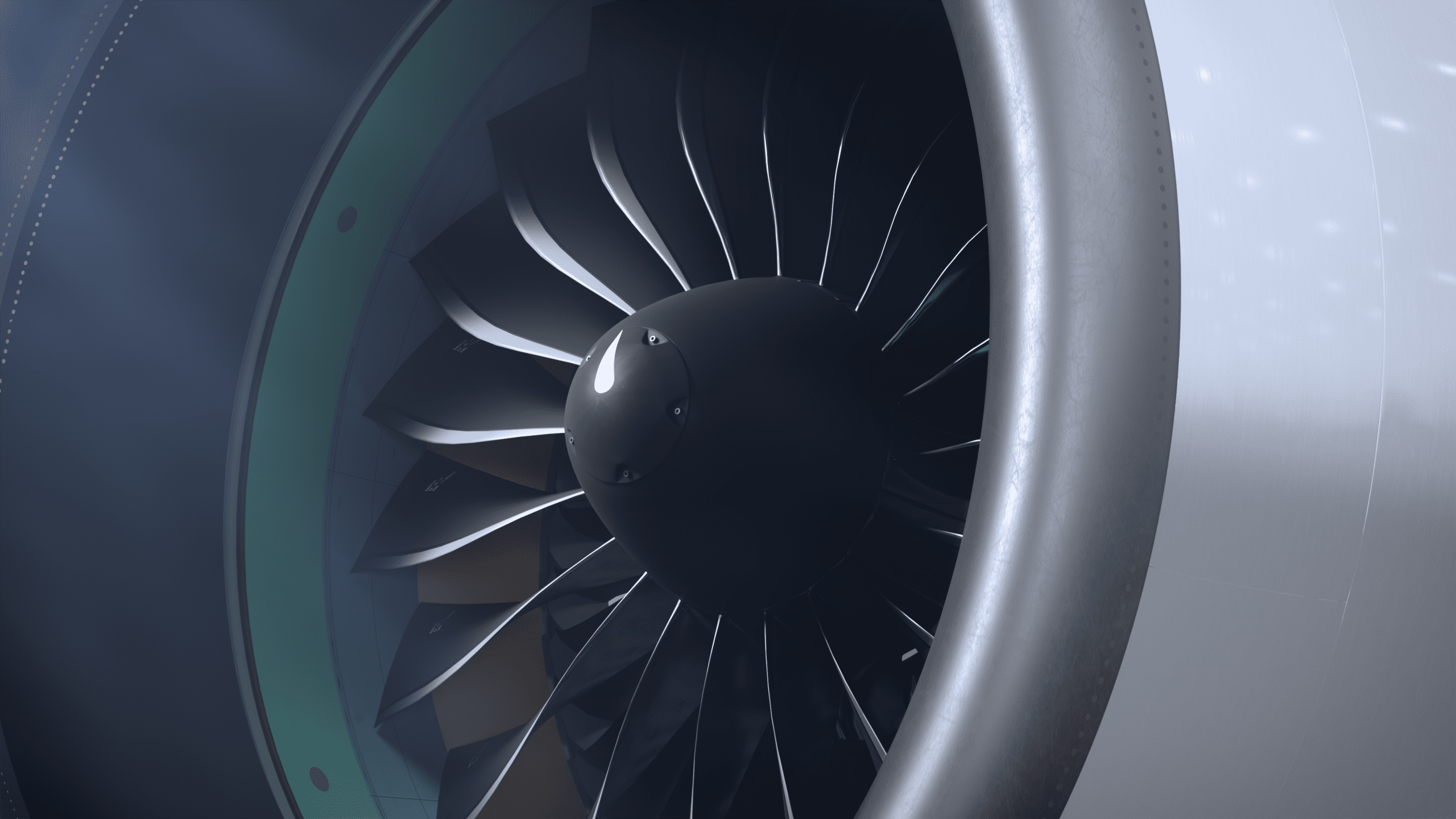

PW GTF Engine

Two big aero engine companies reported Q3 earnings today. First up, Raytheon Technologies, parent of Pratt & Whitney.

Raytheon Technologies reported 3Q22 results with adjusted EPS of $1.21 coming in ahead of the consensus estimate of $1.14. The company updated its 2022 guidance, with the adjusted EPS range tightened from $4.60-4.80 to $4.70-4.80. P&W reported $5.380 billion in sales, up 14 percent, but this includes commercial and military programs and an Adjusted operating profit of $318 million. This reflects the recovery of the commercial aftermarket and shop visits. Pratt delivered 192 large civil engines to customers Airbus and Boeing in Q3, up from 177 in Q2. The number for Pratt & Whitney Canada is 509 versus 459.

JPMorgan noted: Operational beat came from Pratt & Whitney. Adjusted segment EBIT came in 1% above our expectation at $1.7 billion, driven by a ~40% beat from Pratt & Whitney. Pratt’s outperformance came from higher aftermarket sales and a favorable military/OE sales mix. The other segments missed our estimates by a range of 3-7% on EBIT. The modest operational upside still drove a 7% adjusted EPS beat vs our number thanks to tax and share count.

Bank of America noted: Commercial OE was up 16% at Collins and 26% at P&W. Commercial aftermarket was up 25% at Collins and up

23% at P&W. Military was down 6% at Collins and down 2% at P&W. Organic sales at the company level grew 6% year-on-year. RMD saw continued declines, primarily driven by persistent supply chain constraints.

Vertical Research Partners noted: A bit of a mixed bag from RTX, but probably in line with general expectations. The continued supply chain issues in the defense divisions have been well-flagged, while the strength in the aero aftermarket should also have been widely expected. There could be some relief that the 2022 cash flow guidance has been held steady, while the middle of the EPS range has actually been raised despite the ongoing challenges. We’ll see if the management has anything to say on 2023 expectations on the call, as that could decide what the stock ends up doing today.

With sales up 6% as expected by most analysts, the focus remains on the aftermarket and the supply chain. P&W benefits from being on the Airbus single-aisle family which continues to see potential higher production rates. P&W’s engines are also found on the popular A220 and the Embraer E2 which has seen some deals lately. The GTF Advantage engine should help build demand as airlines continue to seek better fuel burn and associated “greener” credentials.

Raytheon benefits from continuing strength in air travel recovery. Especially in China, where Boeing is having a tough time while Airbus is able to deliver. Bank of America points out “Upside risks are if the commercial aerospace and business aviation jet recoveries are better than expected, earnings could fare better than our projections“. They also note: “Downside risks to PO are a downturn in commercial aviation due to the natural business cycle or an exogenous event such as a terrorist attack or a pandemic.”

The commercial aviation industry is, apparently always, on some sort of precipice. War in Europe could easily spread beyond its current battlespace. Raytheon’s military side might benefit from that but the commercial side would take a severe hit. If cool heads can restrain the political madness it would be of great help and be a significant help to mankind as a whole.

Views: 2