further rise. The International Energy Agency expects fuel prices to rise by six percent this year, with a return to pre-pandemic levels by late 2022. The graphic shows that this would mean fuel prices would be around $75-80, so higher than the average calculated by IATA until now. Remember that last December, the association expected jet fuel to cost $49.5 a barrel.

Keep in mind that airlines have of course benefitted from the lower fuel prices in 2020, but only to a limited extend. The fuel that went into airplanes was cheaper, but airlines operated at huge losses as their network had collapsed. Also: pre-Covid, most airlines had hedged their fuel against certain prices. When the flying stopped, they lost billions on fuel, which has been translated into their net losses. A few airlines like Ryanair have said that they have stopped hedging. In the current market with rising fuel prices, this will likely have a negative effect.

IATA’s financial monitor showed that combined airline losses in the first quarter of 2021 were almost on par with those of Q4 in 2020, or $17.9 billion. For the whole of 2021, IATA maintains its outlook from April that airlines will suffer post-tax losses of $47.7 billion this year. Last year, the sector lost $126.4 billion.

Unsurprisingly, North America is expected to perform best as domestic traffic has almost fully recovered since March. The region is the only one where the net cash outflow of airlines has returned positive again in Q1 at 11.9 percent. By contrast, in Europe net cash flow is at -39.7 and in Latin America at -34.8 percent. Only thanks to stringent cost-cutting measures, European have been able to stem their losses in the first quarter.

Views: 28