77455013 arrive on time clock punctual schedule 3d illustration

The January data that was published provides some interesting data points. We are updating the models.

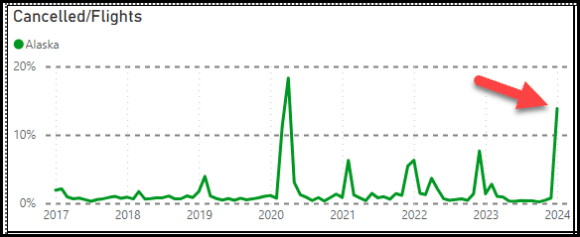

The following charts examine the percentage of flights canceled for selected US airlines that show obvious signs of disruptive cancellations. The industry average for cancellations is 1.8%.

Take a look at how seriously the MAX 9 grounding impacted the airline.

This was almost as disruptive for Alaska as the pandemic itself.

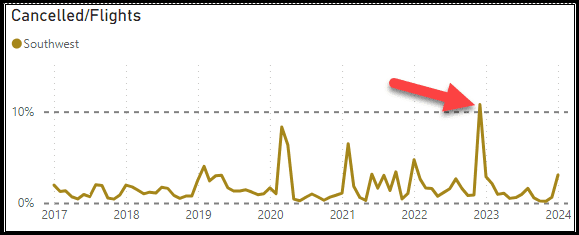

Southwest Airlines

Southwest suffered several cancellation hiccups over the period tracked. But the winter 2023 meltdown was monumental.

The MAX grounding that impacted the airline did not show much of an impact on cancellations.

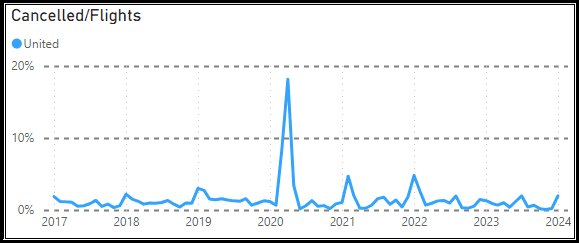

United Airlines

Here’s another airline that was impacted by the MAX issues.

Despite what the airline claimed regarding disruptions caused by the recent MAX 9 issue, cancellations don’t look out of line compared to history.

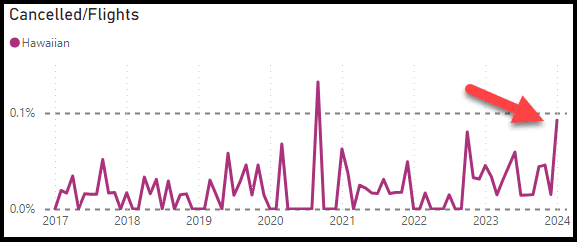

Hawaiian Airlines

Moving on to the other disruptor, the Pratt & Whitney GTF. Hawaiian got hammered by cancellations.

The airline’s GTF-powered fleet is small, But it is big enough to impact ops.

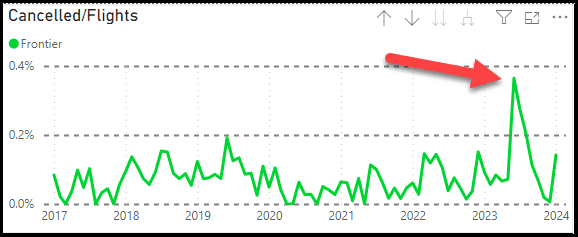

Frontier Airlines

This airline switched to GTFs for its A321neo fleet, and it seems something upset ops.

The GTF-powered fleet is still small, but clearly, something upset their schedule. Although the percentage is low, there was a noteworthy spike.

The other reporting airlines don’t show any unusual data spikes that draw attention.

As annoying as the GTF issues may be, they did not have nearly the same level of impact as the MAX 9 grounding.

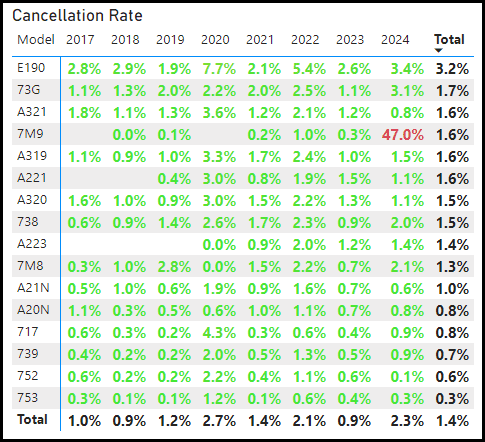

The E-190 had the highest number of cancellations over the period, significantly higher than other aircraft. The old-school Boeings have the lowest number of cancellations.

Views: 1