Lufthansalogo

UPDATE – The German state has sold the last 6.2 percent of its share in Lufthansa Group, one year earlier than it was prescribed to do so. This means that the airline is now fully private again and no longer has any financial obligations to the state, which supported the national carrier in 2020 at the start of the Covid crisis. German state sells final stake in Lufthansa.

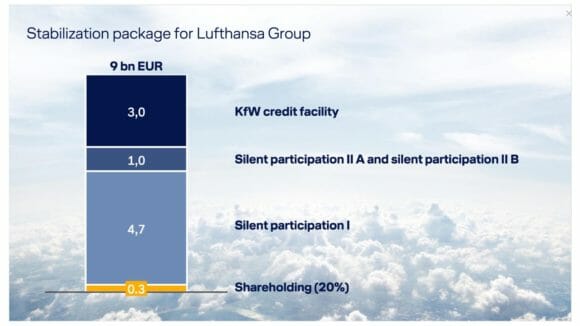

The state aid was provided by the Economic Stabilization Fund or Wirtschaftsstabilisierungsfonds (WSF) in June 2020 and consisted of €5.7 billion as two silent participations and €300 million in a 20.05-percent minority share. Another €3.0 billion was offered in loans by KfW Bankengruppe and other investors. The aid was conditional on Lufthansa not doing any mergers and acquisitions, suspension of dividend payments, a ban on cross-subsidizing subsidiaries, and various auditing duties. Regulations from the European Commission forced the airline to surrender 48 slots at its main bases in Frankfurt and Munich.

Lufthansa drew only €2.5 billion from the two silent participations and repaid €1.5 billion on the first tranche in October 2021 and another €1.0 billion on the second tranche in November 2021. It terminated any unused WSF funding. In February 2021, it had already repaid €1.0 billion to KfW that was drawn. The airline group raised €1.0 billion in bonds in July 2021 and €2.2 billion through a capital increase on the capital markets in October last year, which helped it to repair its balance sheet.

The original stabilization package as granted to Lufthansa in June 2020. (Lufthansa)

Since June 2020, WSF has gradually reduced its share from 20.05 percent to 15.94 percent in August 2021, and to 14.09 percent in October 2021. The fund was supposed to sell this stake no later than October 2023. Since then, WSF reduced its stake to 9.92 percent by the end of July. In a statement on September 13, the fund said that it had sold the last remaining stake of approximately 6.2 percent to institutional investors for €760 million. This brings the total proceeds of the sale of its stake in Lufthansa to €1.07 billion, which significantly exceeds the €306 million originally invested in 2020.

This means that the state actually made good money on its aid to Lufthansa. Back in June 2020, the support package met opposition from some factions who feared that the money would be lost forever. Already in July, WSF Board member Jutta Dönges said: “Thanks to the support from the state, the company (Lufthansa) has survived the crises well. Already now, proceeds exceed the investment, so we can conclude already now that the outcome is positive.” In a statement on Tuesday, she said: “The stabilization of Deutsche Lufthansa AG has been successfully completed. Proceeds of €1.07 billion clearly exceed the original €306 million investment by some €760 million. This completes the participation of WSF and lays the company back in private hands again.”

Spohr thanks taxpayers

In a media statement, Lufthansa CEO Carsten Spohr says today: “On behalf of the entire Lufthansa staff, I thank the previous and current governments and German taxpayers for their support to Lufthansa in the worst financial crisis in the history of our company. The stabilization of Lufthansa has been successful and has been beneficial to the government. Earlier than expected, we have already repaid the stabilization funding, and a year before the deadline WSF has now also sold its last remaining shares. (…) Lufthansa is now completely in private hands again. All within the airline will work hard to improve our leading position in the world, for example through the already announced offensive to improve our premium products and quality.”

The sale of the WSF stake reshapes the shareholder’s position within Lufthansa. Entrepreneur Klaus-Michael Kuehne, the owner of Kuehne Aviation GmbH, signaled his interest last week to increase his share from the current 15.01 percent that he acquired in July, up five percent from his share in April. This made him the single biggest shareholder of the airline. Kuehne has been in talks with Spohr about growing his share but he told media that he had no interest in acquiring the entire portfolio from WSF. Kuehne confirmed to Reuters later on Wednesday that he has increased his share to 17.5 percent.

Views: 5