1 21 2022 10 46 20 AM

We have previously demonstrated that the economic differences between the CFM LEAP and Pratt &Whitney GTF are very close. For an airline or lessor to select between the two (on the Airbus) has to be tough and probably drives both engine OEMs to make very sharp deals. But how are the aircraft doing that use these state of art engines?

We updated our model on fuel burn with data through October 2021. Below is the three-page model, and page 3 (displayed) is the NEO vs MAX page. Please click the double-headed arrow at the bottom right to optimize the model for your monitor.

You can select between LCC and Network airlines. You can also select an individual airline to see how its fleet has been operating.

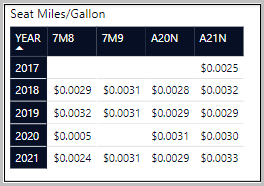

As the two tables at the top of the page illustrate, the economics in terms of fuel burn is very close. Clearly, the MAX data for 2020 is unreliable. But the earlier periods and. we suggest 2021, is more reliable. The takeaway here is that just like the engines are nearly identical in terms of fuel burn performance, so are the aircraft. The differences are at the fourth decimal, which adds up obviously, but shows just how close things are.

The MAX competes very well against its competitive NEO family in terms of fuel burn. Since fuel accounts for 40% or more of operating costs, this is arguably the most important variable cost. And it is highly variable at that. Moreover one can see how Boeing can readily offer competitive pricing (deep discounts may be unnecessary) to get the MAX into airlines since Boeing can deliver faster. With competitive fuel burn numbers and earlier delivery slots, it is not such a surprise that DAE found customers for its MAX fleet so quickly. Or why Allegiant selected the MAX.

Views: 53

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →